当前位置:网站首页>Venture DAO Industry Research Report: Macro and Classic Case Analysis, Model Summary, Future Suggestions

Venture DAO Industry Research Report: Macro and Classic Case Analysis, Model Summary, Future Suggestions

2022-08-09 09:16:00 【Blockchain technology researcher】

一、Venture DAO 宏观分析

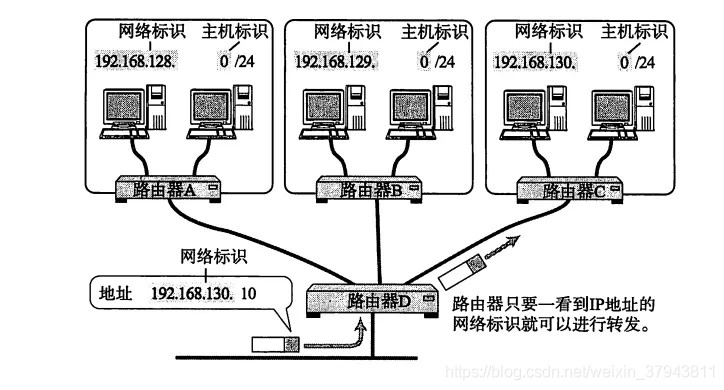

DAO(Decentralized Autonomous)can be understood as a blockchain-based, 以智能合约为运行原则的去中心化组织.DAO 的发展逐渐开始涵盖各类社区和业务需求,而 Venture DAO 将 DAO和 VC 结合起来,It has gradually become a new organizational model for everyone to invest in early projects..与传统 VC 相比, Venture DAO 有以下突出特点:

1. wider network

2. lower capital risk

3. More democratic investment decisions

4. Operations are more transparent

5. 退出更灵活

同时,Venture DAO也有劣势,表现在:

1. Risks of Legal Tax System Compliance.DAO Still need to overcome many potential regulatory and legal challenges.

2. Lack of endorsement from big institutions and uncertainty about early-stage projects,Make investment credit and investment scope limited.现有的Venture DAOalmost all investmentWeb3项目,It is not yet possible to challenge the traditional financial field that requires a larger scale of capitalVC的地位.

3. Smart technology risk of contracts.目前 DAO 的生态系统还不够完善,黑客攻击的可能性是一个较大的风险.

总体来说,Venture DAO还是Web3Very early in the species,但是已经有Metacartel, The LAO, Cult more successful cases,未来可期.

二、经典案例分析

案例一:CultDAO

概况

CultDAO 是第一个 100%Decentralized Venture Capital DAO,有以下特点:

• Although an anonymous project,但很多 Web3 The founders of the project are willing to endorse it.

• Project started by founder,但与 Token 归属、智能合约、 uniswap All keys related to liquidity provision have been destroyed.每当 discord When someone asks who is the project leader,回答是“ No one and everyone”.

• The founding team cannot be modified DAO 的既定规则. DAO 的投资/收益将通过智能合约运行,而智能合约的所有权已被销毁.many great charities DAO 最后都不了了之,因为这些 DAO The operation is premised on the founder's ethics,But human nature is unpredictable.

2. 代币模型

2.1. 募资

于 2022 年 1 月 30 日拿出 50%代币在 unicrypt 预售,Pricing is total 250 个 ETH,Only purchases per wallet 1 个 ETH.Pre-sale reached 125ETH 就能启动项目,Final raise 178.4 个 ETH,remaining unsold CULT All destroyed.of pre-sale funds 60%已添加到 uniswap 中提供流动性,并被 unicrypt 锁死 264 年.此外,The project will also receive tokens from$CULT Each charge in the secondary market trading 0.4%

taxes into the treasury.

2.2. 运营

For the remaining part of the pre-sale fundraising 40%资金,Part of the start-up marketing fee for the project,A portion is paid to the development team as R&D、测试、the cost of the audit.For unsold 50%CULT,大部分进入 uniswap 中提供流动性,A portion is given to a famous person to make it a“The Guardians”(守护者) ,总额的 10%给到无偿工作的开发团队(12 个月内线性归属) .

2.3. 投资决策

buying tokens$CULT 之后,只有把 $CULT 进行质押,获得质押凭证 $dCULT to participate in voting and proposals. dCULT 持有者有两种身份:

• “The Guardians”(守护者) : dCULT 持有数量的前 50 名,have and only the right to propose.

• “The Many”: The Guardians 以外的 dCULT 持有者,也即 dCULT 持有数量 50address after name, have and only vote.

若提案通过,则将由 DAO 国库拨款 13 个 ETH 进行投资.When the treasury collects every value 15.5ETH 的$CULT,and has a voted proposal,这些$CULT 中价值 2.5ETH 的 $CULT It will be broken into the black hole wallet and destroyed,additional value 13 个 ETH 的$CULT will be invested in the projects approved by the proposal.

2.4. 退出

被投项目需要在发行代币后,卖出预先约定的项目代币并换为 $CULT 归还给 CultDAO.其中 50%的 $CULT 被打入黑洞钱包销毁,另外 50% 的 $CULT 将作为奖励 分配给 $CULT 的质押者.

3. 团队

创始人( Mr O'Modulus ) 虽然匿名,but it has been done Solidproof 的 KYC 认证, He is the founder of a very well known cryptocurrency.同时, Mr O'Modulus We will also invite some well-known Web3 项目的创始人担任守护者(Guardian) ,目前对外公开的有:@TrustlessState (Bankless 创始人) 、 @dominicVEMP (vEmpire DDAO 的 CEO) 、@auryn_macmillan(GnosisDAO)、 @hackapreneur(Justin Wu)、 @only_rares(Ethereum Towers 的 CPO) 、 @deepcryptodive、 @META_DREAMER 、 @abv_avg_joe 等 10 来人,Celebrities are still invited. Mr O'Modulus will send a share of these famous people$CULT,to ensure that they can 50 名 CULT among the pledgers.同时, Mr O'Modulus Think big names won't sell $CULT,Because they need to maintain its reputation.

4. Join the threshold

dCULT The holder automatically becomes Cult DAO 的成员.The step is to buy first$CULT,Then pass the pledge$CULT来获得 dCULT.持有 dCULT Only then have the right to vote or propose.

5. 资金规模

截止 2022 New York time 8 月 1 日,size of the treasury 536ETH,已投资金额 975ETH, $CULT 总市值约 5900 万美元.

6. 投资组合

Shall be formulated by the economic model,A single bill fixed investment value 13 个 ETH 的 Cult 代币,Depending on the legal tender in the specific investment amount ETH 价格.上一节【5.资金规模】中提到,The total amount invested is 975=13X75 个ETH,Since each proposal is fixed 13 个 ETH,That is, the total investment 75 个提案,Total number of proposals 107 个,Bill passing rate is about 70%.已投资 30 个项目,其中 DAO 有 7 个, NFT 和 Defi each project 2 个以

上,At the same time, there are also some proposals to purchase spot on the secondary market,有 BTC/DOGE/People 等.There are investment projects PoolyNFT, Adrenaline Token, Crypto Natty, sonsofcrypto, peopleDAO 等.

7. 提案要求

前 50 名 CULT Pledgers are defined as 守护者(The Guardians) ,These guardians can DAOSubmit an investment proposal,但没有投票权,前 50 beyond the name CULT Stakeholders can vote.因此,要向 DAO Submit an investment proposal,Must be the guardian,Or find at least one guardian to represent the proposal.

The content of the proposal should include the following:

1. Total supply of investee protocol tokens and tokens cannot have any minting function,The audit must prove this.

2. 13 个 ETH of individual investments as a percentage of total project supply.

3. Complete token economic model,以及 TGE 的具体时间. ( TGE: Token Generation Event, 代币

生成事件,Can be understood as a tradition VC Exit in investment)

4. If the investee already has a pair of tokens、Audit reports for smart contracts,必须提供.

5. Token Exit Distribution Plan,Release schedule can be daily、周、monthly allocation, However, the maximum lock-up period does not exceed 18 个月

三、Venture DAO模式总结

1、代币经济模型

1.1 募资

Decentralization through fundraising,我们把Venture DAO The way of raising intoDecentralized Fundraising与Semi-Decentralized Fundraising.市面上大部分Venture DAOMainly focus on semi-decentralized fundraising.

To center collect alms endowment in the open market sale tokens as the main way to raise.代币可以IDO、IEO(Issued on the exchange),Can also be publicly tradedNFT,Buy the tokens, there is usually no threshold.比如CultDAO,Tiger VC DAO,AzerDAO.CultDAO从IDO和IEOdrawn from the transaction amount0.4%amount to fill the treasury;Tiger VC DAO via public saleNFT募资;AzerDAOThrough the issuance and requirementsVenture DAO成员质押$AZD(IDO中)Raise funds from the treasury.

Semi-decentralized fundraising is based on the sale of governance tokens in the private market as the main fundraising method,And buy the tokens, usually need to pass throughDAO内部审核.比如MetaCartel Venture DAO,Pleasr DAO, The LAO,GCR.MetaCartelRequire the investor pledgeETH或DAI到国库,But advance the investor must through internal vote to got the certificate of capital contribution;The Lao 通过售卖LAO Token(Not listed on the exchange)募资;GCRin a similar traditionVCway of raising funds,The open market token sale is just to reward community members.

Advantages of Decentralized Fundraising:

符合Web3去中心化理念,有利于叙事.

decentralized fundraisingVenture DAOCan accept more investors,so everyone entersVenture DAO的资金门槛更低,Financial risk is less.

Venture DAOAfter the public offering tokens流动性更好.

Advantages of semi-decentralized fundraising:

Because of the funding threshold and screening system,DAOmembers within the general质量更高,Can be provided for the invested project更好的资源.

Bigger money management,Because investors have higher net worth.

Compliance GuaranteeMore,Because the model is more similar to traditional funds,they better use legal subjects,比如Delaware LLC架构.

1.2 投资决策

Investment decision-making is the basic framework:排队 > 投票 > 缓冲 > 待处理 > 完成,每个DAOThe decision-making process is similar.

以Metacartel为例:

排队:Investment proposals submitted and awaiting voting.Submitted proposals need to have sufficient information.

投票期(Voting Period):每个提案7天,每天最多可以提交5个方案.Members vote on proposals,51%That means the proposal is approved.

缓冲期(Grace Period):The proposal as voting period,有7天时间的缓冲期.Members who do not agree with the voting result can choose to retire at this time.

待处理:缓冲期结束后,提案进入待处理阶段,可由任何一名成员进行处理,实现该提案的目标(例如,分配份额、接受贡献)完成.

凡是处理完的提案会与其他所有呈最终状态的提案一起记录在 DAO 内(IPFS上).

大部分Venture DAO的成员Has the right to propose and vote at the same time,小部分Venture DAO Only the top dozens of members with token pledges have the right to propose.有一些Venture DAOOne will be set upSmall investment committees with less than ten members,After the project by the public vote to again after a small committee agreed to pass,This can be betterCheck project quality,But also at the risk of being more centralized.

Time for Proposals and Voting,Vote the average percentage of each proposal:各个Venture DAOAfter the proposal published for members to participate in the voting time range,The voting period is almost here5-14天内.各个Venture DAOThe standard setting for proposal adoption is similar,一般满足20%The proposal can be passed after the two conditions of participation and approval are more than opposition..The average percentage of votes of each proposal has not reached a very high degree,Rarely exceeds50%的,多数都是30%左右,It reflects that there is still a certain gap between the participation of the members and the author's imagination..对于初创的Venture DAO来说,Increase member engagement是值得思考的问题,进一步利用DAOThe advantages of decentralization are also startupsVenture DAO后来居上的机会.

1.3 退出

Most of the process of investment exit and return is presented in these three forms:

Waiting for treasury funds to appreciate(Exit through project currency rights unlocking or equity appreciation),But the Treasury to allow the exit of fixed number of year eachDAO不一样.

Use the tokens of the invested project party/Withdrawal amount to buy自己的代币,使自己的代币升值.

After the investment profit is withdrawn空投own tokens to members.

To quit halfway throughDAOMainly in two ways:

怒退(Rage quit):成员对investmentIf you are not satisfied, you can leave,and acquire their unallocated assets.The projects they have invested in will retain them.

把自己的股权转让给DAOother internal members.

总体来说,decentralized fundraisingVenture DAOWill pay more attention when exitingOwn tokens appreciate,And semi-decentralized fundraisingVenture DAOexits more like traditional funds,直接分红.

2. The role of tokens

为了方便DAOto fundraising and governance,每个Venture DAOWill create a token economic model.

大部分DAOThe issued tokens will simultaneously play募资与治理的作用.If this token is only used for governance,说明这个Venture DAOThe fundraising process is centralized,比如Fundraising within the circle of acquaintances.如果Venture DAO想让More willing investors to join到DAOof management,DAOWill be more inclined to issue tokens that take into account both fundraising and governanceDAOMore decentralized organization.

Raise tokens are divided intoIDO/IEOlater tokens,and tokens not listed on exchanges.If this token hasIDO/IEO,Often means more decentralized raised,比如CultDAO, AzerDAO,Tyger Venture DAO.Fundraising Tokens Not Listed on Exchanges For Purchasers(出资人)Generally, there are certain threshold requirements,比如Metacartel,The LAO.GCRof tokens are also listed on exchanges,但GCRThe official website clearly statesIEOof tokens have no real value,For internal governance and rewards only.

3. Join the threshold

加入Venture DAOUsually by the several ways:

Buy public or private tokens/NFT,进行质押.比如CultDAO要求购买CULTCurrency and the pledge to the state Treasury,Tiger VC DAO要求购买Tiger系列NFT并质押.

有些DAOAfter the scrip pledge still needInsider vote能否加入,比如MetaCartel.

Tokens not publicly issuedVenture DAOThere are often more法律合规要求,如The LAO, MetaCartelThe legal subject of a limited liability company is set up in Delaware, USA(Delaware LLC),and members need满足SECRequirements for Accredited Investors.

4. 合规要求

Semi-centralized fundraising的Venture DAOOften has a better legal system,And completely to center collect alms endowmentVenture DAOGenerally no legal body.

根据DAODifferences in the location of key members,DAOFaced with different compliance requirements,Correspondingly, it will also affectDAOThe maximum number of people and the threshold for joining.

以The LAO和MetaCartel为例,Both principal members are located in the United States and are legally美国公民/Permanent Resident Status,So registeredDelaware LLC,And this also brings legal restrictions on the number of people,上限为99人.Due to the definition of public offering by relevant US laws in99/100range of people,Therefore more than99人,They are likely to be tokensSECSecurities identified as public offerings.但The LAO和MetaCartelWhile being restricted, it also received more legal protection.

像CultDAOmore decentralizedVenture DAO就There is no legal subject,therefore not subject to these terms.But the investor money also have no corresponding legal protection,If the scale of funds is large, it may also be affected bySEC的处罚.

5. Human Architecture

Refers to the human architectureVenture DAOThe composition of internal members.成为Venture DAOMembership prerequisitesThere are pledged tokens orNFT、Contribute capital and sign legal agreements等方式.

第一种:质押量前xNamed and(只)have the right to make proposals,Others only have the right to vote.(代表: Cult DAO)

第二种:Everyone has the right to propose and vote.

第三种:Divided into funders and contributors.Contributors do not need to contribute,But be sure to have labor contribution,If you don't contribute, you will be fired.Investors are free to choose whether contribution to Labour.(代表:the LAO, metaCartel)

6. 团队

Usually have a more successful teamAt least one the following characteristics:

The founder is great,比如CultDAO,Able to invite famous people through personal relationshipsWeb3Practitioners come to endorse themselves.

DAOMembers are averagely strong,比如MetacartelThere are many project founders,Senior technical staff,Financial Legal Professionals.In this way, the invested project party can get support resources similar to incubators,And to find more high quality projects.

7. DAO社区作用

社区为Venture DAO提供的价值:

Gathering senior practitioners in multiple directionsDAOThe community to provide similar projects孵化器的支持,比如技术、法律、Financial and other post-investment management content,It can increase the success rate of the invested project,也能增加DAOAttraction to project parties.

有着相似理念和愿景composed of membersDAOCommunities can be more explicitDAO的投资方向,at the decision-making stageMake more efficient decisions,Reduce unnecessary differences due to capacity constraints.

Strong community members canDAOProvide a strong network of contacts,增强获取项目的能力.

DAO社区可以汇集信息、提高信息传播效率,Facilitate the exchange of research results,Generate more valuable information.

8. Manage funds

We mentioned in this reportDAOBasically have a large scale of funds.

Anonymous projects that issue tokens publiclyCultDAO,截至7月29The total daily market value is approx7600万美元,The size of the treasury is 698.9ETH,已投资金额949ETH.

有多位a16z投资人、专注投资NFT的Pleasr DAO,初始资金为52.5万美元,截至今年2Before the latest fundraising round,资金规模为8360万美元,They are expected to raise after will be achieved1亿5000万美元,Actual amount not disclosed.

在DAOThe originator projectThe DAOcreated on the basisThe LAO,截至7月29received in total18378个ETH,合计约3150万美元.

Top stream investment research communityGCR(Global Coin Research)完成了3100$10,000 in foreign investment,举办了100多场活动,订阅者达到3万人.

在发行NFT募资的Venture DAO中,AzerDAOThe size of the funds is approximately600万美元,今年5On sale at the end of the monthNFTstart-up projectsTiger VC DAOThe treasury also has approx42万美元.

9. 代币总市值

This section will briefly introduceVenture DAOToken Issuance of、Market Cap and Influencers.

Venture DAOTokens are usually divided into:Issued on the exchange的代币,Not issued on the open market的代币.

大部分的Venture DAOThere is no open market issuance of tokens.

In projects that have publicly issued tokens,比较有名的有Cult DAO(截至8月1日,市值5900万美元)和Alpha Venture DAO(截至8月1日,市值7100美元)等.

In addition to fundamental factors related to investment capacity in economic models,Token market value is also affected byDAO营销行为的影响.以CultDAO为例,Careful social media operations and dissemination indirectly increase investors' attention and recognition of its tokens.

10. 投资组合

The average single investment amount of the project:because it is difficult to find eachVenture DAOSpecific share of investment in each project,故(Define the average investment=The amount of project this round of funding/Number of participating institutions,如项目A最新一轮融资1000万美元,由20家机构投资,The average investment is50万美元,In each fittingVenture DAO的投资情况.)CultDAOEach of the investment proposal for13个ETH,The specific fiat value depends on the timeETH的市价.The LAO(42笔投资)和MetaCartel(29笔投资)of the average investmentThe median does not exceed50万美元,Their average investment is100Single-digit investments above $10,000 are also in the single digits.

不同Venture DAOFocusing on the different in the field of investment,Highly dependent on team background and market situation.

四、给Venture DAO Buidlers的建议

Positive Venture DAO researchers think, Venture DAO The degree of decentralization mainly depends on“募资”方式.

1. If the founding team want to fully practice decentralization concept、And let each of the participants fund risk is small enough,is more suitable forCollect alms to center way, Such as the public offering or tokens NFT.随之而来的风险是 VentureDAO The quality of members varies,Not conducive to management and resource integration;Open market price controls are resource intensive,And still difficult to control;The scale of fund management cannot be expanded.This approach is suitable for teams with the following characteristics:

• Has a strong marketing ability and resources;

• already working on other projects(比如 Gamefi)绑定此 Venture DAO,这样Venture DAO Can be linked with tokens of other projects;

• Capable of managing market value,Prevent the currency price from fluctuating too much.

use this mode Venture DAO often have a large number of members, Therefore, in terms of human structure, it is recommended to only grant the proposal right to the top dozens of token pledges., Other members have the right to vote,This ensures the quality of the proposal.When exiting, it is recommended to link the realized amount with your own tokens, Increase the value of own tokens.

2. If the founding team wants to build a company with higher quality talent DAO 社区,and increase the capacity of funds,Is more suitable for half a decentralized way of fundraising, For example, the issuance of on-chain tokens in the private market.But the compliance threshold is high, Eligible member selection population is smaller.

This approach is suitable for teams with the following characteristics:

• The resources of the founding team are strong enough, Able to reach enough high net worth、high-quality crowd.use this mode Venture DAO The number of members will be limited(法律限制,Or just to ensure member quality),So everyone can have the right to propose and vote at the same time.If there are members willing to pay large sums of money,But no energy to manage the same percentage of voting power,则可以参考 Metacartel 架构,To a certain extent, separate contributors and contributors, 让 DAO In the case of expansion of management scale,Still keep voting equality.

从 Venture DAO of the establishment,Early Lightweight Startup Could Be in Cayman/新加坡/BVI Other places to note friends—A minimum viable legal entity capable of signing valid legal contracts,And use this subject to sign a legal contract with the invested project party.Take the Cayman Foundation as an example,可以让 DAO of the members become shareholders of the foundation,One more layer of protection beyond smart contracts.这也是很多 Web3 初创 VC Practices that have been adopted and proven,Start with the smallest feasible unit first, wait for some projects、Complete legal settings after contacting more capital.

边栏推荐

猜你喜欢

The 5th Blue Cap Cup preliminary misc reappears after the game

一篇文章带你熟悉 TCP/IP 协议(网络协议篇二)

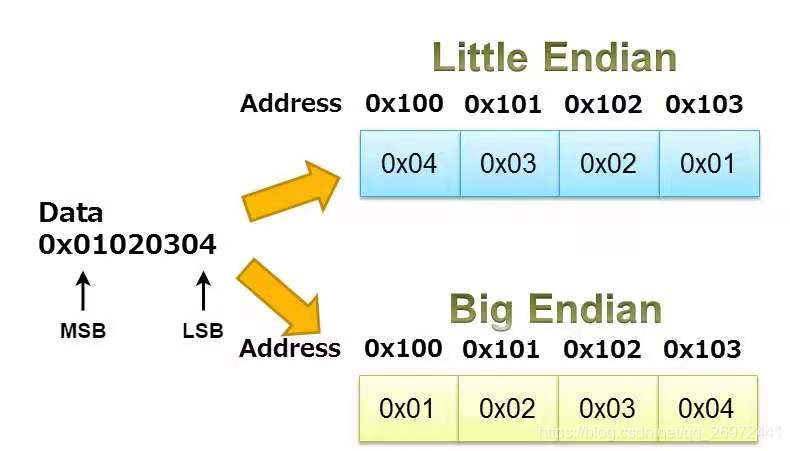

The difference between big-endian and little-endian storage is easy to understand at a glance

支付宝小程序使用自定义组件(原生)

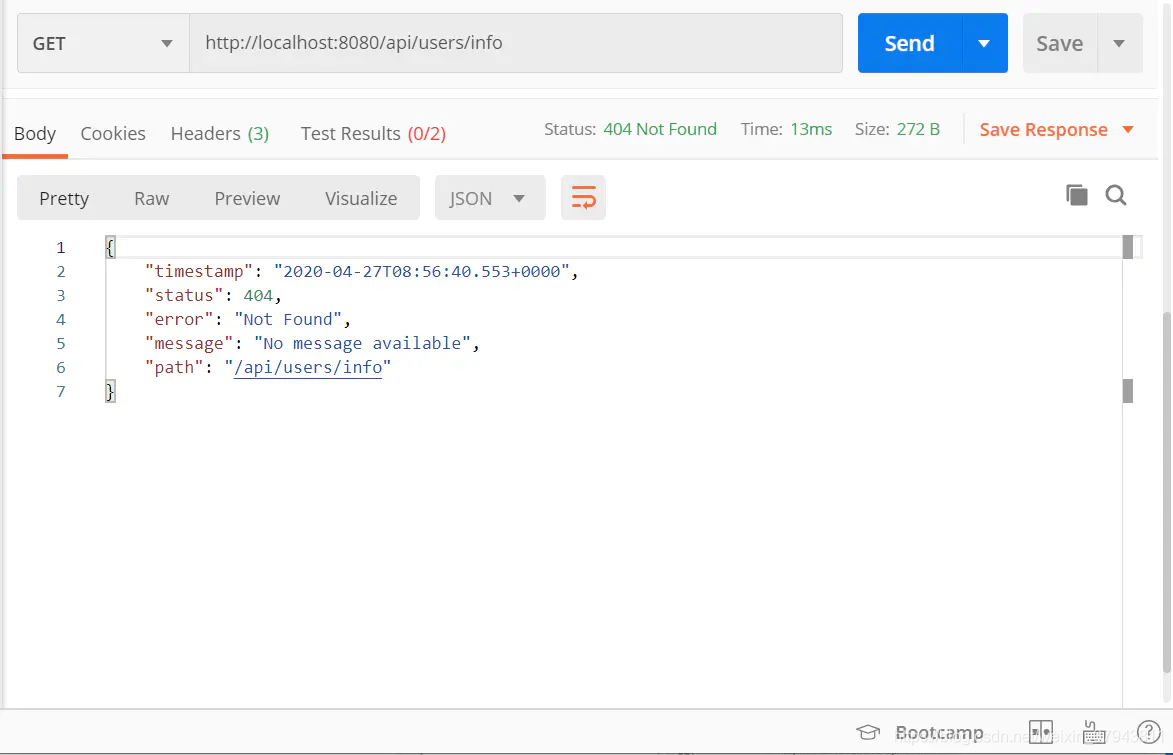

RESTful

js在for循环中按照顺序响应请求

MySQL索引

大学四年不努力,出社会后浑浑噩噩深感无力,辞去工作,从头开始

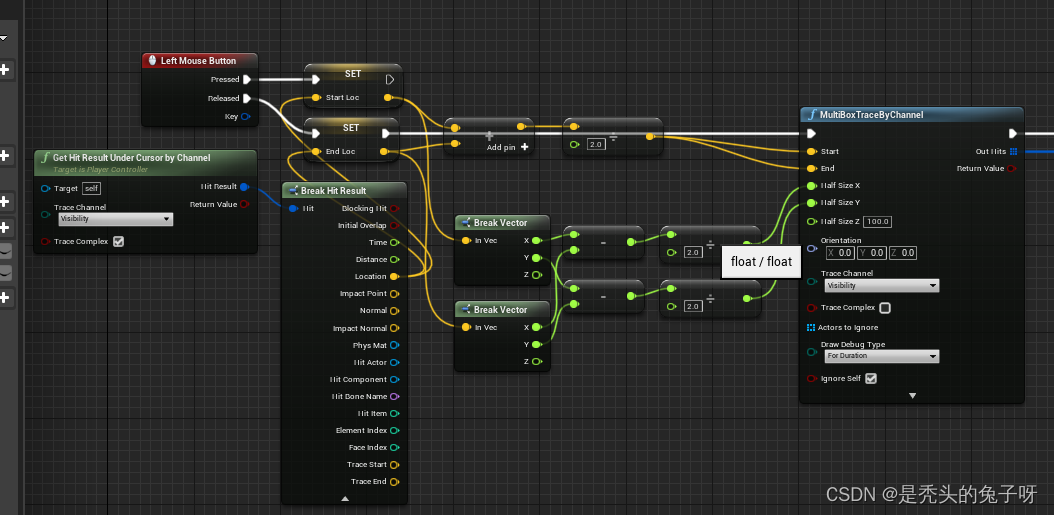

UE4 RTS frame selection function implementation

【场景化解决方案】构建门店通讯录,“门店通”实现零售门店标准化运营

随机推荐

MySQL lock

数据治理(四):数据仓库数据质量管理

gin中模型中增删改查+搜索分页

Es6连续解构赋值+重命名

Module模块化编程的优点有哪些

往二维数组追加键值

MySQL事件_单次事件_定时循环事件

js实现看板全屏功能

SQL Server2000 各个版本之间的区别

The embedded serial port interrupt can only receive one byte

NodeMCU(ESP8266) 接入阿里云物联网平台 踩坑之旅

Getting started with ctfshow-web Part of the file upload part solution

按字节方式和字符方式读取文件_加载配置文件

gin清晰简化版curd接口例子

SQL语言中的distinct说明

【场景化解决方案】OA审批与用友U9数据集成

gin中简单的curd接口例子

convert转换时间详解

没有对象的可以进来看看, 这里有对象介绍

STM32 如何知道FLASH的使用情况