当前位置:网站首页>Mobile finance (for personal use)

Mobile finance (for personal use)

2022-04-23 15:34:00 【Xiao Liu has a lot of money】

Mobile finance ( Personal notes )

Chapter one E-commerce and payment

Section 1 : E-commerce construction

-

Three development stages of e-commerce :

1. be based on Electronic data Exchange e-commerce

2. be based on Internet Our e-commerce

3. be based on Mobile Internet Our e-commerce

-

Mobile financial activities :

- Check your bank account with your mobile phone

- Stock trading with mobile phones

- Mobile insurance with mobile phone

-

Classification of e-commerce :

- ABC: By == Agent (Agents)、 merchants (Business) And consumers (Consumer)== Jointly built integrated production 、 business 、 E-commerce platform integrating consumption .

- B2B:(Business To Business, In English 2 The same pronunciation as to equally ) Pattern is a kind of Between enterprises Products through the Internet 、 The marketing mode of service and information exchange .

- Amazon

- eBay

- Alibaba

- B2C: Refer to Electronic Commerce A model of , It's also == Directly to consumer Sales of products and services retail Pattern .

- Suning e-buy

- Weipinhui

- C2C : Full name Consumer to Consumer, Professional terms of e-commerce , Means Consumption activities between individuals .

- TaoBao

- JD.COM

- Tmall : Tmall was founded in 2011 year 6 Month is a comprehensive shopping website .

- Vipshop : Vipshop is a comprehensive shopping website .

- B2G: It is a newly emerging e-commerce model , namely “ Businesses go to the government ”( It's a term B2B or business-to-government Change form of )

- B2T:(Business To Team), Is the B2B,B2C,C2C After another E-commerce model . That is, a team purchases from merchants .

- O2O:( English :Online to Offline), Also known as offline business model , It refers to online marketing, online purchase or reservation ( make an appointment ) Drive offline operation and consumption .

- Meituan

- 58 Same city

- Suning ——“ Store to business district + Double line with the same price ” Of O2O Pattern

-

E-commerce features :

- Globalization

- virtualization

- Transparency

-

The software and hardware foundation to ensure the normal operation of e-commerce application system :

- Network infrastructure

- Fundamentals of network development

- Fundamentals of network delivery

- E-commerce service foundation

-

Global e-commerce development

- The market is expanding

- The regional gap is gradually narrowing

- Mergers and acquisitions tend to be frequent

- The sharing economy has sprung up

In the second quarter : E-commerce and Finance

- Classification of network externalities

- Direct network externalities

- It is the change of economic income caused by the change of the number of users consuming the same product , That is, the increase in the number of users consuming a product directly leads to the increase in the value of the commodity .

- Indirect network externalities

- As the number of users of a product increases , The number of complementary products of this product has increased , Changes in value resulting from lower prices .

- Three laws of e-commerce network economy

- Moore's law

- This is the real reason for increasing returns , Because it shows a falling marginal cost .

- Metka's law

- The value of network economy is equal to the square of the number of network nodes , This shows that the benefits generated and brought by the network will increase exponentially with the increase of network users .

- Davydo's law

- It is believed that the first generation products entering the market can automatically obtain 50% Market share

- Moore's law

- The product of network economy ——BAT The monopoly

- New opportunities brought by e-commerce to the financial industry

- E-commerce enables the financial industry to reduce costs , Increase revenue , Increase competitiveness

- E-commerce makes the financial industry surpass the limitation of time and space

- E-commerce will further consolidate the payment and settlement position of the financial industry

- Completion

- In real economic activities, there are mainly two development trends

- Promotion of information technology

- Globalization

- E-commerce makes The financial industry reduces costs , Increase revenue , Enhance competitiveness

- Ant gold clothing has two plates , Namely Payment sector and Financial sector

- In real economic activities, there are mainly two development trends

- E-commerce brings new circumstances to the financial industry

- E-commerce reduces financial costs , Increase revenue , Enhance competitiveness

- E-commerce makes the financial industry surpass the limitation of time and space

- E-commerce will further consolidate the payment and settlement position of the financial industry

The evolution of payment methods and payment systems

- Payment and payment system are the foundation of modern social and economic development 、 The basis for the normal operation of business activities

- Limitations of e-commerce

- Lack of convenience

- Low security

- Lack of coverage

- Not very adaptable

- Lack of support for micro payment

- The world's first online bank was established on the Internet by three American banks —— Security first, Internet banking (SFNB)

- The local clearing house is owned and operated by the central bank , Its main responsibility is to be responsible for the fund settlement of intra city payment transactions .

- China's national modern payment system (CNAPS) It's on China's national financial communication network (CNFN) Running China's national modern payment system

- Completion

- Payment and payment system are the foundation of modern social and economic development 、 The basis for the normal operation of business activities

- China's financial system is dominated by state-owned commercial banks , The current banking system with the coexistence of multiple financial institutions

The fourth quarter, : Online payment and the development of e-commerce

- The development of e-commerce requires information flow 、 The three flows of capital flow and logistics are unblocked

- Capital flow mainly refers to the process of capital transfer , Including payment 、 Transfer accounts 、 Exchange and other processes

Chapter two : Electronic banking

Section 1 : Overview of bank electronization

- Bank electronization refers to the adoption of Computer technology 、 Communications technology 、 Network technology and other modern technical means

- The process of bank electronization can be summarized into four stages :

- Electronic stage of traditional business processing

- Provide self-service stage (ATM POS)

- Stage of providing financial information services for customers ( fund , bond , foreign exchange , Financial news )

- Online banking stage

- Characteristics of bank electronic system :

- Timely and effective

- Accurate and reliable

- Continuously scalable

- Open and multifunctional

- Security

In the second quarter : Architecture of e-banking

- EFT System

- E-banking generally has the financial information and transaction system shown in

- Customer

- Accounting settlement

- Trading Services

- Financial information services

- People's Bank of China

- It is the only institution that issues money in China. It is the Bank of the bank

- Short answer

- According to the object-oriented, the integrated business service system of e-banking is mainly divided into several types of business systems

- Customer oriented business system

- Business system for correspondent banks

- Internet banking system

- Bank internal management system

- According to the object-oriented, the integrated business service system of e-banking is mainly divided into several types of business systems

In the third quarter : Overview of electronic payment system

- Electronic payment system is determined by three aspects

- Means of payment

- Means the payment medium , E-cash , E-check , The credit card …

- Payment mode

- It refers to when users use money to buy payment means , That is, prepayment or post payment

- Scope of payment

- Refers to the field of system application

- Means of payment

- Participants included in the electronic payment system

- The issuing bank

- Payer

- merchants

- Accept bank

- Clearing bank

- Security of electronic payment system

- integrity

- anonymity

- Non observability

- Untraceability

- No relevance

- Compared with traditional payment methods , What are the characteristics of electronic payment

- Electronic payment uses advanced technology to complete the transmission of information through digital flow , The traditional way of payment is through cash flow ….

- The working environment of electronic payment is based on an open system platform

- Electronic payment uses the most advanced means of communication

- Electronic payment is convenient , quick , Efficient , Economic advantages

The fourth quarter, :ATM Systems and POS System

- ATM function

- Cash withdrawal function

- Deposit function

- Transfer function

- Pay merit can

- Account balance query function

- Non cash transaction function

- management function

- ATM System ( According to the nature of the network )

- Proprietary systems

- Bank

- Sharing system

- Bank Go with him

- Proprietary systems

- POS System

- Transmatic

- Automatic Authorization

- information management

- POS How the system works

- Direct transfer

- Offline Authorization

- Online Authorization

- POS Transaction processing flow of the system

- Apply for authorization

- Accounting treatment

- Close the deal

The third chapter : Electronic money

Section 1 : Overview of electronic money

- The basic function of money

- Value measure

- Circulation means

- Storage means

- Means of payment

- The currency of the world

- The concept of electronic money

- E-money refers to the retail payment mechanism through the sales terminal 、 All kinds of electronic equipment , And the method of performing payment on the open network ‘ Store value ’ Products and prepayment mechanisms . there " Store value " A product is a value that is stored in a physical medium and can be used to pay , This physical medium can be a smart card , Wallet …

- Conditions for the generation of electronic money

- The progress of information technology is the premise of the emergence and development of e-money

- The difference between electronic money and traditional money

- The distribution mechanism is different

- Different occupancy space, simultaneous interpreting of traditional currency denominations

- Different delivery methods

- Different degrees of anonymity

In the second quarter : Bank card

- In a broad sense : Refers to commercial banks , Those issued to the public by non bank institutions or professional card issuing companies have credit overdraft 、 Consumption settlement … Payment instrument

- narrow sense : Bank card refers to the bank card issued by commercial banks

- Bank card

- Debit Card

- Deposit before consumption

- The credit card

- Within the credit limit, use it first and then pay it back

- Debit Card

- Composition of mobile communication system

- Mobile communication network technology

- Mobile application platform

- Mobile communication terminal

- The function of bank card

- Deposit and withdrawal function

- Consumer payment function

- Transfer settlement function

- Agent collection and payment function

- Consumer credit function

- Online payment function

- Bank card features

- fashion

- modern

- Information

- High-tech

- quick

- facilitate

In the third quarter : Virtual currency

- The economic function realized by virtual currency

- Payment instrument

- Trading medium

- Incentive tools

- Accounting tools

- Operation process of virtual currency

- Release process

- The transfer process between non operators

- Recycling process

Chapter four : Electronic bill payment system

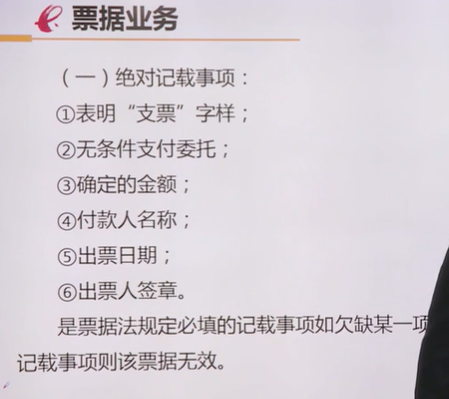

Section 1 : Bill business

- In a broad sense : Stocks 、 Corporate bonds

- narrow sense : Bills of exchange and bank cheques

- Note characteristics

- Essential formality

- Semantic

- No cause

- independence

- sodality

- The three parties to the bill

- Ticket issue

- Drawee

- payee

- Bills of exchange can be divided into

- Bank draft

- The issuer is the bank , A draft drawn on another bank

- Mostly clean tickets

- Commercial draft

- The issuer is a firm or individual

- Mostly documentary bills

- Bank draft

- Check

- Check classification

- Check to order

- Record the name of the payee

- Bearer check

- Cross a check

- Certified check

- cash cheque

- Bank check

- Traveler's checks

- Check to order

- Check features

- Simple and convenient

- flexible

- rapid

- reliable

- The main features of the bill

- A bill is a certificate of authority : Claim for payment 、 The right of recourse

- There is no reason for the rights and obligations of the instrument

- The bill laws of various countries require the standardization and standardization of the form and content of bills

- Bills are negotiable securities

In the second quarter : E-check

- advantage

- Electronic checks work in the same way as traditional checks , Easy to understand

- Electronic checks are encrypted with a public key

- Third party financial service providers can not only withdraw fixed transaction fees from both sides of the transaction Office … Bring benefits to third-party financial institutions

- Electronic check technology connects public networks to financial payment and bank clearing networks , Realize the automation of business process processing

- Electronic checks can float , Floating is an important condition for business

- Save money

- People who use electronic checks only need to deal with banks , Convenient for customers , In addition, if an electronic check is lost, you can report the loss and stop payment

- E-check can enter the e-commerce market between enterprises

- Electronic checks involve three entities :

- Buyer

- Seller

- Financial institutions

- NETBILL working process

In the third quarter : National check image exchange system

- National check image exchange

The fifth chapter : Pay online

Section 1 : Online payment basis

- payment gateway

- Secure interface between public network and bank private financial network .

- Electronic credit card payment tools

- Debit Card

- phonecard

- The smart card

- Payment and settlement is the final realization of Cash entities From the sender to the payee Business process

- Basic functions of online payment

- Be able to use digital signature and digital certificate to authenticate all parties of online commerce

- Encrypt relevant payment information flow

- Digital summary ( Digital fingerprints ) The algorithm confirms the authenticity of electronic payment information

- The online payment system must generate or provide sufficient evidence in the process of transaction to quickly distinguish right from wrong in the dispute

- Dealing with multilateral payments in online trading

- It can ensure the speed of online payment and settlement

- Characteristics of online payment

- The online payment method is digital code

- Online payment is based on Internet And VPNs

- Online payment is easy to use , A wide range of content

- Online payment and settlement have high security and consistency

- It is the customer's responsibility for banks to provide online payment and settlement service support Increased satisfaction and Loyalty

In the second quarter : Online payment method

- B2C E-payment is between enterprises and individuals , Government departments and individuals , The online payment method used by individuals in online transactions

- B2B E-payment is between enterprises and enterprises , Enterprises and government departments Online payment is adopted in online transactions ( Suitable for larger networks )

- MONETA: It is a mobile payment business brand jointly launched by Korean companies and five card organizations

- Online payment method :

- Micro payment

- Consumer level online payment

- Commercial online payment

- Short answer

- E-cash is also called Digital cash , It is the digitization of paper money and cash

- Electronic check in a broad sense refers to Paper check Electronic substitutes for , It is issued by the customer to the payee 、 Unconditional digital instruction

- In a narrow sense, e-check refers to be based on Internet For sending and processing payments Online service tools

Chapter six : Third party payment

Section 1 Overview of third party payment

- Type of third party payment

- Account payment mode

- Transaction platform account payment mode

- Platform account payment mode without transaction account

- Payment gateway mode

- UnionPay electronic payment mode

- Account payment mode

- Mobile payment tools belonging to electronic check include : Electronic money order , Electronic transfer , E-check

In the second quarter : Supervision of third-party payment institutions

- According to the size of transaction finance, mobile payment can be divided into :

- Micro payment

- Macro payment

- Brief introduction of China's current electronic payment market system

- Mainly by Focus on functional supervision And Focus on the main body supervision form

- The scope of functional supervision is transcend trades and professions 、 Cross market " strip " Pattern

- It is important to pay attention to the supervision of the main body For a certain industry or market " Lump " Pattern =

- Mainly by Focus on functional supervision And Focus on the main body supervision form

In the third quarter : Introduction to the third payment platform

- Typical third-party payment services in the United States Paypal

- Transaction search

- Record transaction details

- Transaction cancellation

- Bulk payment

- Alipay online usage flow

- register

- Recharge

- Select goods

- payment

- Received the goods

The fifth chapter : Mobile finance

Section 1 : Overview of mobile finance

- Photon payment

- What is mobile finance :

- Mobile finance is to access computer media network with the help of electronic mobile devices , Any transaction to realize the ownership or use right of goods and services

- Improved convenience

- Improve safety

- Provide the function of short-range communication consumption

- The advantages of mobile banking include :

- Breakthrough in business functions , Safety protection is guaranteed , Customer operation is more convenient

- Briefly describe the advantages of mobile finance

- Compared with traditional entity financial services , The advantage of mobile finance lies in its flexibility , Not limited by space and time , Meet customers' demand for payment services and other financial services in the era of information economy anytime and anywhere

In the second quarter : Application of mobile finance

- The payment model included in mobile payment

- be based on SMS Payment

- The transaction is carried out by means of SMS active on-demand

- advantage : Broad user base , All mobile phones support SMS , Most people use SMS

- shortcoming : Low safety , Slow speed

- Move bills directly

- On mobile sites

- advantage : convenient , Security , Simple and convenient

- shortcoming : Provide this service on a limited number of sites , It cannot be reflected in more areas of transaction and consumption

- adopt WAP Mobile network payment

- User from WEB Download additional applications on the page for payment

- Trading services are limited to third-party payment platforms

- Contactless proximity payment

- NFC technology

- SIMPASS technology

- RF-SIM technology

- be based on SMS Payment

- Mobile banking function

- Account query

- Self service transfer

- financial service

- self-service

- Long distance payment applied to mobile banking :

- Short message

- WAP( Wireless application protocol ), use WML( Wireless Markup Language )

- KJAVA

- BREW

- Ordinary SMS

- Advantages of mobile banking :

- Mobile banking does not need to set up physical online stores , Lower transaction costs , Conducive to attracting rural areas , Low income people in remote areas participate in business activities , And take advantage of mobility and geography 、 The infinity of time provides personalized and convenient business channels for busy business people

In the third quarter : Business model of mobile finance

- Short answer

- Briefly describe the research on mobile finance Significance of business model

- Mobile finance is of great significance to the development of China's financial industry , This paper makes an in-depth study on the current situation and business model of mobile finance of commercial banks in China , It will help to promote the rapid development of mobile finance in China , Form a perfect mobile financial industry with national characteristics , Provide more innovative choices for the development of China's financial services

- Briefly describe the research on mobile finance Significance of business model

The fourth quarter, : Foreign mobile finance development

- Short answer

- Briefly describe the development of global mobile banking business

- From the current situation of global mobile banking , South Korea and Japan are in the electronics industry 、 Communication products have certain first mover advantages , The development of mobile banking is better ; The European 、 The United States is also mature in technology ; And in Brazil 、 venezuela 、 South Africa 、 Kenya 、 Sudan and other emerging market countries , The coverage of bank outlets is small , Facilities construction is also relatively backward , Therefore, there is a great demand for mobile banking , Therefore, the promotion is also relatively smooth

- Briefly describe the development of global mobile banking business

Chapter viii. : Internet Banking

Section 1 : Overview of Internet Banking

- According to the service object

- Personal bank

- Corporate banking

- By type of business

- Retail banks

- Wholesale banks

- Press create mode

- Burden the bank

- Direct bank

- At present, the implementation of mobile banking has been widely used

- GSM SMS mode

- WAP The way

- Briefly describe the services provided by Internet Banking

- The services provided by Internet banking generally include two types :

- Business of traditional commercial banks , This kind of business basically occupied a dominant position in the early stage of the construction of Internet Banking

- The other is designed completely for the characteristics of multimedia interaction of the Internet

- The services provided by Internet banking generally include two types :

In the second quarter : The development of Internet banking

- The world's first financial organization named after Internet Banking —— Security first, Internet banking (SFNB)

- Mobile banking

- Mobile banking is the use of ATM And financial services formed by information exchange between computer wireless technology and banks , Mobile banking can be extended to remote villages through modified cars , Cellular packet control technology can also be used to ensure safe and fast data exchange , Realize the virtual mobile of bank financial services

In the third quarter : Functions and characteristics of Internet Banking

- The specific application of mobile banking is mobile fund

版权声明

本文为[Xiao Liu has a lot of money]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204231527114802.html

边栏推荐

- Precautions for use of dispatching system

- 让阿里P8都为之着迷的分布式核心原理解析到底讲了啥?看完我惊了

- 网站建设与管理的基本概念

- Will golang share data with fragment append

- 网站压测工具Apache-ab,webbench,Apache-Jemeter

- Baidu written test 2022.4.12 + programming topic: simple integer problem

- Cookie&Session

- Deeply learn the skills of parameter adjustment

- 【Leetcode-每日一题】安装栅栏

- 激活函数的优缺点和选择

猜你喜欢

Deep learning - Super parameter setting

The wechat applet optimizes the native request through the promise of ES6

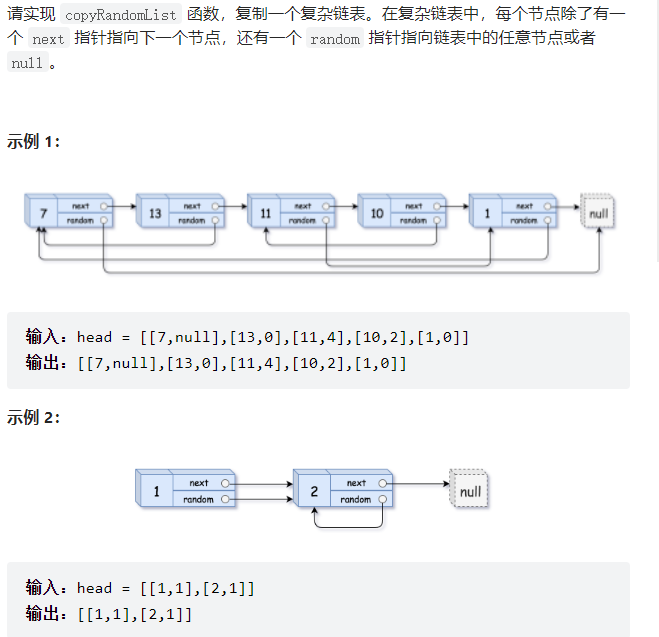

Sword finger offer (1) -- for Huawei

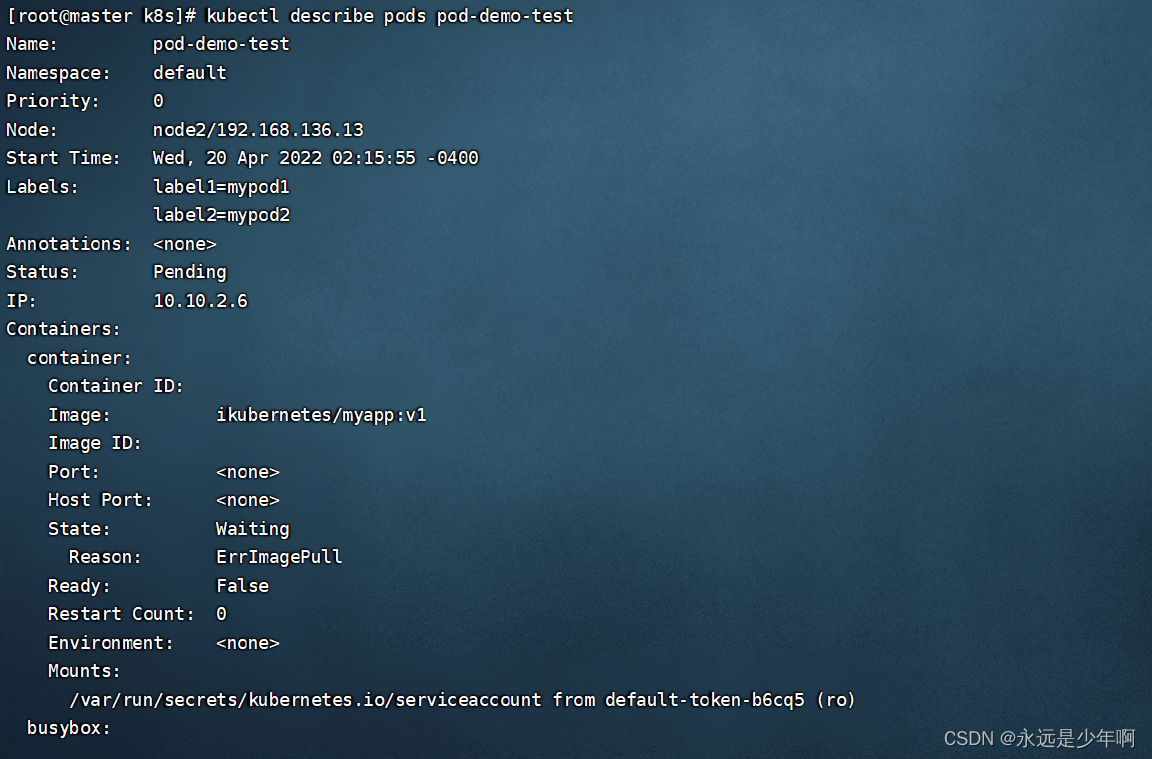

Detailed explanation of kubernetes (IX) -- actual combat of creating pod with resource allocation list

Functions (Part I)

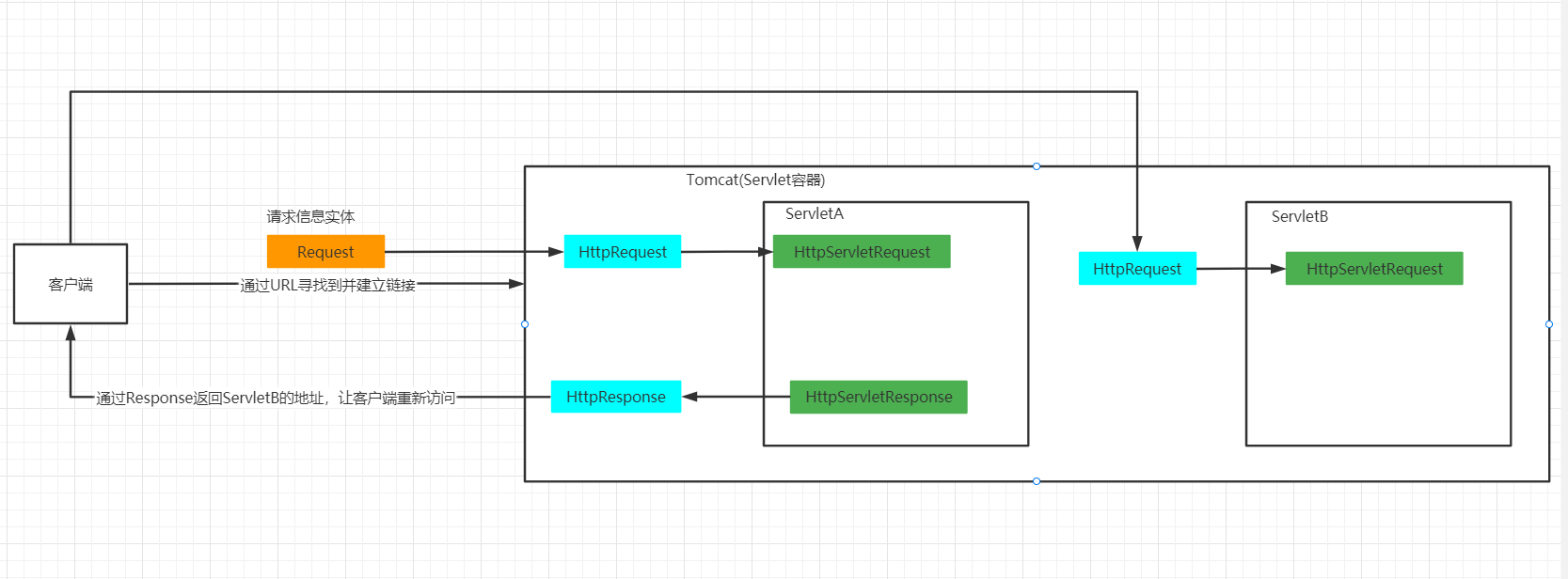

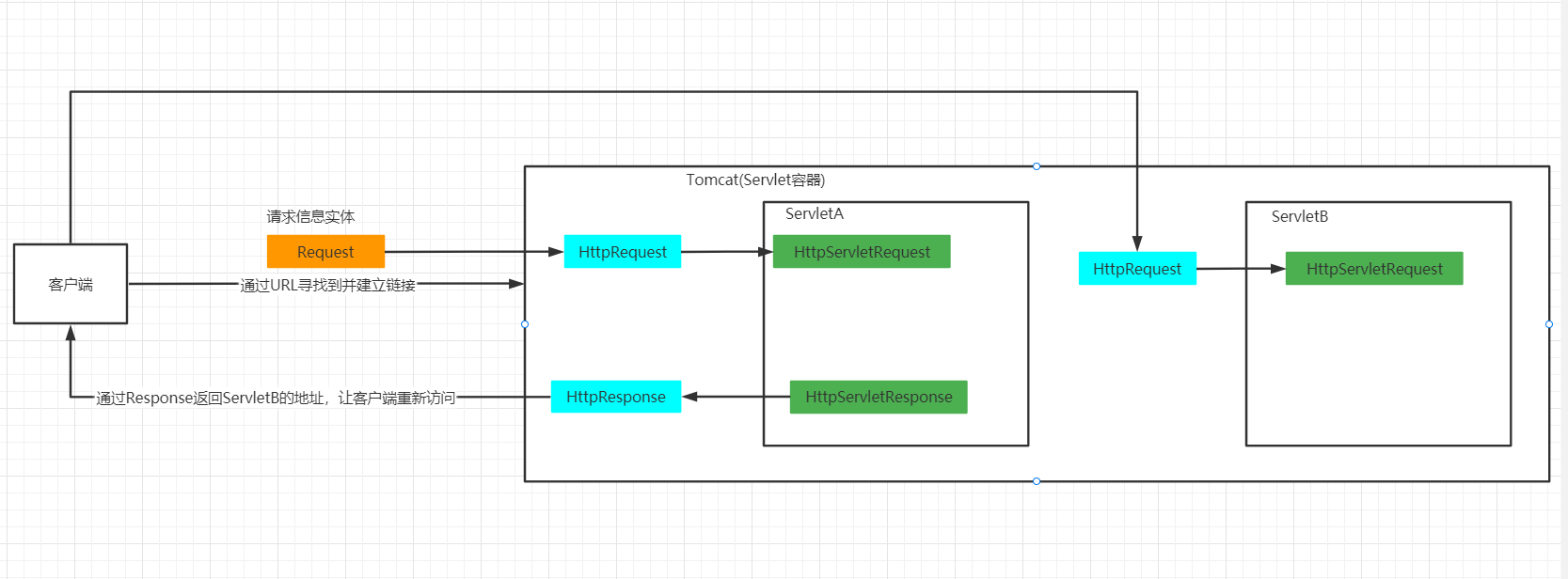

重定向和请求转发详解

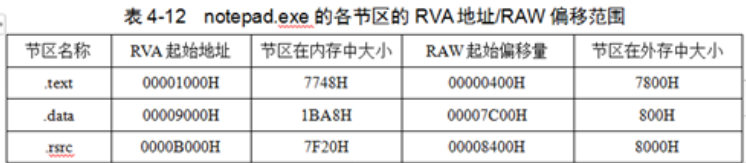

导入地址表分析(根据库文件名求出:导入函数数量、函数序号、函数名称)

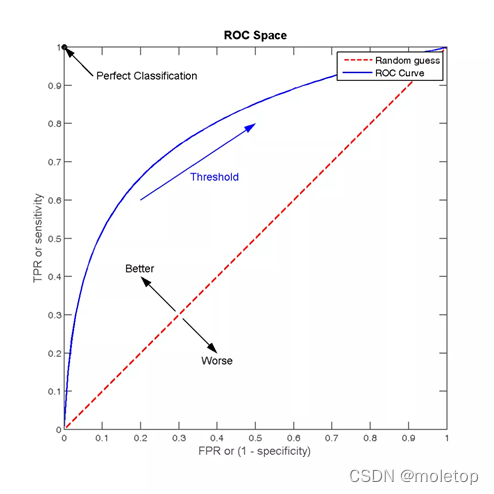

Recommended search common evaluation indicators

Detailed explanation of redirection and request forwarding

Mumu, go all the way

随机推荐

Application of skiplist in leveldb

regular expression

What role does the software performance test report play? How much is the third-party test report charged?

Demonstration meeting on startup and implementation scheme of swarm intelligence autonomous operation smart farm project

重定向和请求转发详解

Detailed explanation of redirection and request forwarding

G007-hwy-cc-estor-03 Huawei Dorado V6 storage simulator construction

redis-shake 使用中遇到的错误整理

Comparaison du menu de l'illustrateur Adobe en chinois et en anglais

[backtrader source code analysis 18] Yahoo Py code comments and analysis (boring, interested in the code, you can refer to)

kubernetes之常用Pod控制器的使用

Precautions for use of dispatching system

Code live collection ▏ software test report template Fan Wen is here

HJ31 单词倒排

控制结构(二)

字节面试 transformer相关问题 整理复盘

PHP PDO ODBC loads files from one folder into the blob column of MySQL database and downloads the blob column to another folder

PHP PDO ODBC将一个文件夹的文件装载到MySQL数据库BLOB列,并将BLOB列下载到另一个文件夹

MySQL query library size

Grep was unable to redirect to the file