当前位置:网站首页>How to achieve long-term benefits through the Tongdaxin quantitative trading interface?

How to achieve long-term benefits through the Tongdaxin quantitative trading interface?

2022-08-09 16:13:00 【Q1841085904】

The quantitative trading interface is based on writing a software system to monitor the real-time buying and selling of the stock market sales market, and set some standards. Once the trading conditions of the sales market reach those conditions, the actual operation can be automatically implemented, such asoperations such as buying and selling.

The core of the long-term benefit of the trust quantitative trading interface is that the trading logic can continue to grasp the advantages, and by establishing a trading system and outputting the trading logic for a long time, then long-term benefits can be obtained.

It is easy to see that when a trend appears, there will be a certain probability advantage. For example, in a rising trend, the probability advantage of going long will definitely exceed 50%.At this time, you can try to sell high.

At the same time, you also need to track the trend, and you can do transactions according to the market conditions. Then you can establish your own set of trading rules, and have your own set of trading systems that allow you to hold positions when the trend appears. This set of transactionsThe system also includes transaction logic and money management.

The transaction logic is to ensure that users continue to output their advantages, and fund management allows investment users to always have money to trade and to control risks, so in other words, long-term consistent execution of the trading system can achieve the goal of sustained profitability, that's itSimple.

But in many cases, human nature is difficult to overcome. But after investment users have a trading system with stable and positive returns, they can hand it over to the computer for execution, which can better overcome consistencyTherefore, the quantitative trading interface can be stably profitable.

边栏推荐

猜你喜欢

【胡扯】量子力学与单线程

卷积神经网络表征可视化研究综述(1)

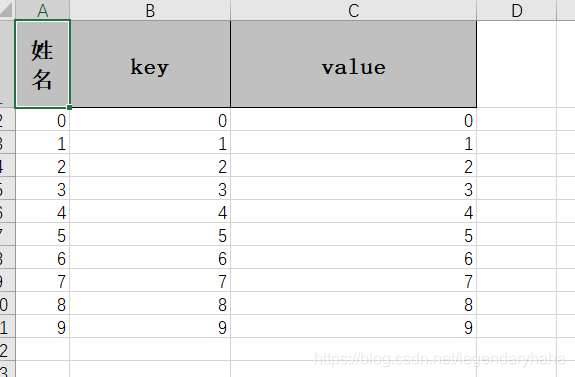

EasyExcel的应用

DBCO-PEG-DSPE, Phospholipid-Polyethylene Glycol-Dibenzocyclooctyne, Reaction Without Copper Ion Catalysis

![[MySql]实现多表查询-一对一,一对多](/img/7e/8f1af4422a394969b28a553ead2c42.png)

[MySql]实现多表查询-一对一,一对多

常用类学习

常见自动化测试工具及框架的选用

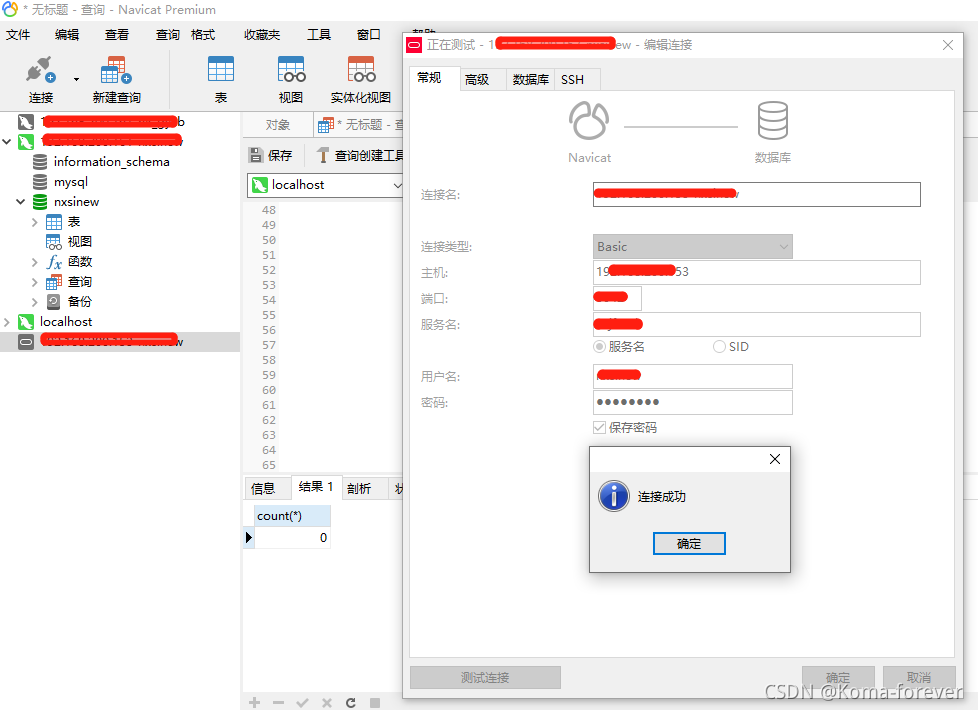

navicat for Oraclel链接oracle 报错oracle library is not loaded的解决办法

基于FPGA的FIR滤波器的实现(2)—采用kaiserord & fir2 & firpm函数设计

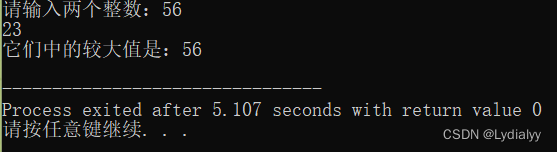

C语言——函数、参数和指针

随机推荐

C语言——函数、参数和指针

Computer Graphics From Scratch - Chapter 5

量化投资者是如何获取实时行情数据的呢?

听书项目总结

How do users correctly understand programmatic trading?

【微信小程序】利用MPFlutter开发微信小程序

如何灵活运用量化交易接口的优势取长补短?

Grad CAM model visualization

由于谷歌版本自动更新,导致selenium项目报错,如何关闭谷歌浏览器的自动更新?

OpenCV - Matrix Operations Part 3

JVM简学笔记

爬虫处理乱码问题

运算符学习

Swift中的Error处理

约束性统计星号‘*’

docke安装mysql以及主从搭建(并且指定数据生成路径)

经典面试题 之 SQL优化

shell之函数和数组

抢占量化交易基金产品先机,量化投资有发展空间?

DSPE-PEG-Aldehyde, DSPE-PEG-CHO, Phospholipid-PEG-Aldehyde MW: 1000