由中国电子银行网、易观分析联合发布的“2022中国手机银行综合运营报告”显示:二季度,China's banking industry mobile banking operation index rose month-on-month.From the specific data, it shows a trend of increasing month by month,6The composite index for the month is88.8,创半年新高.从不同类型银行手机银行运营指数来看,The mobile banking operation index of large state-owned banks has risen more significantly.

一、Current hot spot monitoring of China's digital financial industry

Commercial Bank Digital RMB Application Scenario Innovation 重点发力B端和G端

As digital renminbi pilot application,应用场景不断丰富,Banks to seize the moment,重点在B端和GEnd-to-end scene innovation.

China Construction Bank launched the country's first digital RMB prepaid consumption platform for the education and training industry.5月6日,在中国人民银行深圳市中心支行与深圳市地方金融监督管理局的指导下,福田区政府联合深圳建行举办全国首个数字人民币教培机构预付式平台发布暨签约仪式,深圳建行与首批合作教育培训机构签署数字人民币合作协议,标志该项目在福田区成功落地.

Agricultural bank to complete the first digital yuan pratt &whitney loans.6月7日,Agricultural bank of suzhou in jiangsu province taicang branch in the form of digital currency,向太仓市亿砼新型材料科技有限公司发放普惠贷款150万元,并作为原料款支付至上游供应商数字人民币钱包.这是全国首笔由银行发放的数字人民币普惠贷款,Achieved the first breakthrough in the application scenario of digital RMB.the same agricultural bank,在今年5月份,该行通过“The fact cloud league”The platform successfully connected with the Lianyirong supply chain platform,For the first time in the industry, the full-process application of digital renminbi in the supply chain field has been realized.

China Minsheng Bank is the first to launch digital RMB payroll service directly to corporate accounts.6月24日,苏州市相城区数家小微企业通过民生银行企网使用基本结算账户,直接向其员工的数字人民币钱包成功发放津贴,标志着该行围绕企业客户率先打造的对公账户直接发放数字人民币薪资服务正式面市.

Nanjing Bank online“智慧食堂”Provided faces for employees of Suzhou Branch+数字人民币支付、饭卡+数字人民币支付、Digital RMB co-constructionAPPScan code payment and other new payment channels and settlement methods,Employees can pay for meals by swiping their face or swiping their cards to automatically identify their identity.

Bank of Suzhou and Bank of Communications in digital renminbi2.5Actively try the functions and services of layered generation,Closely combine the characteristics of digital renminbi with government subsidy distribution scenarios,探索出了2.5Digital renminbi distribution model for high-level banking institutions,Completed digital RMB care fund for Suzhou Municipal Party Committee Organization Department and Municipal Finance Bureau respectively、Key projects such as the issuance of digital RMB official transportation subsidies.

Baixin Bank landed its first“数字人民币+票据贴现+绿色金融”场景.6月14日,Baixin Bank successfully issued the first digital RMB bill discount fund to China Renewable Resources Company2700余万元,Used to support the steady development of the resource recycling industry,Realize the innovative application of digital renminbi in the field of green finance.

Banks are online“云闪付”Version of the mobile phone bankAPP

6月初,China UnionPay and China Minsheng Bank launched Universal LifeAPPExclusive promotions for Cloud QuickPass.每日6点起,Users use the national lifeAPPCloud QuickPass version arrives at home on JD.comAPP、多点APP支付,Will have the opportunity to enjoy the full50-10元优惠.following the previous quarter,Minsheng Bank launches cloud flash payment versionAPP后,6月28日,China CITIC Bank jointly developed by China UnionPay and China CITIC BankAPP(Cloud flash version)正式发布,其中IOSThe version is the first to go online,Android version on7月推出.6月29日,Shanghai Pudong Development Bank jointly developed by UnionPay and Shanghai Pudong Development BankAPP(Cloud flash version)、浦大喜奔APP(Cloud flash version)“Huanxin upgrade”正式发布.

Bank robo-advisory service presses the pause button

继去年12After the end of the month to suspend purchase function,Bank robo-advisors welcome major adjustments again.二季度,招商银行、Industrial and Commercial Bank of China has announced that its robo-advisory business will suspend subscriptions、Warehouse adjustment and other services,The original fund portfolio recommendation will no longer appear,However, the redemption transactions of customers who have already held positions will not be affected..As the first bank to obtain the pilot fund investment advisory,The suspension of the robo-advisory business of the above two banks has caused heated discussions in the market.事实上,Not only China Merchants Bank and ICBC,建设银行、平安银行、浦发银行、Bank of Jiangsu and others have also suspended or offline robo-advisory business.

digital bank“碳”而行

“中信碳账户”Officially released the first bank personal carbon account,4月22日,A personal carbon inclusive platform based on the green financial system of China CITIC Bank——“中信碳账户”的正式上线.同期,中信银行“绿·信·汇”Low-carbon ecological platform officially launched,Aiming to work with multiple partners to actively promote green innovation,Broaden the cooperation ecosystem,Give full play to the synergistic effect of the industrial chain and the ecosystem,Promote the transition of social life to green and low-carbon,助力我国“双碳”目标的实现.

6月22日,Bank of Beijing holds digital and low-carbon service brand“京碳宝”发布仪式,并与中国人民银行数字货币研究所签订战略合作协议.据了解,Carbon Account Innovation Green Payment and Green Financing Services,Established a full-product green life cycle equity plan,Record corporate green footprint,Enterprise green wealth accumulation,Practice in power enterprises“双碳”战略的同时,Form a beneficial cycle of green finance and energy conservation and emission reduction,打造企业“Green ecological new business card”.

对此,易观分析认为:在当前金融脱媒的困境下,个人碳账户的应用将有助于银行对客户生活场景的渗透,捕捉客户金融服务需求,从而驱动渠道端的生态场景建设;相应地,渠道场景建设也可以为客户提供更多种类的绿色金融业务,构建全面的绿色生活轨迹,形成有益循环.另外,绿色金融业务的线上化、移动化特点,对于银行的客户身份识别、交易反欺诈能力提出了更高要求,实现融合、高效、安全的客户运营也需要银行渠道经营能力的有力支撑.

二、2022Analysis of the overall situation of digital operation of China's mobile banking in the second quarter of 2019

手机银行运营:The operating index rose steadily in the second quarter

2022年第二季度,The digital operation of mobile banking in China's banking industry is affected by the growth of active users、The number of starts per capita and the growth of per capita usage time、Influenced by factors such as functional innovation and optimization,The operating index has increased compared to the previous quarter.

具体来看,2022年4月,The decline in the number of active users of mobile banking has led to a lower operating index;5月及6月,Active users are growing rapidly、Growth in launches per capita、Service innovations such as digital RMB financial scenarios and digital employees,Drive operation index to rise steadily.

从不同类型银行手机银行运营指数来看,The mobile banking operation index of large state-owned banks has risen more significantly,2022年6月达95.5,This is mainly due to the rapid growth in the number of active users,The advantage of user scale is further highlighted,And the version is updated frequently.

股份制银行手机银行6The monthly operating index is85,Focus on financial management、Credit card function optimization.如招商银行AppTo optimize financial returns show,Added a reminder of excess financial performance reward,方便及时、Comprehensive view of financial income.Ping An Pocket Bank focuses on credit card repayment services,Credit card repayment gold tandem dual card,Drive debit card payments with credit card spending.

Mobile banking of city commercial banks due to the scale of active users、Transaction size is small,As well as the overall functional richness, etc to improve services and activities,Its operating index is relatively low.

三、Analysis of digital development of mobile banking in China

活跃用户:6Rapid growth of monthly active users,Functional Innovation Focuses on Digital RMB Financial Scenario Expansion

2022年第二季度,Mobile banking innovation and optimization is mainly manifested in three aspects:First, expand the application scenarios of digital renminbi,Including digital RMB financial services、Payroll service;The second is digital workforce expansion,Bank of Shanghai Mobile Banking7.0Online digital employees“small sea blue”,Support via text、Voice and other ways to ask questions,And guide customers to complete business transactions through multiple rounds of interactive intelligence;Third, from the convenience of operation、Common function optimization and other aspects to improve user experience,such as optimizing income and expenditure categories,Supported by other names、交易类型、Amount quickly find transaction details, etc,Simplify the user discovery process,Improve operation convenience;The wealth management details page optimizes the income display,It is convenient for users to view the financial income status.

分析认为,Mobile banking has entered a mature stage of application,功能日益完善,服务能力不断提升,Mobile Banking Pays More Attention to Smart、Mobile banking competitiveness user experience, etc.With the improvement of the bank's digital service capabilities,Push the user's expectations of bank service experience,Building a systematic user experience management system has become a key part of the digitalization of mobile banking.

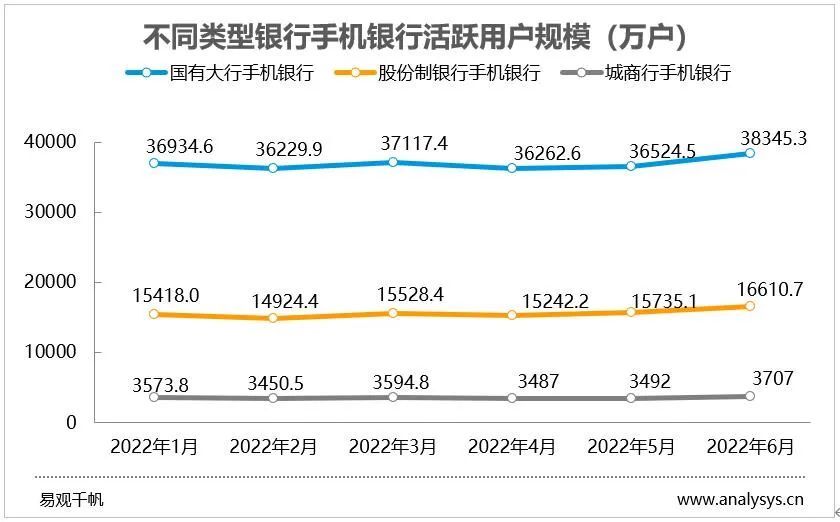

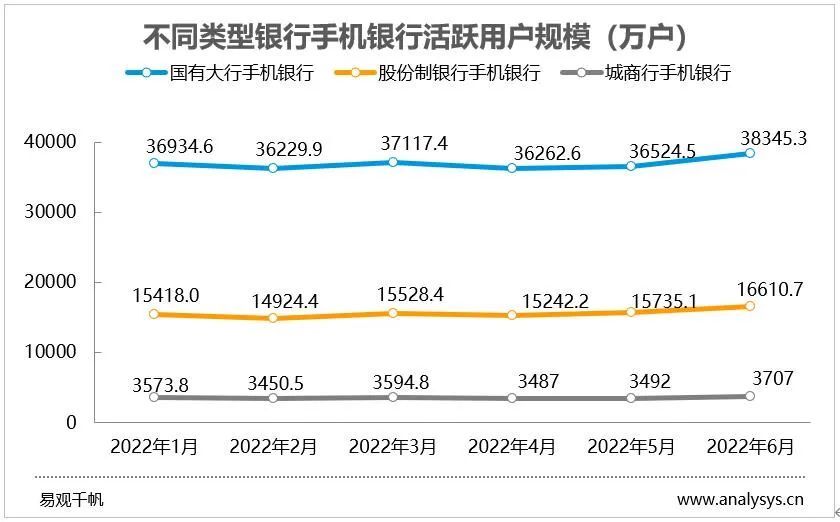

具体从活跃用户规模来看,2022年6月,国有大行手机银行、股份制银行手机银行、城商行手机银行活跃用户规模分别为38345.3万户、16610.7万户、3706.7万户,环比分别增长5.0%、5.6%、6.2%.分析认为,手机银行APP作为零售银行服务及经营的主阵地,是银行最为重要的平台,Connected to the huge user volume of the bank.With the continuous improvement of mobile banking digital service capabilities,And the digital behavior of users makes mobile banking the main service channel,The overall number of active users of mobile banking will remain on the rise.

From the perspective of the typical application of digital renminbi scenarios,CCB Mobile Banking Launches Digital RMB Automatic Combination Payment Function,When the balance of the digital RMB wallet is insufficient,Support automatic cash out from bank card to wallet to complete payment.The bank also launched a digital renminbi wealth management product area,The digital RMB wallet is upgraded to“一类钱包”You can buy financial products,This move expands the financial application scenarios of digital renminbi.未来,The digital yuan is expected to be in the fund、Application breakthroughs in insurance and other wealth management fields.China Construction Bank's digital renminbi payment scenario has covered transportation、生活消费、生活缴费、餐饮住宿、学校教育、医疗健康、娱乐休闲、Retail payment fields such as government services,And with a number of joint-stock Banks、Small and medium-sized banks carry out cooperation in the field of digital renminbi.2022年6月,The number of active users of CCB mobile banking is9511.3万户,环比增长5.74%.

Bank of Suzhou as a non-operating institution for digital RMB,Provide digital renminbi services through a bank-to-bank cooperation model.One is the direct business model,with BOC、Cooperation with digital RMB operating institutions such as Bank of Communications,Realize digital RMB personal wallet、Acceptance services for public wallets and merchants.The second is the indirect business model,Through its silver liquidation access Numbers in RMBAPP,Realize the extension of fast payment service.In terms of Numbers the scene,Bank of Suzhou and Bank of Communications explore digital renminbi payroll services,Completed digital RMB care fund for Suzhou Municipal Party Committee Organization Department and Municipal Finance Bureau respectively、Digital RMB official transportation subsidy distribution.同时,Layout of local characteristic consumption scenarios,Cooperate with chain companies to promote the daily life scenarios of digital renminbi.Digital RMB application pairAPPActive has a role in promoting.2022年6月,The number of active users of Bank of Suzhou mobile banking is49.0万户,环比增长13.31%.

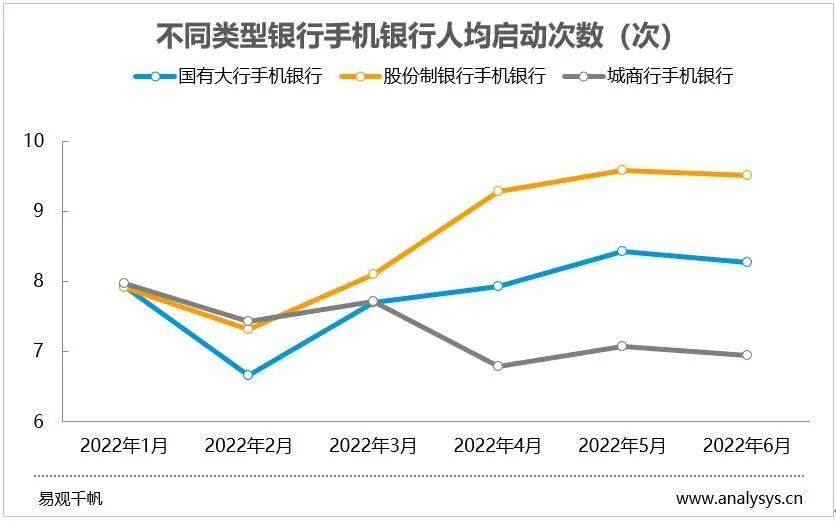

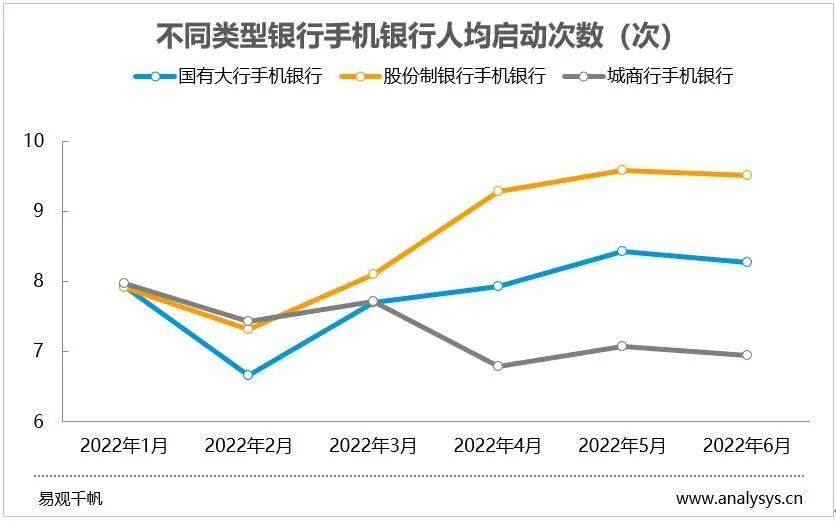

用户粘性:国有大行、The number of mobile banking activations per capita in joint-stock banks has increased significantly

手机银行APP大力争夺线上流量实现用户增长的同时,也需要不断提升用户忠诚度及用户粘性.从人均启动次数来看,国有大行、The number of mobile banking activations per capita in joint-stock banks is relatively higher and the increase is more obvious,用户粘性更优,这得益于APP良好的用户体验、The function of the rich services、持续的营销活动等促进因素.

Discovery through continuous tracking,Mobile banking of various banks mainly adopts the following measures to improve user stickiness.First, on the basis of the attributes of financial instruments,树立财富管理与生活服务平台形象,在促进金融服务使用的同时,培养用户高频生活服务使用习惯,以此提升用户使用频次.The second is to build a content community,丰富资讯文章、视频直播内容,手机银行APP希望通过内容运营提升用户使用时长.The third is from the interactive experience、视觉体验、Product function experience、安全体验、Continuously improve user experience in all aspects such as performance experience.

分析发现,User experience score positive growth,Helps to improve stickiness indicators such as the number of starts per capita,It shows that the user experience has a promoting effect on increasing the frequency of users.当前,手机银行APP经营策略重点聚焦金融转化及AUM提升,提高用户价值,而用户粘性是用户价值提升的一个关键点,用户的高活跃及高粘性是银行金融服务转化变现的基础,因此,会更加重视以用户体验优先的原则优化完善经营管理.

四、典型手机银行数字化运营分析

工商银行手机银行RPATechnology powers intelligent marketing,Increase mobile banking activity

自2021年下半年开始,Industrial and Commercial Bank of China launched aRPATechnology-enabled smart marketing pilot,Launched Mobile Banking Customer Journey Operation Robot、Digital operation robots for key customer groups, etc.,Explore Big RetailRPATechnology Marketing Innovation,Driving Mobile Banking Customer Automation Journey Marketing,and collaborate with account managers、Caller and other channels,Realize low-efficiency agency payroll customers、Automatic operation of key customer groups such as active credit card customers.

Since the online marketing robot performance,The Bank's Mobile Banking Customer Journey Operation Robot Sending Strategy1200多万条、覆盖客户640多万户,Mobile banking activity increased63%;The digital operation robot for key customer groups drives the natural growth of the full inefficient customer group2.38asset gain,The treatment group increased the North Star index relative to the control group50%以上;Under the coordination of the master control robot,The ability of pilot branches to operate digitally has been greatly improved,实现了85%的资产、85%of customers operate with robotics,Better user experience and maximum efficiency play the role of the channel,Effectively promote business growth.Monitoring data from Analysys Qianfan shows that,2022年6月,The number of active users of ICBC mobile banking is12276.9万户,环比增长6.04%.

指数样本附录(排序不分先后):

大型商业银行:工商银行、建设银行、农业银行、中国银行、交通银行、邮储银行

股份制商业银行:招商银行、平安银行、浦发银行、民生银行、中信银行、光大银行、兴业银行、广发银行、华夏银行、浙商银行、渤海银行、恒丰银行

城市商业银行:北京银行、江苏银行、上海银行、徽商银行、长沙银行、蒙商银行、中原银行、哈尔滨银行、天津银行、宁波银行、河北银行、南京银行、杭州银行、汉口银行、成都银行、四川天府银行、苏州银行、兰州银行、桂林银行、贵阳银行、青岛银行、龙江银行、郑州银行、乌鲁木齐银行、泰隆银行、齐鲁银行、甘肃银行、长安银行、吉林银行、盛京银行、山西银行、威海银行、东莞银行、昆仑银行、泸州银行、晋商银行、西安银行、张家口银行、泉州银行、江西银行、重庆银行、洛阳银行、泰安银行、唐山银行、潍坊银行、济宁银行、贵州银行、广西北部湾银行、九江银行、石嘴山银行、锦州银行、齐商银行、莱商银行、温州银行、台州银行、福建海峡银行、广东南粤银行、烟台银行、东营银行、营口银行、临商银行、绍兴银行、日照银行、承德银行、德州银行、民泰银行、珠海华润银行、厦门银行、金华银行、大连银行、邢台银行、邯郸银行、宁夏银行

声明须知:

易观分析在本文中引用的第三方数据和其他信息均来源于公开渠道,易观分析不对此承担任何责任.任何情况下,本文仅作为参考,不作为任何依据.本文著作权归发布者所有,未经易观分析授权,严禁转载、引用或以任何方式使用易观分析发布的任何内容.经授权后的任何媒体、网站或者个人使用时应原文引用并注明来源,且分析观点以易观分析官方发布的内容为准,不得进行任何形式的删减、增添、拼接、演绎、歪曲等.因不当使用而引发的争议,易观分析不承担因此产生的任何责任,并保留向相关责任主体进行责任追究的权利.

原网站版权声明

本文为[InfoQ]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/222/202208101724514120.html