当前位置:网站首页>Introduction to loan market quotation interest rate (LPR) and loan benchmark interest rate

Introduction to loan market quotation interest rate (LPR) and loan benchmark interest rate

2022-04-23 14:15:00 【pureluckyfish】

Benchmark interest rate and LPR There are two different interest rates , The benchmark lending rate of the people's Bank of China is an interest rate with guiding significance formulated by the people's Bank of China ;LPR Is the quoted interest rate of loans in the inter-bank market ,LPR Interest rate is a market-oriented index . It is the first step of interest rate marketization in China , First, we should marketize the loan interest rate , Then carry out the marketization of deposit interest rate .

One 、LPR Introduce

| LPR Publish website | http://www.shibor.org/shibor/web/html/index.html |

The interest rate quoted in the loan market (LPR) By each quotation bank at the open market operating interest rate ( It mainly refers to the medium-term loan facility interest rate ) Add points to form a quotation , Calculated by the national interbank lending center , Provide pricing reference for bank loans . at present ,LPR Include 1 Years and 5 More than two years old varieties .

LPR The quotation line currently includes 18 Home bank , monthly 20 Japan ( Postpone in case of holidays )9 When the former , Each quotation line is marked with 0.05 Percentage points for steps , Submit the quotation to the national interbank lending center ,

The national inter-bank lending center is based on the arithmetic average after removing the highest and lowest quotation , And to 0.05% The integral times of the nearest round LPR, On that day 9 when 15 Sub publication , The public can check it at the national interbank lending center and the website of the people's Bank of China .

Two 、 Introduction to loan benchmark interest rate

The benchmark interest rate for RMB loans of financial institutions is set by the central bank , Guiding interest rate for loans to commercial banks , Not the actual loan interest rate . Promulgated by the people's Bank of China , It hasn't changed for a long time , Last updated on :2015 year 10 month 24 Japan .

| Website of the people's Bank of China's benchmark loan interest rate |

| http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125440/125838/125888/2968985/index.html |

3、 ... and 、 distinguish between

| LPR | Benchmark interest rate | |

| Interest rate model | Market interest rate | Policy guiding interest rate |

| Release time | monthly 20 Japan 9 when 15 Sub publication ( Postpone in case of holidays ) |

Issued by the people's Bank of China |

| Publish website | National interbank lending center | National interbank lending center The People's Bank of China |

| Floating mode | Floating scale 、 Floating point number | Floating point number |

| Term grade | 1 Years and 5 More than years | Within a year ( Including a year )、 One to five years ( Including five years )、 More than five years and three grades |

summary : Talk about your own views , This is the essence. . The benchmark interest rate is a tool for the people's Bank of China to exert its interest rate policy to regulate the market , To regulate bank behavior , With mandatory and obvious policy nature , The loan interest rate of commercial banks cannot be arbitrarily too high or too low .LPR Interest rate is completely a market-oriented behavior of interest rate , If the capital cost of commercial banks is low , In order to expand the scale of loans , The interest rate can be reduced according to the principle of marketization . I personally believe that under the national conditions of socialism with Chinese characteristics, there will be no complete marketization of interest rate .

版权声明

本文为[pureluckyfish]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204231406485860.html

边栏推荐

- Recyclerview advanced use (I) - simple implementation of sideslip deletion

- 关于云容灾,你需要知道这些

- 快速搞懂线程实现的三种方式

- 在电视屏幕上进行debug调试

- Some experience of using dialogfragment and anti stepping pit experience (getactivity and getdialog are empty, cancelable is invalid, etc.)

- Mysql的安装过程(已经安装成功的步骤说明)

- postman批量生产body信息(实现批量修改数据)

- Redis数据库讲解(一)

- ie8 浏览器提示是否 阻止访问js脚本

- Five ways of using synchronized to remove clouds and fog are introduced

猜你喜欢

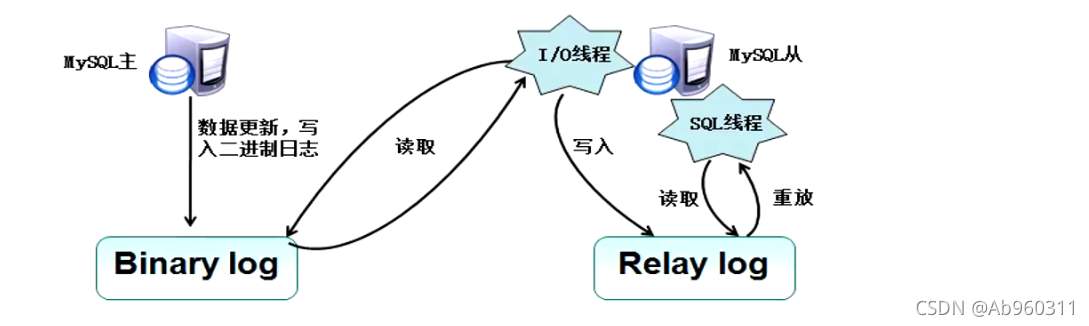

MySQL数据库讲解(十)

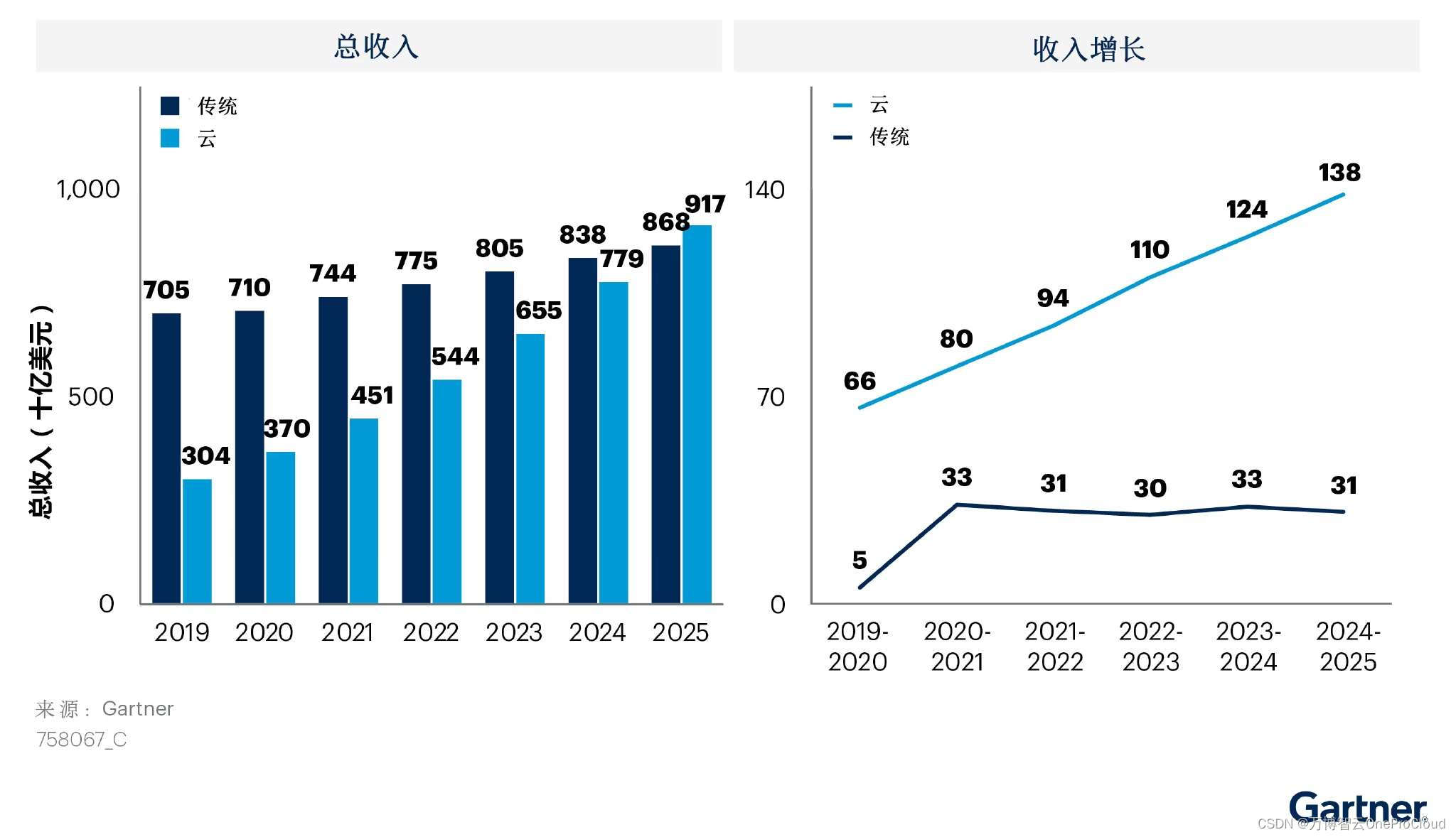

Gartner预测云迁移规模大幅增长;云迁移的优势是什么?

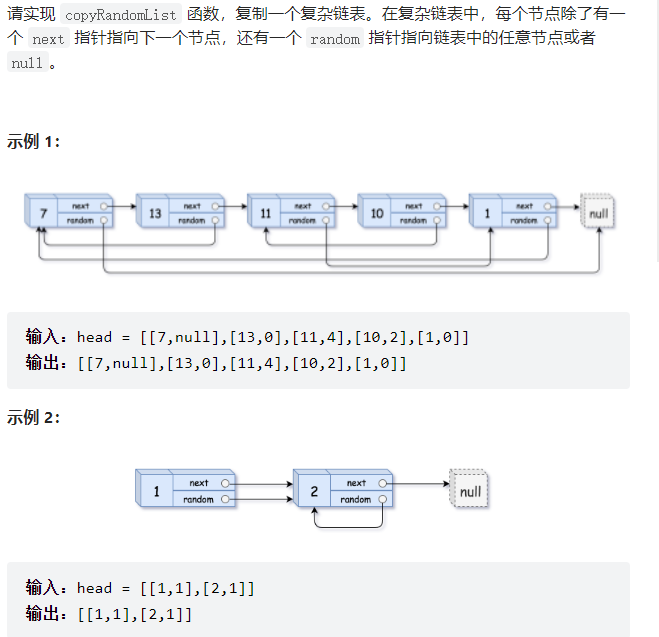

剑指offer刷题(1)--面向华为

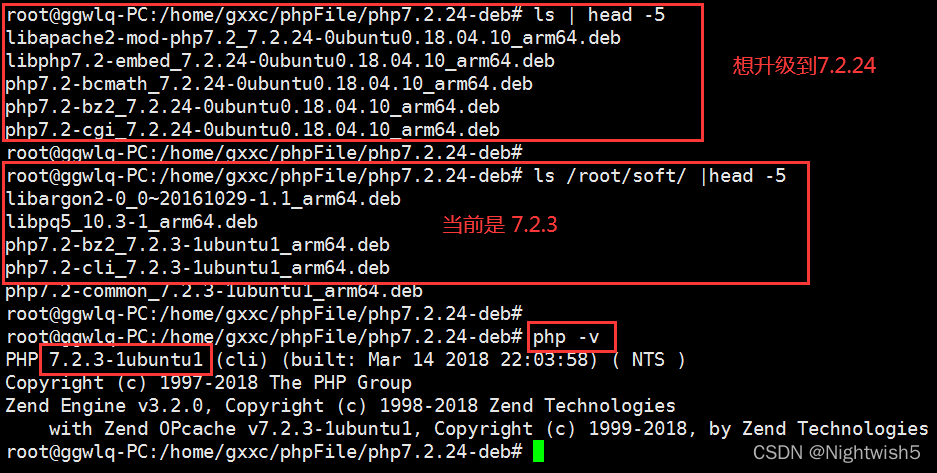

统信UOS PHP7.2.3升级至PHP7.2.24

困扰多年的系统调研问题有自动化采集工具了,还是开源免费的

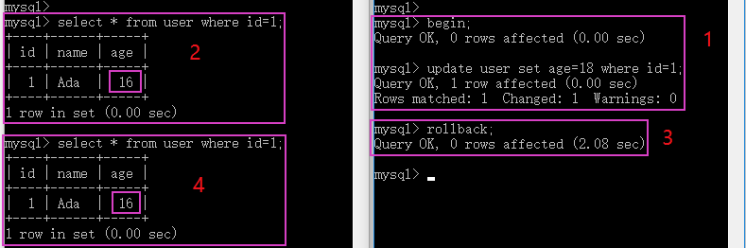

MySQL-InnoDB-事务

金融行业云迁移实践 平安金融云整合HyperMotion云迁移解决方案,为金融行业客户提供迁移服务

HyperBDR云容灾V3.3.0版本发布|容灾功能升级,资源组管理功能优化

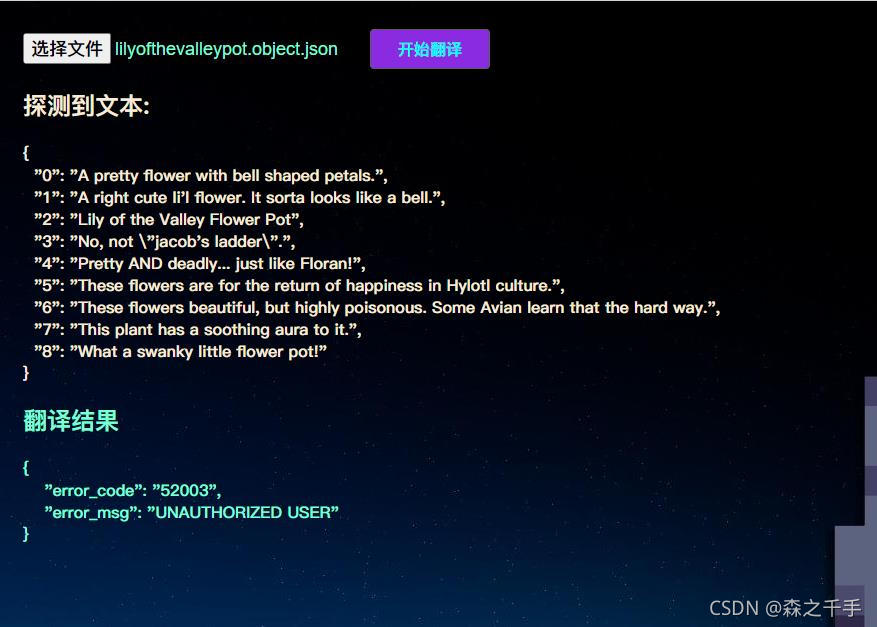

Operation instructions of star boundary text automatic translator

政务云迁移实践 北明数科使用HyperMotion云迁移产品为某政府单位实施上云迁移项目,15天内完成近百套主机迁移

随机推荐

ActiveMQ Basics

JDBC详解

Some experience of using dialogfragment and anti stepping pit experience (getactivity and getdialog are empty, cancelable is invalid, etc.)

VMware 15pro mounts the hard disk of the real computer in the deepin system

Oracle-数据泵使用

星界边境文本自动翻译机使用说明

Multiple inheritance virtual base exercises

MYSQL一种分表实现方案及InnoDB、MyISAM、MRG_MYISAM等各种引擎应用场景介绍

处理 mkdir:无法创建目录“aaa“:只读文件系统

云容灾是什么意思?云容灾和传统容灾的区别?

什么是云迁移?云迁移的四种模式分别是?

void*是怎样的存在?

json date时间日期格式化

RecyclerView细节研究-RecyclerView点击错位问题的探讨与修复

VMware15Pro在Deepin系统里面挂载真机电脑硬盘

剑指offer刷题(2)--面向华为

线程间控制之CountDownLatch和CyclicBarrier使用介绍

RecyclerView高级使用(一)-侧滑删除的简单实现

帆软分割求解:一段字符串,只取其中某个字符(所需要的字段)

MySQL数据库讲解(七)