当前位置:网站首页>Vnpy chapter of quantitative trading - synchronization module avoids self transaction risk and adds synchronization completion prompt

Vnpy chapter of quantitative trading - synchronization module avoids self transaction risk and adds synchronization completion prompt

2022-04-22 01:16:00 【Post-Truth】

"""

The cause of the matter : Although the financial bank has the function module of avoiding self transaction ; But there are still many cases , The program sends multiple empty two-way lists of the same contract at the same time , Rongxing will not deal with , It is estimated that this is a part of the financial bank system bug.

But now MOM Most accounts use the financial banking system , Therefore, the avoidance of self transaction risk still needs to be handled by our own procedures .

"""from vnpy.app.position_manager import StrategyTemplate

from vnpy.trader.utility import BarGenerator

import math

from time import sleep

from vnpy.app.position_manager.tools.position_operator.position_operator import TQZPositionJsonOperator

from vnpy.app.position_manager.tools.symbol_operator.symbol_operator import (

TQZSymbolOperator,

TQZFuturesType

)

from vnpy.app.position_manager.tools.position_data.position_data import TQZPositionData

from vnpy.trader.object import (

TickData,

BarData

)

from vnpy.trader.constant import Direction

class PositionManager(StrategyTemplate):

author = "Post-Truth"

# Policy parameters

offset_tick_counts = 10

parameters = ["offset_tick_counts"]

variables = []

def __init__(self, strategy_engine, strategy_name, vt_symbols, setting):

""" """

super().__init__(strategy_engine, strategy_name, vt_symbols, setting)

print("PositionManager init")

self.bar_generators: {str: BarGenerator} = {}

self.vt_symbols_limit_prices: {str: TickData} = {}

self.strategy_position_dictionary = self.tqz_get_current_cta_strategy_data()

print("cta_strategy_data: " + str(self.strategy_position_dictionary))

self.strategy_vt_symbols = TQZSymbolOperator.tqz_get_strategy_vt_symbols(self.strategy_position_dictionary.keys())

self.last_time_slot: {str, int} = {}

self.last_minute: {str, int} = {}

self.is_new: {str, bool} = {}

self.is_syn: {str, bool} = {}

for vt_symbol in self.vt_symbols:

self.bar_generators[vt_symbol] = BarGenerator(on_bar=self.on_bar)

self.last_time_slot[vt_symbol] = 0

self.last_minute[vt_symbol] = -1

self.is_syn[vt_symbol] = False

def on_init(self):

"""

Callback when strategy is inited.

"""

print("PositionManager on_init")

self.write_log(" Policy initialization ")

def on_start(self):

"""

Callback when strategy is started.

"""

print("PositionManager on_start")

self.write_log(" Strategy start ")

def on_stop(self):

"""

Callback when strategy is stopped.

"""

print("on_stop")

self.write_log(" Strategy stops ")

def on_tick(self, tick):

"""

Callback of new tick data update.

"""

""" bar type

self.vt_symbols_limit_prices[tick.vt_symbol] = tick

self.bar_generators[tick.vt_symbol].update_tick(tick)

"""

self.vt_symbols_limit_prices[tick.vt_symbol] = tick

self.on_x_seconds(tick=tick)

def on_x_seconds(self, tick: TickData, seconds_interval: int = 15):

"""

Callback when x seconds pass or new minute coming.

"""

if self.__is_new_time_slot(tick=tick, seconds_interval=seconds_interval) is False:

return

self.cancel_all()

print("tick.vt_symbol: " + str(tick.vt_symbol), end=" ")

print("datatime: " + str(tick.datetime))

# get current strategy data

self.strategy_position_dictionary = self.tqz_get_current_cta_strategy_data()

strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell = self.tqz_get_strategy_position_and_real_position(

market_vt_symbol=tick.vt_symbol,

strategy_data=self.strategy_position_dictionary

)

current_futures_type = TQZSymbolOperator.tqz_get_futures_type(vt_symbol=tick.vt_symbol)

min_offset_price = self.strategy_engine.contracts[tick.vt_symbol].pricetick

# do nothing when current symbol is in syncronized condition

is_syn = self.__tqz_strategy_is_real(

strategy_position_buy=strategy_position_buy,

strategy_position_sell=strategy_position_sell,

real_position_buy=real_position_buy,

real_position_sell=real_position_sell,

futures_type=current_futures_type

)

if is_syn is True:

self.is_syn[tick.vt_symbol] = is_syn

if False not in self.is_syn.values():

print("account is syn.")

return

if (tick.vt_symbol not in self.strategy_vt_symbols) or current_futures_type in [TQZFuturesType.COMMODITY_FUTURES, TQZFuturesType.TREASURY_FUTURES]:

self.tqz_synchronization_position_double_direction_mode(

market_vt_symbol=tick.vt_symbol,

now_price=tick.last_price,

offset_price=(min_offset_price * self.offset_tick_counts),

strategy_position_buy=strategy_position_buy,

strategy_position_sell=strategy_position_sell,

real_position_buy=real_position_buy,

real_position_sell=real_position_sell

)

elif current_futures_type is TQZFuturesType.STOCK_INDEX_FUTURES:

self.tqz_synchronization_position_cffex_lock_mode(

market_vt_symbol=tick.vt_symbol,

now_price=tick.last_price,

offset_price=(min_offset_price * self.offset_tick_counts),

strategy_position_net=(strategy_position_buy - strategy_position_sell),

real_position_net=(real_position_buy - real_position_sell)

)

else:

self.write_log("futures_type: " + str(current_futures_type) + " is out of futures type")

self.put_event()

sleep(0.1)

def __is_new_time_slot(self, tick: TickData, seconds_interval):

"""

Judge current time_slot is new or not.

"""

current_time_slot = math.floor(tick.datetime.second / seconds_interval)

if tick.datetime.minute != self.last_minute[tick.vt_symbol]: # new minute is come

self.last_time_slot[tick.vt_symbol], self.last_minute[tick.vt_symbol], self.is_new[tick.vt_symbol] = current_time_slot, tick.datetime.minute, True

elif current_time_slot != self.last_time_slot[tick.vt_symbol]: # new minute is not come, but last_time_slot is update

self.last_time_slot[tick.vt_symbol], self.last_minute[tick.vt_symbol], self.is_new[tick.vt_symbol] = current_time_slot, tick.datetime.minute, True

else:

self.is_new[tick.vt_symbol] = False

return self.is_new[tick.vt_symbol]

# --- old modern ---

def on_bar(self, bar: BarData):

"""

Callback of new bar data update.

"""

self.cancel_all()

print("bar.vt_symbol: " + str(bar.vt_symbol), end=" ")

print("datatime: " + str(bar.datetime))

# get current strategy data

self.strategy_position_dictionary = self.tqz_get_current_cta_strategy_data()

strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell = self.tqz_get_strategy_position_and_real_position(

market_vt_symbol=bar.vt_symbol,

strategy_data=self.strategy_position_dictionary

)

current_futures_type = TQZSymbolOperator.tqz_get_futures_type(vt_symbol=bar.vt_symbol)

min_offset_price = self.strategy_engine.contracts[bar.vt_symbol].pricetick

# do nothing when current symbol is in syncronized condition

if self.__tqz_strategy_is_real(strategy_position_buy=strategy_position_buy, strategy_position_sell=strategy_position_sell, real_position_buy=real_position_buy, real_position_sell=real_position_sell, futures_type=current_futures_type) is True:

return

if (bar.vt_symbol not in self.strategy_vt_symbols) or current_futures_type in [TQZFuturesType.COMMODITY_FUTURES, TQZFuturesType.TREASURY_FUTURES]:

self.tqz_synchronization_position_double_direction_mode(

market_vt_symbol=bar.vt_symbol,

now_price=bar.close_price,

offset_price=(min_offset_price * self.offset_tick_counts),

strategy_position_buy=strategy_position_buy,

strategy_position_sell=strategy_position_sell,

real_position_buy=real_position_buy,

real_position_sell=real_position_sell

)

elif current_futures_type is TQZFuturesType.STOCK_INDEX_FUTURES:

self.tqz_synchronization_position_cffex_lock_mode(

market_vt_symbol=bar.vt_symbol,

now_price=bar.close_price,

offset_price=(min_offset_price * self.offset_tick_counts),

strategy_position_net=(strategy_position_buy - strategy_position_sell),

real_position_net=(real_position_buy - real_position_sell)

)

else:

self.write_log("futures_type: " + str(current_futures_type) + " is out of futures type")

self.put_event()

sleep(0.2)

def tqz_synchronization_position_cffex_lock_mode(self, market_vt_symbol, now_price, offset_price, strategy_position_net, real_position_net):

"""

synchronization position with lock mode(cffex mode)

"""

vt_orderids = []

buy_price = min(now_price + offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_up)

sell_price = max(now_price - offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_down)

if strategy_position_net >= 0 and real_position_net >= 0:

if strategy_position_net > real_position_net:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_net-real_position_net)

print(f' Drive more {str(lot)} hand ', end=" ")

vt_orderids = self.buy(vt_symbol=market_vt_symbol, price=buy_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif strategy_position_net < real_position_net:

lot = TQZPositionData.tqz_risk_control(lot=real_position_net - strategy_position_net)

print(f' Pindo {str(lot)} hand ', end=" ")

vt_orderids = self.sell(vt_symbol=market_vt_symbol, price=sell_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif strategy_position_net is real_position_net:

print(f' Net positions are equal , Don't deal with it ')

elif strategy_position_net >= 0 and real_position_net <= 0:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_net-real_position_net)

print(f' Drive more {str(lot)} hand ', end=" ")

vt_orderids = self.buy(vt_symbol=market_vt_symbol, price=buy_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif strategy_position_net <= 0 and real_position_net >= 0:

lot = TQZPositionData.tqz_risk_control(lot=real_position_net - strategy_position_net)

print(f' Open up {str(lot)} hand ', end=" ")

vt_orderids = self.short(vt_symbol=market_vt_symbol, price=sell_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif strategy_position_net <= 0 and real_position_net <= 0:

if abs(strategy_position_net) > abs(real_position_net):

lot = TQZPositionData.tqz_risk_control(lot=abs(strategy_position_net)-abs(real_position_net))

print(f' Open up {str(lot)} hand ', end=" ")

vt_orderids = self.short(vt_symbol=market_vt_symbol, price=sell_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif abs(strategy_position_net) < abs(real_position_net):

lot = TQZPositionData.tqz_risk_control(lot=abs(real_position_net) - abs(strategy_position_net))

print(f' Flat {str(lot)} hand ', end=" ")

vt_orderids = self.cover(vt_symbol=market_vt_symbol, price=buy_price, volume=lot, lock=True)

print(f'vt_orderids: {vt_orderids}')

elif strategy_position_net is real_position_net:

print(f' Net positions are equal , Don't deal with it ')

return vt_orderids

def tqz_synchronization_position_double_direction_mode(self, market_vt_symbol, now_price, offset_price, strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell):

buy_vt_orderids = []

sell_vt_orderids = []

buy_price = min(now_price + offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_up)

sell_price = max(now_price - offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_down)

interval = " | "

print(market_vt_symbol, end=" ")

if strategy_position_buy > real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_buy - real_position_buy)

print(f' Drive more {str(lot)} hand ', end=" ")

buy_vt_orderids = self.buy(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'buy_result: {buy_vt_orderids}', end=interval)

return buy_vt_orderids

elif strategy_position_buy < real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=real_position_buy - strategy_position_buy)

print(f' Pindo {str(lot)} hand ', end=" ")

buy_vt_orderids = self.sell(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'sell_result: {buy_vt_orderids}', end=interval)

return buy_vt_orderids

elif strategy_position_buy is real_position_buy:

print(" Multiple single matching Don't deal with ", end=interval)

if strategy_position_sell > real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_sell - real_position_sell)

print(f' Open up {str(lot)} hand ', end=" ")

sell_vt_orderids = self.short(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'short_result: {sell_vt_orderids}')

return sell_vt_orderids

elif strategy_position_sell < real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=real_position_sell - strategy_position_sell)

print(f' Flat {str(lot)} hand ', end=" ")

sell_vt_orderids = self.cover(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'cover_result: {sell_vt_orderids}')

return sell_vt_orderids

elif strategy_position_sell is real_position_sell:

print(" Empty order matching Don't deal with ")

return list(set(buy_vt_orderids + sell_vt_orderids))

def tqz_synchronization_position_min_netting_mode(self, market_vt_symbol, now_price, offset_price, strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell):

"""

synchronization position in min netting with double direction(buy direction & sell direction) mode.

"""

net_buy_abs = abs(strategy_position_buy - real_position_buy)

net_sell_abs = abs(strategy_position_sell - real_position_sell)

buy_vt_orderids = []

sell_vt_orderids = []

buy_price = min(now_price + offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_up)

sell_price = max(now_price - offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_down)

interval = " | "

print(market_vt_symbol, end=" ")

if net_buy_abs >= net_sell_abs:

if strategy_position_buy < real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=real_position_buy - strategy_position_buy)

print(f' Pindo {str(lot)} hand ', end=" ")

buy_vt_orderids = self.sell(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'sell_result: {buy_vt_orderids}', end=interval)

if strategy_position_sell > real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_sell - real_position_sell)

print(f' Open up {str(lot)} hand ', end=" ")

sell_vt_orderids = self.short(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'short_result: {sell_vt_orderids}')

else:

if strategy_position_buy > real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_buy - real_position_buy)

print(f' Drive more {str(lot)} hand ', end=" ")

buy_vt_orderids = self.buy(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'buy_result: {buy_vt_orderids}', end=interval)

if strategy_position_sell < real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=real_position_sell - strategy_position_sell)

print(f' Flat {str(lot)} hand ', end=" ")

sell_vt_orderids = self.cover(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'cover_result: {sell_vt_orderids}')

return list(set(buy_vt_orderids + sell_vt_orderids))

def tqz_synchronization_position_net_mode(self, market_vt_symbol, now_price, offset_price, strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell):

buy_vt_orderids = []

sell_vt_orderids = []

if strategy_position_buy > strategy_position_sell:

strategy_position_buy, strategy_position_sell = strategy_position_buy - strategy_position_sell, 0

elif strategy_position_buy < strategy_position_sell:

strategy_position_sell, strategy_position_buy = strategy_position_sell - strategy_position_buy, 0

elif strategy_position_buy is strategy_position_sell:

strategy_position_buy, strategy_position_sell = 0, 0

buy_price = min(now_price + offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_up)

sell_price = max(now_price - offset_price, self.vt_symbols_limit_prices[market_vt_symbol].limit_down)

interval = " | "

print(market_vt_symbol, end=" ")

if strategy_position_buy > real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_buy - real_position_buy)

print(f' Drive more {str(lot)} hand ', end=" ")

buy_vt_orderids = self.buy(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'buy_result: {buy_vt_orderids}', end=interval)

elif strategy_position_buy < real_position_buy:

lot = TQZPositionData.tqz_risk_control(lot=real_position_buy - strategy_position_buy)

print(f' Pindo {str(lot)} hand ', end=" ")

buy_vt_orderids = self.sell(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'sell_result: {buy_vt_orderids}', end=interval)

elif strategy_position_buy is real_position_buy:

print(" Multiple single matching Don't deal with ", end=interval)

if strategy_position_sell > real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=strategy_position_sell - real_position_sell)

print(f' Open up {str(lot)} hand ', end=" ")

sell_vt_orderids = self.short(vt_symbol=market_vt_symbol, price=sell_price, volume=lot)

print(f'short_result: {sell_vt_orderids}')

elif strategy_position_sell < real_position_sell:

lot = TQZPositionData.tqz_risk_control(lot=real_position_sell - strategy_position_sell)

print(f' Flat {str(lot)} hand ', end=" ")

sell_vt_orderids = self.cover(vt_symbol=market_vt_symbol, price=buy_price, volume=lot)

print(f'cover_result: {sell_vt_orderids}')

elif strategy_position_sell is real_position_sell:

print(" Empty order matching Don't deal with ")

return list(set(buy_vt_orderids + sell_vt_orderids))

def tqz_get_strategy_position_and_real_position(self, market_vt_symbol, strategy_data):

"""

get real position(buy, sell) and strategy position(buy, sell)

"""

# strategy position

strategy_position_buy = TQZSymbolOperator.tqz_get_strategy_position(

market_vt_symbol=market_vt_symbol,

direction=Direction.LONG,

strategy_data=strategy_data

)

strategy_position_sell = TQZSymbolOperator.tqz_get_strategy_position(

market_vt_symbol=market_vt_symbol,

direction=Direction.SHORT,

strategy_data=strategy_data

)

# real position

real_position_buy = self.tqz_get_real_position(

market_vt_symbol=market_vt_symbol,

direction=Direction.LONG

)

real_position_sell = self.tqz_get_real_position(

market_vt_symbol=market_vt_symbol,

direction=Direction.SHORT

)

return strategy_position_buy, strategy_position_sell, real_position_buy, real_position_sell

def tqz_get_current_cta_strategy_data(self):

""" """

return TQZPositionJsonOperator.tqz_load_jsonfile(jsonfile=self.strategy_engine.strategy_positions_all_path)

# ------ private part ------

def __tqz_strategy_is_real(self, strategy_position_buy, real_position_buy, strategy_position_sell, real_position_sell, futures_type: TQZFuturesType):

"""

strategy position(buy, sell) is real position(buy, sell) or not

"""

if futures_type in [TQZFuturesType.COMMODITY_FUTURES, TQZFuturesType.TREASURY_FUTURES]:

is_same = (strategy_position_buy is real_position_buy) and (strategy_position_sell is real_position_sell)

elif futures_type is TQZFuturesType.STOCK_INDEX_FUTURES:

is_same = (strategy_position_buy - strategy_position_sell) is (real_position_buy - real_position_sell)

else:

self.write_log("__tqz_strategy_is_real: futures_type is error.")

is_same = True

return is_same

版权声明

本文为[Post-Truth]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204220035517637.html

边栏推荐

- 在setTimeout里设置倒数5秒计时的方法

- Redis个人笔记:Redis应用场景,Redis常见命令,Reids缓存击穿穿透,Redis分布式锁实现方案,秒杀设计思路,Redis消息队列,Reids持久化,Redis主从哨兵分片集群

- R language generalized linear model function GLM and GLM function are used to construct logistic regression model, and chi square test is used to verify whether the two logistic regression models are

- 不能再简单的意向锁

- [audio and video] RTCP

- A comprehensive analysis of the application of histogram

- What are the main constraints on the development of mobile phone hardware performance

- 使用多个可选过滤器过滤 Eloquent 模型

- PR如何对裁剪之后的视频进行resize,指定到期望大小?

- Solve the problem that the idea web project does not have small blue dots

猜你喜欢

Ivorysql unveiled at postgresconf SV 2022 Silicon Valley Postgres Conference

Cookie & session learning

. net treasure API: ihostedservice, background task execution

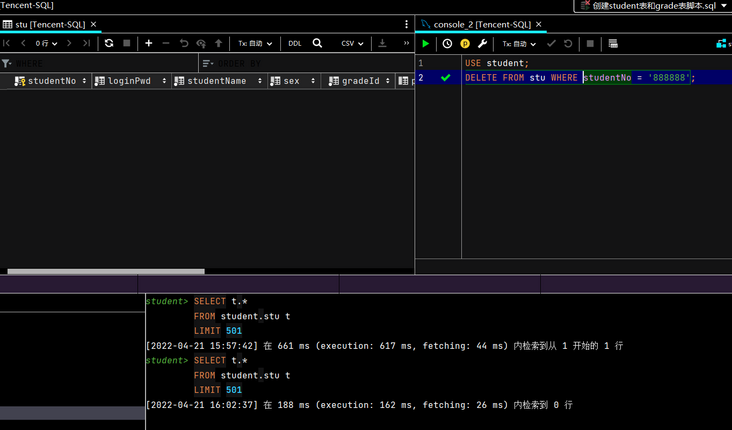

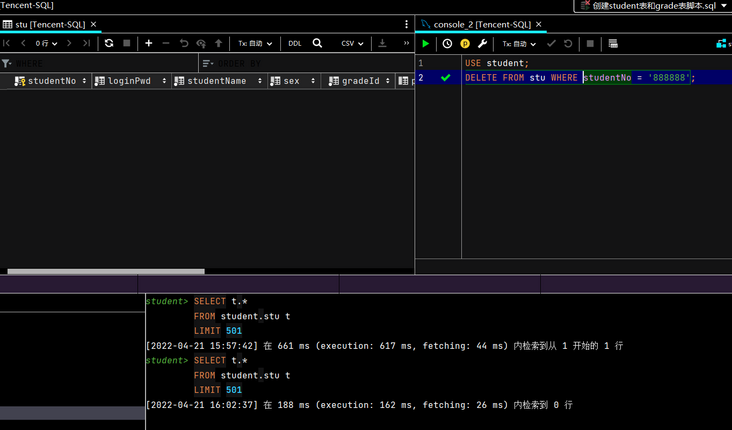

MySQL进阶之数据的增删改查(DML)

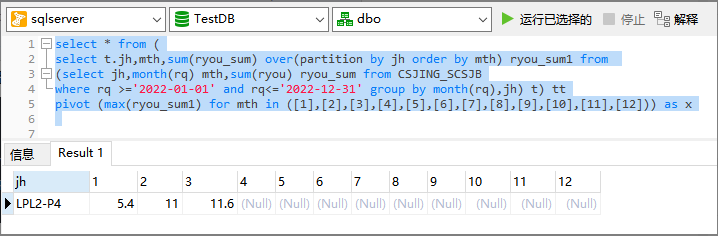

SQL Server 2008 uses over (partition by.. order by..) Syntax error displayed

Why does the web login need a verification code?

April 21, 2022, day 14

精品:千字长文手把手教你使用字节跳动的火山引擎veImageX

Addition, deletion, modification and query of advanced MySQL data (DML)

Servlet

随机推荐

Boutique: thousand word long text hand-in-hand teaches you to use the byte beating volcanic engine veimagex

Interview questions for system engineers, college students, ant gold clothes on three sides

Five tips for novices to do cross-border e-commerce in 2022

Redis personal notes: redis application scenario, redis common commands, redis cache breakdown and penetration, redis distributed lock implementation scheme, spike design idea, redis message queue, Re

观测云登陆阿里云计算巢,共建ISV新生态

13 bullish forms of K-line chart (Part 2)

DPI released the latest progress report on AI drug research and development

【音视频】RTCP

JS array object de duplication

sql server 2008使用over(PARTITION BY..ORDER BY.. ) 显示有语法错误

. net treasure API: ihostedservice, background task execution

2022年Redis最新面试题第1篇 - Redis基础知识

What do you need to know to join smart home?

From concept to realization, how does smart home come into our life step by step

JS prototype, prototype chain, constructor

Error message of "this file does not be long to any project, code insight features might not work properly" in clion

Algorithm interview classic 100 questions, sprint for 7 days to win offer

Griddata layout description

The WPF control created through WinForm control cannot be input

Probe architecture of open source project kindling based on ebpf Technology