当前位置:网站首页>Talking about quantitative trading and programmatic trading

Talking about quantitative trading and programmatic trading

2022-08-09 16:14:00 【Q1841085904】

Quantitative trading is a relatively broad concept. Simply put, it is the application of quantitative technology to trading decisions.Quantification is the transformation of an object into something that can be described and compared numerically.

In this era, as long as you can read indicators, you can call yourself a quantitative trader.

In this way, do you feel that the threshold for quantitative trading is very low?In fact, there are also very high thresholds in quantitative trading, such as programmatic trading.

Programmatic trading is the use of programmatic technology to conduct transactions, and programmatic has another name, called automation.

So what is programmatic trading all about?

First, manage a large amount of market transaction data and organize it into a data structure that is easy to call and calculate.

Secondly, there is a language system that can develop models based on market transaction data, which can be some common high-level programming languages, such as c, c++, java, python, etc.Traders need to use this language system to develop model programs that can be tested and actually run trades.

Third, a set of tools that can combine the model programs developed in the previous step with different varieties for performance testing and parameter tuning.

Fourth, risk control tools, risk control tools can handle both trading and technical aspects. The trading aspect mainly involves the monitoring of data such as positions, leverage, and risk levels. The technical aspect needs to monitor whether the real-time market is continuous and accurate.Whether the ordering behavior is normal and smooth, etc.

The above four parts are the main work that a complete set of programmatic transactions need to deal with.Various platforms on the market now have different functions. The most important feature of a platform is that all transaction development work can preferably be performed on one platform, which can facilitate a lot of operations.

边栏推荐

猜你喜欢

【Qt5 + OpenGL】glPointSize(10); error: undefined reference to `__imp_glPointSize‘

Regular Expressions for Shell Programming

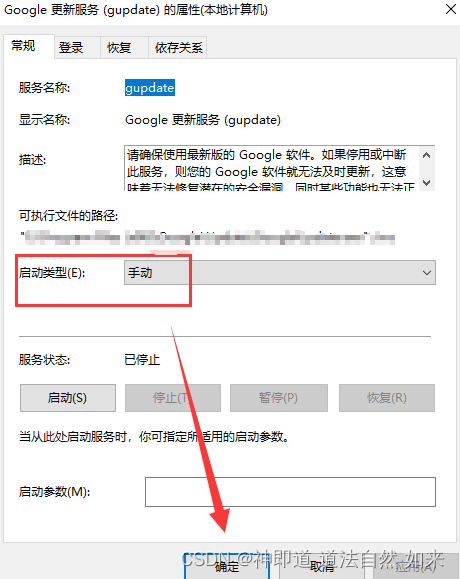

由于谷歌版本自动更新,导致selenium项目报错,如何关闭谷歌浏览器的自动更新?

DSPE-PEG-Hydrazide, DSPE-PEG-HZ, Phospholipid-Polyethylene Glycol-Hydrazide MW: 1000

注解与反射

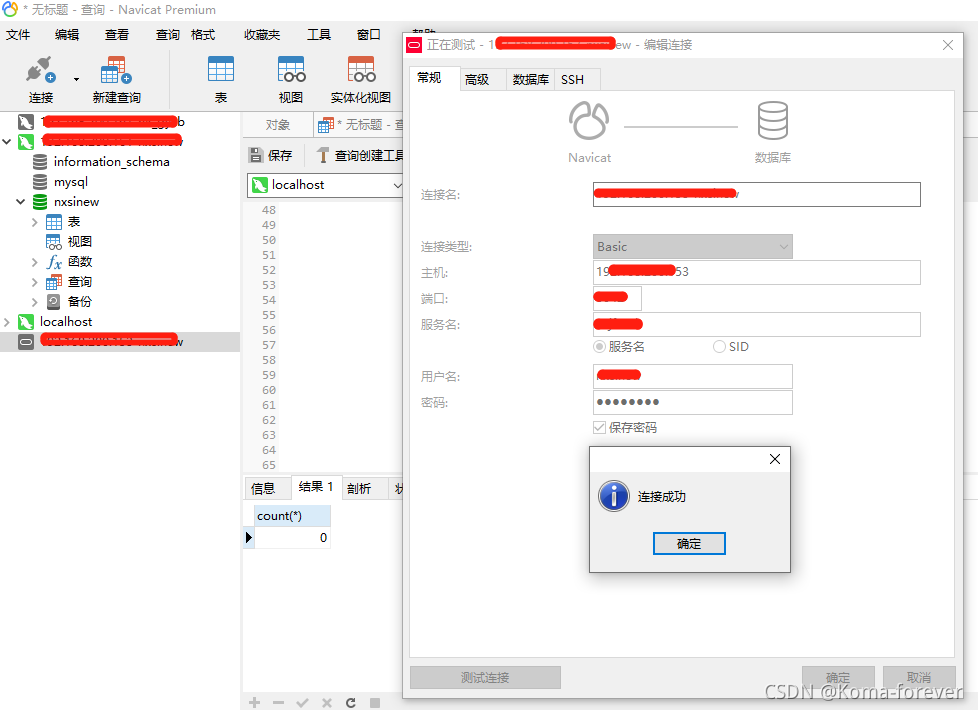

navicat for Oraclel链接oracle 报错oracle library is not loaded的解决办法

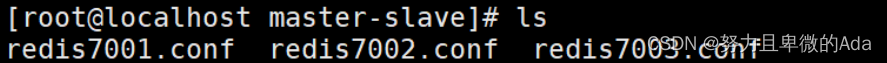

redis从入门到精通

Anaconda3安装后无法启动,启动闪退 2020-9

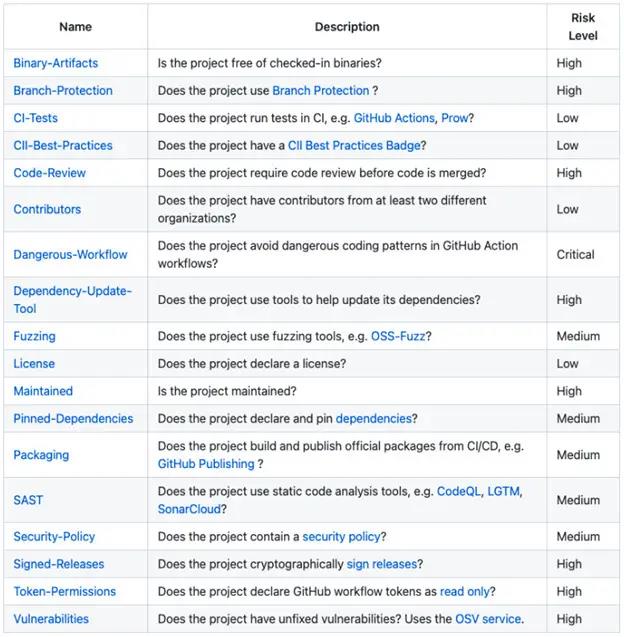

OpenSSF的开源软件风险评估工具:Scorecards

多线程学习

随机推荐

redis从入门到精通

What are the implications of programmatic trading rules for the entire trading system?

如何将List<Map>进行分组数值计算合并排序

如何灵活运用量化交易接口的优势取长补短?

【OpenGL】四、OpenGL入门总结:LearnOpenGL CN教程中关于欧拉角公式推导

OpenCV - matchTemplate image template matching

FilenameFilter filters filenames

JVM简学笔记

My MySQL database was attacked and deleted for ransom, forcing me to use all my might to recover data

Similar image detection method

How to make your quantitative trading system have probabilistic advantages and positive return expectations?

一种基于视频帧差异视频卡顿检测方案

经典面试题 之 TCP 三次握手/ 四次挥手

和月薪5W的测试聊过后,才知道自己一直在打杂...

Jmeter性能测试步骤入门

Mathematica 作图详解

基于FPGA的FIR滤波器的实现(3)—采用Filter Design & Analysis设计

Seize the opportunity of quantitative trading fund products, and quantitative investment has room for development?

UDP多线程实现聊天

数组学习笔记