当前位置:网站首页>The latest development of fed digital currency

The latest development of fed digital currency

2022-04-23 13:57:00 【yeasy】

since 2016 From the year onwards , Central bank digital currency (Central Bank Digital Currency,CBDC) It has gradually become an important subject of research and development experiments of central banks around the world . From the application scenario , Universal CBDC For retail 、 online shopping 、 Personal payment, etc , It basically corresponds to the cash scenario , It is the main research direction at present . in addition , There are also reserves of financial institutions CBDC etc. .

The Federal Reserve has been cautious in exploring digital currency , Once suppressed Facebook Of Libra project . But it has been exploring and studying itself , It mainly includes its financial laboratory and the authorized Boston branch “ Hamilton (Hamilton)” project .

notes : The name of the project is to commemorate two people : Alexander · Hamilton (Alexander Hamilton) He was the first Secretary of the Treasury of the United States , The founder of the financial system . Margaret · Hamilton (Margaret Hamilton), Director of software engineering, instrument laboratory, Massachusetts Institute of Technology , Participated in the software development of Apollo program .

Hamilton Project

“ Hamilton ” The project is a collaboration between the Boston branch of the Federal Reserve and the monetary research center of MIT , It belongs to an exploratory research project .

The project is divided into two phases :

- The first stage : Solve high performance 、 Reliable transaction 、 Scalable 、 Core issues such as privacy protection . The goal is 10 ten thousand TPS, Second level confirmation , Multi region fault tolerance .

- The second stage : Auditable 、 Programmable contract 、 Support the intermediary layer 、 Anti attack 、 Key issues such as offline trading .

After years of hard work , The first phase has been completed this year 2 Month completion , Source code OpenCBDC Released as open source software , Mainly through C++ Development , follow MIT Open source license agreement , The project address is mit-dci/opencbdc-tx.

Two engines were tested , Single sort node engine Atomizer( Keep the order ) Can achieve 17 ten thousand TPS Peak value ; Parallel execution engine 2PC( No order ) Can achieve 170 ten thousand TPS.

From the perspective of architecture, it is similar to other central bank digital money systems , It draws on the technical characteristics of blockchain and cryptocurrency .

- A centralized transaction structure is adopted , Because the central bank can provide a strong premise of trust ;

- The transaction is verified by private key signature ;

- Users use money through the wallet client ;

- Refer to the UTXO Model , The money spent will be destroyed , Then create a new currency ;

- Transaction verification and execution are decoupled , It's easier to expand .

The project is still in its early stages , The scenarios considered are very limited . The author believes that there is still a long way to go before it can be used on the ground .

At present, there are several main open issues :

- How to implement identity verification ? This still depends on the public-private key mechanism , Can be accelerated by specific hardware .

- How to monitor anti money laundering ? This may be handled offline in an extended way .

- How to achieve the audit granularity of identity and transaction data ? The main purpose is to let different characters see different granularity , This can be achieved through data isolation , Plus encryption mechanism .

- How to issue money ? It can be exchanged directly to individuals , Secondary commercial banks can also be authorized to ( Digital RMB adopts the latter ).

- How to integrate with the existing financial system ? Through the transaction gateway , Or don't get through at all , Go your own way .

summary

In fact, objectively speaking , Under the premise of centralized architecture , Adopt the existing software and hardware system , It is not difficult to implement a high throughput trading system . The difficulty is to support complex financial businesses , Multi transaction Association , Can expand , And compliance 、 Auditable 、 Conflicting needs to protect privacy . These often require a lot of practical experience .

===== About TechFirst official account =====

Focus on financial technology 、 Artificial intelligence 、 Data Science 、 Hot technologies and future directions in related fields of distributed systems . Welcome to contribute !

If you love the official account number , Welcome to a glass of encouragement coffee~

版权声明

本文为[yeasy]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204231346266567.html

边栏推荐

- Tensorflow & pytorch common error reporting

- Oracle database combines the query result sets of multiple columns into one row

- Move blog to CSDN

- Express②(路由)

- L2-024 部落 (25 分)

- Handling of high usage of Oracle undo

- 19c RAC steps for modifying VIP and scanip - same network segment

- leetcode--977. Squares of a Sorted Array

- Strange bug of cnpm

- 【项目】小帽外卖(八)

猜你喜欢

淘宝发布宝贝提示“您的消保保证金额度不足,已启动到期保障”

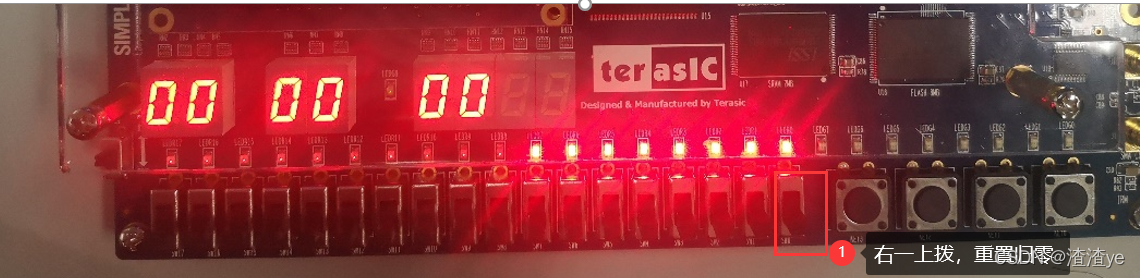

Quartus Prime硬件实验开发(DE2-115板)实验二功能可调综合计时器设计

自动化的艺术

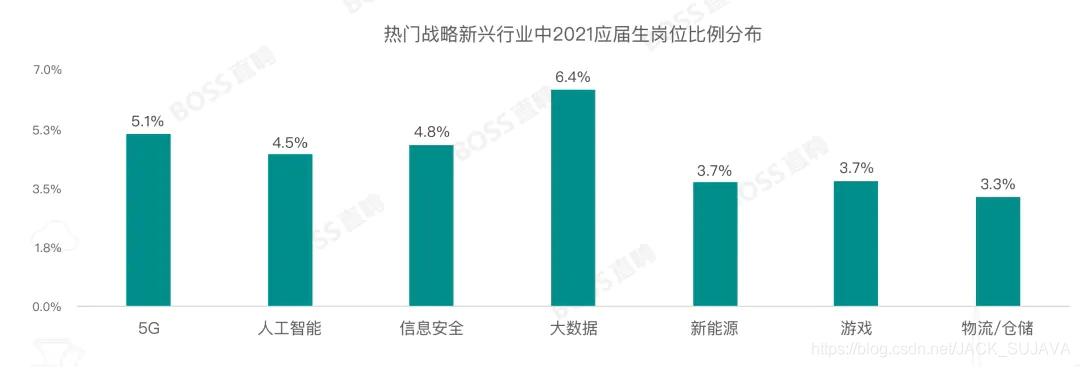

2021年秋招,薪资排行NO

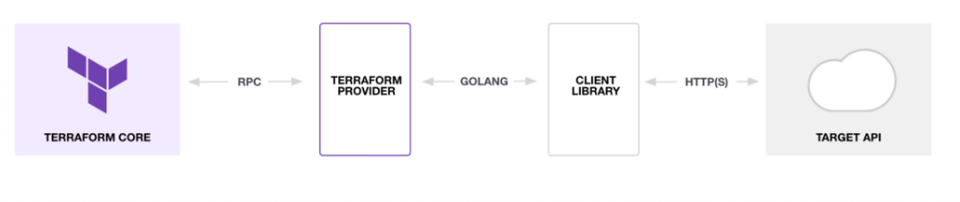

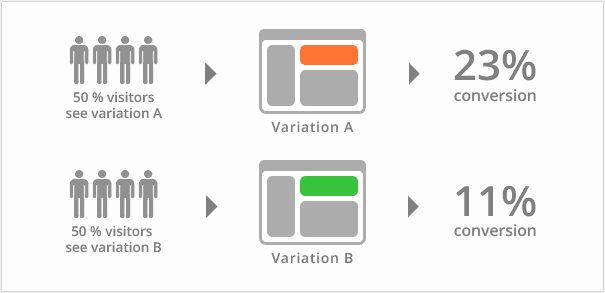

蓝绿发布、滚动发布、灰度发布,有什么区别?

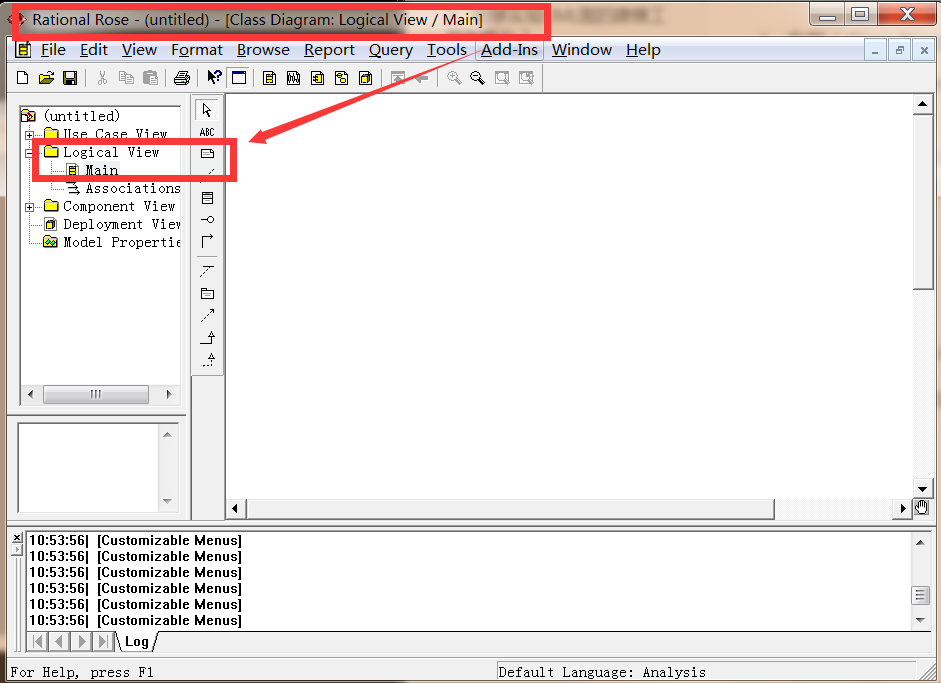

UML统一建模语言

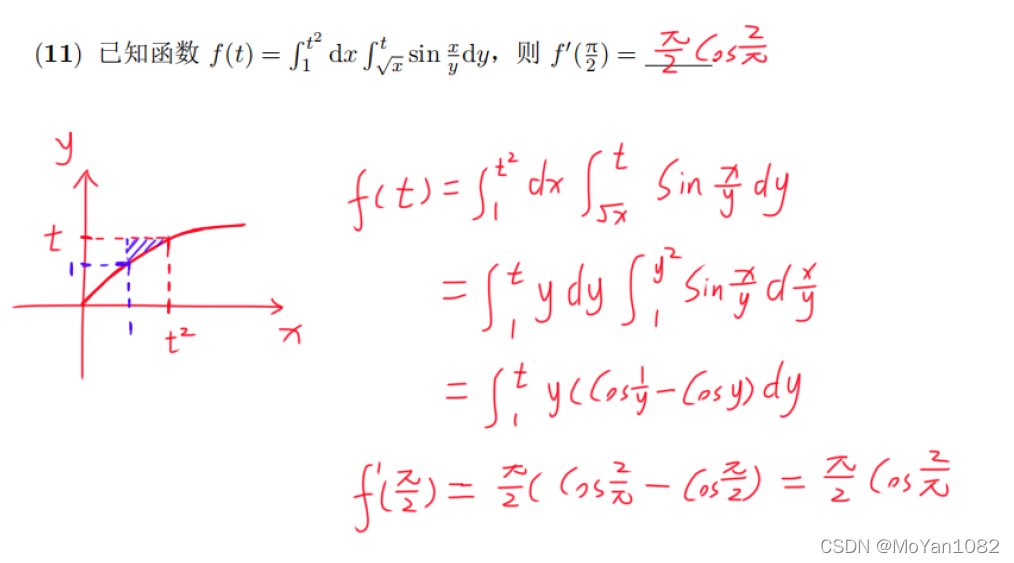

专题测试05·二重积分【李艳芳全程班】

Small case of web login (including verification code login)

![Three characteristics of volatile keyword [data visibility, prohibition of instruction rearrangement and no guarantee of operation atomicity]](/img/ec/b1e99e0f6e7d1ef1ce70eb92ba52c6.png)

Three characteristics of volatile keyword [data visibility, prohibition of instruction rearrangement and no guarantee of operation atomicity]

Building MySQL environment under Ubuntu & getting to know SQL

随机推荐

Detailed explanation of redis (Basic + data type + transaction + persistence + publish and subscribe + master-slave replication + sentinel + cache penetration, breakdown and avalanche)

Strange bug of cnpm

Dolphin scheduler source package Src tar. GZ decompression problem

19c environment ora-01035 login error handling

Get the attribute value difference between two different objects with reflection and annotation

Android篇:2019初中级Android开发社招面试解答(中

L2-024 部落 (25 分)

33 million IOPs, 39 microsecond delay, carbon footprint certification, who is serious?

Oracle告警日志alert.log和跟踪trace文件中文乱码显示

Tensorflow & pytorch common error reporting

Oracle and MySQL batch query all table names and table name comments under users

leetcode--357. 统计各位数字都不同的数字个数

JS 力扣刷题 102. 二叉树的层序遍历

Problems encountered in the project (V) understanding of operating excel interface poi

Analysis of cluster component gpnp failed to start successfully in RAC environment

Oracle modify default temporary tablespace

JS 烧脑面试题大赏

函数只执行第一次的执行一次 once函数

Storage scheme of video viewing records of users in station B

China creates vast research infrastructure to support ambitious climate goals