当前位置:网站首页>The United States raised interest rates and devalued the RMB, but such products ushered in a honeymoon period

The United States raised interest rates and devalued the RMB, but such products ushered in a honeymoon period

2022-04-22 03:52:00 【snowball】

I once read this sentence when I was reading :

Raise interest rates and do not speculate in stocks .

The principle is also simple , Raising interest rates is a form of tightening monetary policy , There is less money in the market , Naturally, the stock market can't play .

Well known international investment banks Merrill Lynch Also developed a set of Merrill Lynch clock theory , It also shows the decline of inflation , Market hot money decreases , The view of the return difference of stock assets .

But is that really the case ?

We counted 2000 Since the start of the year , The s&p 500 Index The relationship with the US federal interest rate .

The conclusion is very obvious , There is a positive correlation between stock market and interest rate , in other words , Raising interest rates will not lead to a long-term downturn in the stock market , It will push up the stock market .

Does the theory fail ?

It's not , Because these three interest rate cuts in history correspond to extreme events ,2001 Geopolitical conflict in 、2008 The financial crisis of 、2020 The new epidemic in .

These are not natural cycles , But an obvious external shock .

And now , We are in the cycle of raising interest rates in the United States again , This time, , How would you choose ?

Maybe the market can give us some enlightenment .

This Monday , S & P of Cathay Pacific Fund 500ETF Official issue , It can be regarded as expressing the optimism about the performance of US stocks under the interest rate hike cycle with practical actions .

This new fund also has a very flattering place : The RMB exchange rate has fallen continuously in these days .

Once lost this morning 6.41, For last year 11 For the first time in months , And as the US raises interest rates , The RMB exchange rate is likely to continue to decline .

It means , Compared with buying domestic fund products ,QDII The fund can also earn the income of RMB devaluation .

Actually ,QDII The most important thing that the fund needs to pay attention to is exchange gains and losses . In particular, the RMB has been appreciating in the past two years , quite a lot QDII There is a big gap between the net value trend of the fund and the tracking target .

The United States raises interest rates 、 Devaluation of RMB . This QDII Sweet window of release , Cathay Pacific Fund is in a good hurry .

Add the new one ETF product , Domestic tracking The s&p 500 Index Our products already have 14 Only ,

There are many kinds of products ,ETF、LOF、ETF Linked fund 、 Over the counter fund .

Today, let's take a look at the difference between these funds , What investors should choose ?

From the perspective of cost rate , Floor funds are the most appropriate .

Bosch's S S & P 500ETF Management fee and custody fee , Add up to only... A year 0.85%.

Cathay Pacific's new S & P 500ETF, Lower cost rate , Management expense + The trusteeship fee is only one year 0.75%.

In the case of serious homogenization ETF field , This difference in rates is really an advantage of Cathay Pacific Fund .

Another kind of on-site products , E fund's S S & P 500LOF The cost rate is a little higher , The management fee is better than that of ETF high 0.2%.

And OTC funds , Include ETF Feeder Fund 、 Outside LOF、FOF, They all have a certain subscription and redemption fee .

1. In the field ETF

We've sorted it out 2020 S & P at the beginning of the year 500 After touching the bottom ,ETF And the index .

Compared with the index ,ETF The annualized income difference is nearly 5%.

This difference mainly comes from two parts .

The first is exchange loss .

The exchange rate of US dollar against RMB is from 2020 year 3 In the 7 It's down 2022 year 4 Mid month 6.4, RMB exchange rate appreciation 9.4%.

If the exchange loss is ignored , The s&p 500ETF Trend and trend of The s&p 500 Index The trend is basically the same .

The second is position control .

2021 In the fourth quarter , Bosch S & P 500ETF Reduce the equity position to 88%. This operation is very forward-looking , Because self 2022 Started early , The s&p 500 Index Experienced the biggest pullback since the outbreak .

therefore , If the influence of exchange rate is excluded , The s&p ETF The annualized rate of return is even higher than The s&p 500 Index about 1%.

2. In the field LOF

And with the ETF comparison ,LOF The annualized rate of return is poor 1.3%.

E fund's S S & P 500LOF It's actually tracking The s&p 500 Index Products , Except for the difference of two thousandths of the management fee ,LOF Our asset allocation should be more conservative , Equity positions are also lower .

In two years , Three quarters of equity asset positions were less than 90%.

3.ETF Feeder Fund

Let's have a look at ETF Feeder Fund , For small partners outside the field , Fixed investment ETF The feeder fund is to obtain The s&p 500 Index An important way of earning .

And ETF comparison ,ETF The annualized return of the feeder fund is low 1.9%.

ETF The underlying assets of the feeder fund are actually Boshi's ETF, It just gives investors an opportunity to buy directly at net value from the OTC market ETF Share channels .

But in response to the pressure of investors to redeem ,ETF Feeder funds are allocated a certain proportion of bank deposits .

therefore ,ETF The feeder fund is compared to the ETF, The proportion of equity is lower , In the bull market, the yield naturally can not beat the floor with heavier equity positions ETF 了 .

however , about QDII Of ETF, There is another special point , As the fund investment involves the amount of foreign exchange , In the field ETF There is often a premium on OTC feeder funds , So buying floor share is not necessarily better , It still depends on the specific situation at the time of purchase .

4.FOF

And ETF comparison , Tianhong's one QDII-FOF The annualized return of the fund is poor 2.6%.

The gap is still large .

The underlying asset of this product is S & P managed by some fund companies in the United States 500ETF product .

and FOF In order to cope with the redemption, the product also needs to reserve cash assets with certain positions . The lower limit of equity asset allocation ratio in the prospectus is 80%, And this fund basically operates at the lower limit .

The quarter with the highest proportion of equity assets in history was last year 3 quarter , The proportion of positions exceeds 85%.

Except for this reason , The fund itself is also relatively small , It may lead to high transaction costs and lower the level of yield .

5. General OTC funds ( Dacheng )

The underlying assets of this OTC fund are very special , You can see from his name , The underlying index that this fund actually tracks is S & P 500 Equal weight index .

comparison The s&p 500 Index , The preparation rule of equal weight index is not market capitalization weighting , It's a simple average , Allocate equal weight to all constituent stocks .

In short , Dacheng's fund is more average 、 More dispersed .

From the perspective of position , For it The s&p 500 Index The highest position of a single component stock in the is only 0.21%. And Bosch's S S & P 500ETF The component stock with the highest weight is Apple , Proportion of positions 6.44%.

From the perspective of asset allocation , This fund and Boshi ETF equally , Both have a relatively high proportion of equity assets .

In terms of revenue , Dacheng Fund has a much higher annualized rate of return 1.8%, Excess return is mainly the weight of individual stocks α earnings .

These tracks S & P 500 Each fund has its own characteristics .

If you pay more attention to the return on equity assets like me , Investors on the floor can choose Bosch S & P 500ETF Or the upcoming Cathay Pacific Standard & Poor's 500ETF, But pay attention to the floor premium rate ; The words of OTC investors , You can buy Dacheng S & P 500 Equal weight index QDII fund ,

by comparison , They will have a higher proportion of equity assets .

Want to vote for S & P 500 Index investors can buy ETF Feeder Fund .

After all, the relatively successful OTC Fund ,ETF Feeder funds are cheaper , And the position is closer to The s&p 500 Index .

original Mister Lee iETF linghu chong

@ Today's topic @ Snowball creator Center

$ The s&p 500ETF(SH513500)$ $ Dacheng S & P 500(F096001)$

# The new fund is intensively issued this week , Low risk products dominate # # Adversity sees Niuji ? Which anti falling funds deserve attention #

版权声明

本文为[snowball]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204211101387930.html

边栏推荐

- Analysis of JMeter pressure measurement mqtt results

- [server data recovery] a data recovery case in which multiple hard disks of server raid6 are offline successively

- 10-Personalized Top-N Sequential Recommendation via Convolutional Sequence Embedding论文详解

- What is the future direction of GPU?

- MySQL Download

- Learning neural network drawing Matplotlib

- Product sharing: QT + OSG education discipline tool: Geographic 3D planet

- Implementation of small cases

- How do programmers take orders alone?

- Registration process of New Zealand company and materials required

猜你喜欢

These good works of finclip hacker marathon competition, come and have a look

Xiaomi and zhiting's smart cameras protect your family privacy

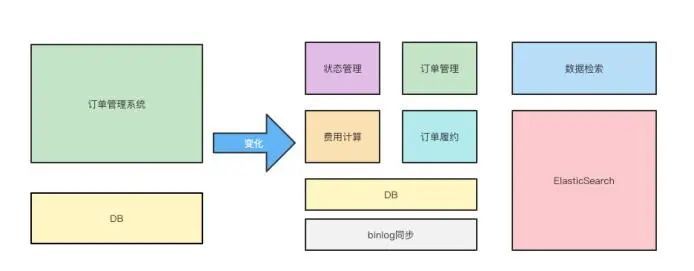

Zhongshanghui ⺠ evolution of trading platform architecture: response to Apache shardingsphere

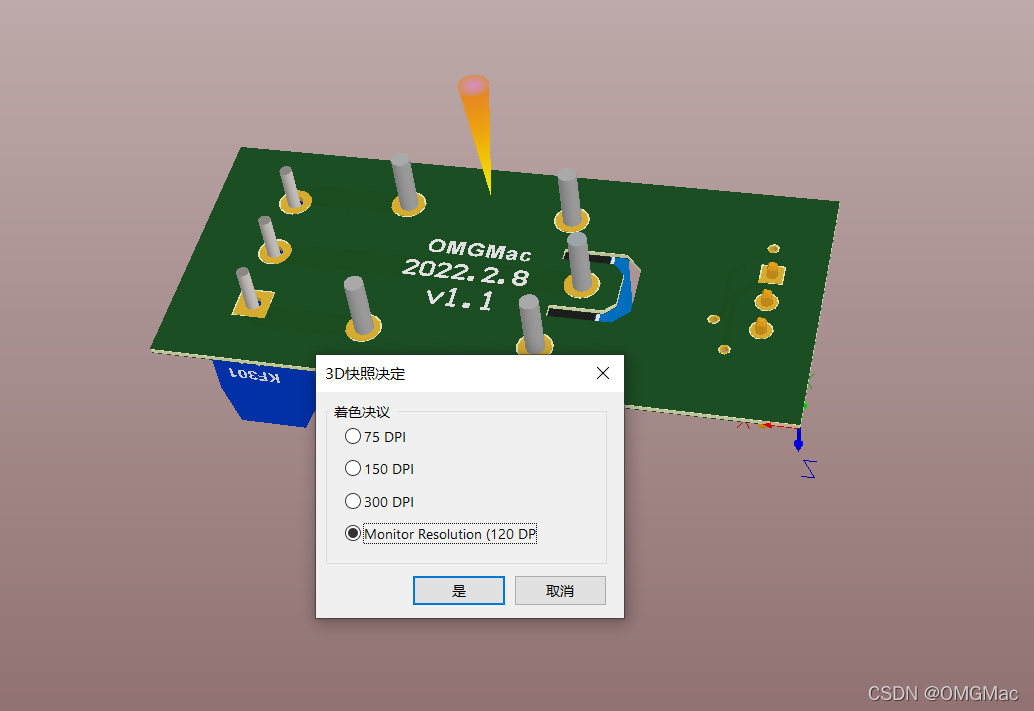

How to generate PCB real-time snapshot in 3D in Ad

On the origin of wireless operation and maintenance and project construction

Autodesk Genuine Service2020删除

vscode 打造 shell 使用

MySQL Download

Ivorysql 1.2 has come

数据挖掘系列(2)_Excel的数据挖掘插件连接SQL Server

随机推荐

Common tool NC Wireshark rebound shell

2021-11-06 database

There is no input method after win11 system starts up - the solution is effective through personal test

类unix系统中history命令不显示行号的5种方法

MongoDB——聚合管道之$match操作

Vscode shell

Deep learning and image recognition: principle and practice notes day_ ten

Introduction to Alibaba's super large-scale Flink cluster operation and maintenance system

Learning neural network drawing Matplotlib

英语 | Day11、12 x 句句真研每日一句(意思群)

Open source culture is still shining - in the openeuler community, with technology and idea, you are the protagonist

English | Day11, 12 x sentence true research daily sentence (meaning group)

Rasa dialogue robot serial 2 lesson 121: the actual operation of Rasa dialogue robot debugging project: the whole process demonstration of e-commerce retail dialogue robot operation process debugging-

染色法判定二分图

Smart Life - how convenient is it to schedule smart home devices?

JS dynamically generates a table and adds a scroll bar

DataGrip闪退,如何解决?MySQL

Cognitive system services

Implementation of small cases

【网络实验】/主机/路由器/交换机/网关/路由协议/RIP+OSPF/DHCP