当前位置:网站首页>关于数字货币现货期权合约交易所系统开发详情源码

关于数字货币现货期权合约交易所系统开发详情源码

2022-08-07 16:35:00 【I357O98O7I8】

先使用ccxt获取交易所的实例,然后获取历史k线,得到的数据使用dataframe格式接受

huobipro.fetch_ohlcv(symbol=symbol,limit=limit_num,timeframe=timeframe)

然后利用pandas提供的函数计算MA,

df['median_short']=df['close'].rolling(n_short,min_periods=1).mean()

df['median_long']=df['close'].rolling(n_long,min_periods=1).mean()

然后再找出买入卖出信号,

#找出买入信号

condition1=df['median_short']>df['median_long']#短均线上穿长均线

condition2=df['median_short'].shift(1)<=df['median_long'].shift(1)

df.loc[condition1&condition2,'signal']=1#产生买入信号的k线标记为1

#找出卖出信号

condition1=df['median_short']<df['median_long']#短均线上穿长均线

condition2=df['median_short'].shift(1)>=df['median_long'].shift(1)

df.loc[condition1&condition2,'signal']=0#产生卖出信号的k线标记为0

有了交易信号,就可以获取信号,再判断进行下单(huobipro.create_limit_buy/sell_order()了)

第五步:其实第四步就可以交易了,第五步是回测,一般来说先回测再根据回测结果选用策略,最后才进行实盘

回测分析的相关有很多种,在这方面我也不是很懂,目前我还是习惯用累计利润来进行分析,

#由signal计算出实际的每天持仓

df['pos']=df['signal'].shift()

df['pos'].fillna(method='ffill',inplace=True)

df['pos'].fillna(value=0,inplace=True)

到这里持仓信号就有了,就可以根据持仓和历史k线的价格计算累计利润了,

df['change']=df['close'].pct_change(1)#根据收盘价计算涨跌幅

df['by_at_open_change']=df['close']/df['open']-1#开盘买入到收盘的涨跌幅

df['sell_next_open_change']=df['open'].shift(-1)/df['close']-1#这根收盘到下根开盘的涨跌幅

df.at[len(df)-1,'sell_next_open_change']=0#补全空值df.at[4,'B']

#选取开仓条件

condition1=df['pos']==1

condition2=df['pos']!=df['pos'].shift(1)

open_pos_condition=condition1&condition2

#选取平仓条件

condition1=df['pos']==0

condition2=df['pos']!=df['pos'].shift(1)

close_pos_condition=condition1&condition2

#对每次交易进行分组

df.loc[open_pos_condition,'start_time']=df['open_time']

df['start_time'].fillna(method='ffill',inplace=True)

df.loc[df['pos']==0,'start_time']=pd.NaT

init_cash=1000#初始资金

#计算仓位变动

#开仓时仓位

df.loc[open_pos_condition,'position']=init_cash*(1+df['by_at_open_change'])

group_num=len(df.groupby('start_time'))

if group_num>1:

temp=df.groupby('start_time').apply(lambda x:x['close']/x.iloc[0]['close']*x.iloc[0]['position'])

temp=temp.reset_index(level=[0])

df['position']=temp['close']

df['position_max']=df['position']*df['high']/df['close']

df['position_min']=df['position']*df['low']/df['close']

##平仓时的仓位

#df.loc[close_pos_condition,'position']*=(1+df.loc[close_pos_condition,'sell_next_open_change'])

#计算持仓利润

df['porfit']=(df['position']-init_cash)*df['pos']#持仓利润或亏损

#df.loc[df['pos']==1,'porfit_min']=(df['position_min']-init_cash)*df['pos']#最小持仓盈利或亏损

#df.loc[df['pos']==0,'porfit_max']=(df['position_max']-init_cash)*df['pos']

#计算实际资金量

df['cash']=init_cash+df['porfit']#实际资金

#计算资金曲线

df['equity_change']=df['cash'].pct_change()

#开仓日收益率

df.loc[open_pos_condition,'equity_change']=df.loc[open_pos_condition,'cash']/init_cash-1

df['equity_change'].fillna(value=0,inplace=True)

df['equity_curve']=(1+df['equity_change']).cumprod()

df['equity_curve']=df['equity_curve']*init_cash

边栏推荐

- Redis高频面试题完整版

- LeetCode_796_Rotate String

- ETCD快速入门-01 ETCD概述

- 第13章_事务基础知识

- 研扬Jetson NX镜像备份和恢复

- Chapter 219 New SSM Integration - Getting Through Mysql Database Control Transactions (including interview questions)

- 873. 欧拉函数

- UICamrea和其他Camera的区别,Camera跟随人物移动的脚本,人物移动结合遥感

- 传统伪影去除方案

- MySQL5.7.35 installation and configuration tutorial [super detailed installation tutorial]

猜你喜欢

在树莓派上使用cpolar(番外篇1)

Simple Web Production Final Assignment – The Movie Titanic (4 pages)

京东物流投用新疆最大产地智能供应链中心,农特产品最快 48 小时送达全国

Analysis of UVC device enumeration based on STM32

OK1028A核心板搭建QT开发环境

函数栈简述

Chapter 219 New SSM Integration - Getting Through Mysql Database Control Transactions (including interview questions)

【论文翻译和解释(1)】Mitigating Confounding Bias in Recommendation via Information Bottleneck

【数学建模】matlab向量(数组)

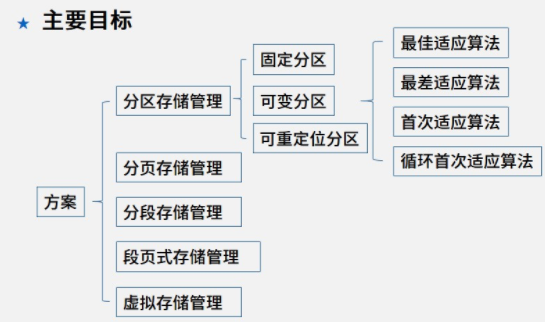

2.10 - 存储管理 2.11 - 页式存储 2.12 - 段式存储 2.13 - 段页式存储

随机推荐

初识微信小程序开发

研扬Jetson NX镜像备份和恢复

The use of csv configuration elements in jmter

R语言使用scale函数将向量数据或者dataframe指定数据列转换为Z分数(z-Scores、转化为规范化数据)

谷歌华人研究员发布MobileNeRF,渲染3D模型速度提升10倍

JVM high frequency interview questions PDF version

2022-08-06 Group 4 Self-cultivation class study notes (every day)

Qt opens and creates projects, runs programs

Web Server 设置缓存响应字段的一些推荐方案

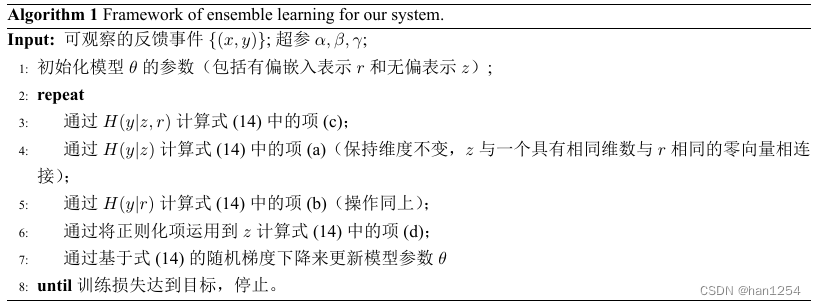

【论文翻译和解释(1)】Mitigating Confounding Bias in Recommendation via Information Bottleneck

2.11-2.10 - storage management page type store 2.12 sections 2.13 - period of storage

简单的网页制作期末作业——电影泰坦尼克号(4页)

JVM

873. Euler Functions

2022-08-06 第四小组 修身课 学习笔记(every day)

杭州股票开户安不安全?

肖sir___面试就业课__非技术面试题

项目管理仅关注交付结果不够,价值实现是未来趋势

轻量级运维工具pssh

No index signature with a parameter