当前位置:网站首页>China venture capital, winter is coming

China venture capital, winter is coming

2022-04-22 01:04:00 【I dark horse】

source : Rongzhong Finance (ID:thecapital) author : Gardenia edit : We

Changes in valuation , Not only is PE/VC Topics of concern , It is also the key to the survival of many start-ups .

today , China's venture capital industry , We are facing unprecedented difficulties and challenges .

“ Entrepreneurs used to block the door , Investors are blocking the door now . Many institutions in order to get good projects , Some investment terms have even been relaxed .” Lifted 3 A project , Compared with the high point after listing , It fell almost half . Now it's just a return . And this pressure has been transmitted to the fundraising side .”

Enterprise check data show ,2022 First quarter of 2009 , Co occurrence in China's Venture Capital Circle 3291 Financing from the event , Year-on-year growth 63.%; The amount of financing exceeds 6660 One hundred million yuan , But it fell year-on-year 21%. among , Proportion of angel round or seed round financing events 7.32%,A Round share 15.65%, exceed B、C、D Total proportion of wheels 9.63%.

Looking back at the later stage , Proportion of strategic financing events 52.45%,IPO Stage proportion 4.98%, Proportion of M & A 9.02%, Proportion of private placement 0.94%. Especially in the strategic investment stage , exceed 1700 rise , Year on year growth rate reached 223.1%.

let me put it another way , In order to avoid the embarrassment of too high valuation for capital investment , They began to focus on A Round and previous investments , Cast early 、 I'm afraid the trend of small investment is also a last resort ; On the other hand , Actively participate in corporate governance with strategic investment , Perhaps in terms of ensuring investment returns , Only believe in yourself and choose to fight in person . But in the primary and secondary market valuation upside down is serious today , The consequence of this choice is that investors will sooner or later suffer the consequences , It's just a matter of time .

today , Continuous fermentation of COVID-19 , The affected area and depth are expanding , The development of many enterprises has been affected , The financing process is also greatly slowing down for various reasons . Combined with the , The window of US stock listing is still facing difficulties , dollar LP There are frequent voices of watching and even withdrawing from the Chinese market . anxious , Perhaps it is the true portrayal of investors now .

01 “ Best catcher ” Deep venture capital 50 There was no obvious change in the second morning

Because of COVID-19's repetition , And geopolitics ,2022 Since then , For the primary market PE/VC for , Obviously, the project valuation and risk control are more strict , Choose earlier stages and tracks that can be profitable in the long term , It seems to be becoming a safe haven from the correction of the secondary market .

In terms of investment ,2022 year Q1, Deep venture capital 50 Time , Become “ Best catcher ”, The field involves automobile manufacturing 、 Chip development 、 Biological medicine 、 Artificial intelligence, etc . Compared with the first quarter of last year , investment 22 Time , Rhythm changes Obviously .

Besides , Sequoia shot 40 Second place , Hillhouse venture capital takes 34 Third place , Junlian capital and Xiaomi group are among the top five . It should be noted that , Represented by Xiaomi and Tencent CVC Compared with last year, the investment rhythm has changed greatly .

From the perspective of Tencent investment ,2021 First quarter , Tencent invested the most , total 87 Time ; Compared with , Only this year 24 Time , In the same period 72.4%. According to Tencent investment insiders , From the Spring Festival , The team has begun to limit the speed of shots , If you can't do it, don't do it .

Another reporter found that , In fact, some head mechanisms , In particular, the rhythm change of RMB funds is not obvious .

Dachen in the first quarter of this year , Intelligent manufacturing investment 8 A project ,3 Software and information technology ,1 A military industry ,1 A medical health ,2 A big consumer and enterprise service . Dachen insiders said ,“ From the track proportion of heavy positions , No big change . Last year, we made a total of 91 A project , Average first quarter 22 individual . Compared with , The rhythm is similar .” For its reasons , In fact, the investment logic of the mainstream track will not be greatly adjusted , What affects the rhythm is nothing more than project valuation .

02 The amount of medical investment is the largest, and the investment in automobile industry is the most expensive

From the popular tracks ,2022 year , Medical health has once again become a tuyere , With the help of capital , The enterprise has achieved rapid development in new product R & D and upstream and downstream industrial chain integration , The medical and health industry is also developing towards high-precision and cutting-edge direction .

Enterprise inspection display , First quarter , Health care 、 Enterprise service 、 Chip R & D and other fields are the first choice in the investment market , Favored by investors . among , A total of financing events occurred in the medical and health industry 507 rise , The largest number , The disclosed amount is 576.93 One hundred million yuan .

For a long time , The medical and health field has always been the focus of capital's long-term attention , Especially during the epidemic , With the improvement of people's health awareness , Increasing demand for medical services , The medical and health industry has entered a new era . however , The healthcare industry is maturing , Investment is more focused on the head players , The importance of M & A and strategic investment has gradually increased . But on the whole , China's new health care covid-19 has tested the achievements of China's medical and health technology development. , At the same time, it is also a great opportunity for capital to preempt the layout .

Co occurrence in enterprise service industry 301 rise , Chip R & D Industry 232 rise , However, the largest amount of financing disclosed is the automobile manufacturing industry , the height is 2216 One hundred million yuan . Relative , Although culture and entertainment only produce financing Events 46 rise , But the total amount of financing is as high as 508 One hundred million yuan .

Besides ,VC/PE The penetration rate of Kechuang Board reached 88.9%, This shows the favor of hard technology enterprises . Relatively speaking , Beijing stock exchange “ Specialization and innovation ” Insufficient proportion of enterprises listed 2%, Investment institutions still have huge exploration space .

03 The project valuation is too high VC Be more cautious

Another survey shows that , In the current market ,46% Investors believe that , The valuation of investment projects this year will be more dead than that of last year 、 Give lower . Many investment managers also told Rongzhong reporters , The interior has been “ Death order ”, We should judge the situation , Don't do it easily .

On the investment side , One side , Affected by the epidemic , Due to the inability of offline adjustment , Investment in many institutions has slowed , On the other hand , Have to say , The scale of early financing continued to increase , Especially seed round financing , Overvalued , It makes it difficult for many institutions to sell .

Only from the perspective of enterprise service market , from 21 Beginning of the year , The valuation has risen collectively , Part of the subject matter is FA Under the support , price oneself out of the market , Some contracts worth tens of millions and millions of annual revenue A Wheel and B Round project , Over valuation after investment 20 There is no shortage of RMB 100 million , Even more than 30 RMB .

A head of Renminbi institutional investors make complaints about reporters. ,“ Today's A Round of financing volume , In fact, with 2010 Year of B The volume of round financing is about the same . I don't know if the quality of the project is really good , still ‘ Money is not worth ’ 了 .”

in fact , On the market today , Most institutions want to get the right share at a lower price , The front has been extended to the early stage , Expect to invest in good projects . But then the problem is , The technology and product maturity of start-up projects are not high , And lack of financial data , The risk is too high .

thus , In turn, , Many organizations have higher and higher requirements for early projects .

In the past two years , When the seed round financing is successfully financed , The proportion of revenue generated by start-ups is rising alarmingly . complete A More than 100 companies in the round of financing 80% All have generated income , Compared with the past, it has been significantly improved . in other words , The company has made substantial business progress . Need to know , Think of the original AI The four little dragons and those enterprises on the science and Innovation Board , At the time of listing, they are still in a state of loss .

“ In a word , Now the situation is , No matter what A Wheel melting B round ,D Wheel melting E round , Dugui , Because it's not cheap in the early days .” The above investors said .

From the exit side , You can't get money if you go public , If you can't get out, you're in a hurry .

2022 First quarter ,VC/PE The pace of listing of invested enterprises is also slowing down as a whole . however , The average book return increased significantly , achieve 6.35 times , near 8 New year high . especially , And 2021 Compared to , Average book return multiple ( When the issue ) The science and innovation board and the growth enterprise board have significantly improved .

However , Sadly , Even if the project goes public , Investment institutions may also face a lack of money 、 An anxious dilemma .

a PE Institutional partners told reporters :“ Now the primary and secondary markets are obviously upside down . Lifted 3 A project , Compared with the high point after listing , It's almost halfway down . Now it's just a return . And this pressure has been transmitted to the fundraising side . Why is everyone talking about long-term investment , Need more patience LP. Because it takes time to exit . That's not another story .”

today , The most potential investment market must be in China , China's most valuable investment must be high technology . once , For some institutions , Market sentiment is too optimistic , The performance of some investment projects is not good , Subsequent financing is difficult , Valuations are hard to sustain . And the performance of Zhongyu stocks overseas is poor , The exit earnings of dollar funds will also suffer heavy losses . This will undoubtedly lead to the dollar LP stay 2022 Become more cautious in . This is certainly not a good thing for dollar funds or dual currency funds .

Whether investing or raising money , China's venture capital industry , We are facing unprecedented difficulties and challenges . As Chen Yi invested in Liu Xiaodan LP What the conference said , Under the background of drastic adjustment of capital market , Once exit is blocked , The price is hanging upside down , Over time , The pressure on investment institutions has soared , The reshuffle of Chinese investment institutions is inevitable . Apply a classic American drama line ,Winter iscoming!

版权声明

本文为[I dark horse]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204211631314331.html

边栏推荐

- L'Internet des objets n'a - t - il pas d'avenir?

- Rasa对话机器人连载二 第121课:Rasa对话机器人Debugging项目实战之电商零售对话机器人运行流程调试全程演示-2

- Technology cloud report: DPU market is hot. Will several large factories be allowed to eat alone in the future?

- 每日一练(46):两个数组的交集

- Apachecon Asia 2022 speech collection begins!

- 终于搞定微信扫码登录了,真香。。

- 智能名片小程序创建名片页功能实现关键代码

- Smart business card applet creates business card page function and realizes key code

- MySQL basic collection

- Solve the problem that prettier is invalid after svelte project uses pnpm

猜你喜欢

随机推荐

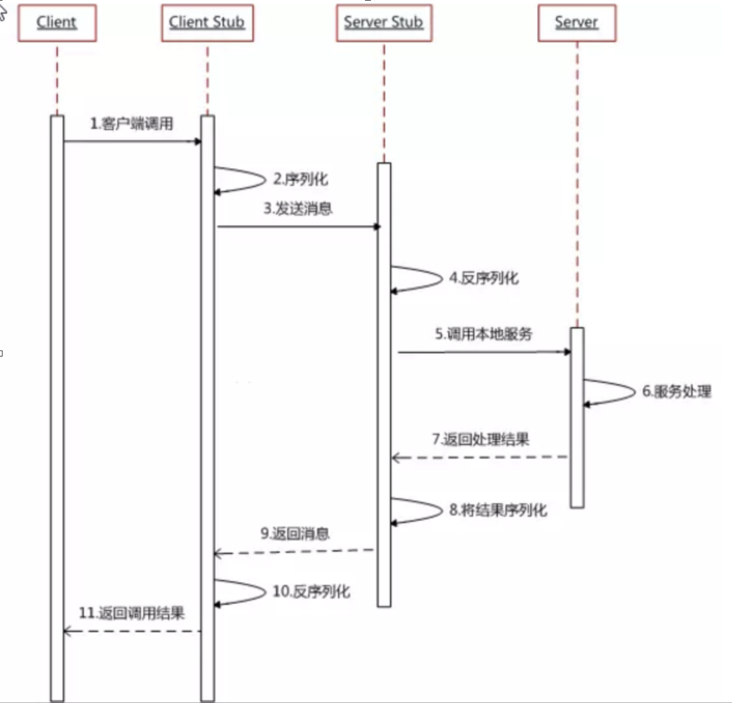

RPCX源码学习-server端

Watch mechanism of redis

MySQL数据库常识之储存引擎

智能生活—给智能家居的设备定时有多方便?

实现Nest中参数的联合类型校验

智能名片小程序创建名片页功能实现关键代码

Basic operation of redis transaction

[知识图谱] 金融证券知识图谱项目目录

Jmeter压测MQTT结果分析

torch. Usage of max()

MySQL basic collection

学习神经网络 绘图matplotlib

为什么Web端登录需要验证码?

【面试普通人VS高手系列】能谈一下CAS机制吗?

Rozrz online measurement automatic measurement online tool compensation CNC remote tool compensation machine tool remote tool setting instrument remote tool compensation scanning code transmission too

终于搞定微信扫码登录了,真香。。

数字化时代,企业运维面临现状及挑战分析解读

Technology cloud report: DPU market is hot. Will several large factories be allowed to eat alone in the future?

JS prototype, prototype chain, constructor

环形链表1和2双指针详解

Anonymous users

Anonymous users