当前位置:网站首页>Coinbase: basic knowledge, facts and statistics about cross chain bridge

Coinbase: basic knowledge, facts and statistics about cross chain bridge

2022-04-23 04:31:00 【chinadefi】

Coinbase: Basic knowledge of cross chain bridge 、 Facts and statistics

Introduce

Bridge is a relatively new concept , stay 2021 It became popular in . The bridge allows cryptocurrency holders to move between different blockchains “ Move ”( or “ The bridge ”) Their assets . This allows them to jump from one chain to another and contact other networks .

We found out from 2021 year 4 Month begins , Ethereum's cross chain activities have increased dramatically . The daily deposit activity of Ethereum bridge is 2021 It peaked in the summer of , Ethereum bridging has a record high of more than 6 Ten thousand transactions took place in 2021 year 9 month 12 Japan .

This article aims to explain what a bridge is , Why are bridges so popular , And why bad actors bridge funds across networks .

What is a bridge ?

A bridge is an application , It uses cross chain communication technology to support transactions between two or more networks , These networks can be the third 1 layer 、 The first 2 layer , Even off chain services . In short , The bridge allows cryptocurrency holders to transfer their assets from one network to another . for example , In Ethereum USDC Holders may want to use the bridge application to transfer their USDC From Ethereum to Avalanche.

However , Bridges do not move assets between chains , It links assets on one network to assets on another network ( Packaged version ). Cross chain transactions are through “ lock ”、“ to mint ” and “ The destruction ” To achieve .

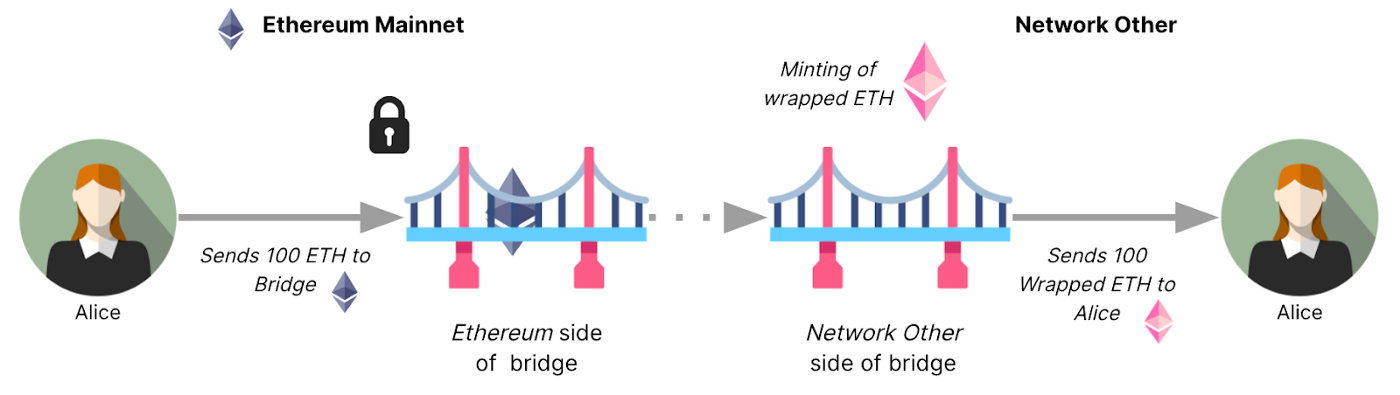

hypothesis Alice I want to pass a call Bridge Your bridge application will 100 individual ETH Bridge from Ethereum to another one called Network Other On the Internet ( A blockchain network ):

- Alice In Ethereum Bridge Deposit... In the contract 100 ETH;

- The bridge contract on Ethereum locks in assets , And notify Network Other Another bridge contract on ; The asset can only be accessed when the user makes a withdrawal request :

- Network Other Bridge contract generation on ( establish )100 Tokens , For locked ETH( That is, packed ETH);

- Bridge The contract will be newly cast ETH Transferred to the Network Other On Alice The address of :

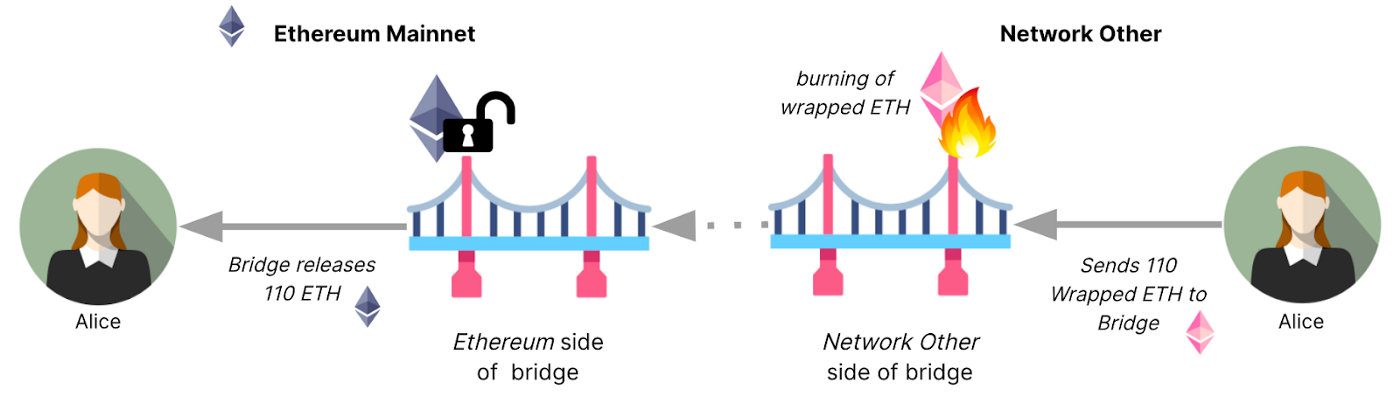

Alice Now in Network Other Hold on to 100 A packed ETH. later , She received a message from someone else 10 A packed ETH. Now? , She is in Network Other The address balance on the is increased to 110 A packed ETH. She decided to withdraw all funds to Ethereum :

- stay Network Other On ,Alice Send... To the bridge contract 110 A packed ETH;

- Network Other The contract on the bridge burned down ( The destruction )110 packaged ETH, And inform the bridge contract on Ethereum ;

- In Ethereum Bridge Contract verification withdrawal request ( for example ,Alice Is it true that Network Other Owned on 110 A packed ETH). If all checks pass , It will 110 individual ETH Unlock to Ethereum Alice The address of :

How and when did bridges become so popular ?

Bridge Technology in 2021 Began to take off in . Especially in 2021 year 4 Months later , We see that the cross chain traffic of Ethereum increases exponentially —— Including the number of transactions per day and the unique address stored in Ethereum bridge . We think , This upward trend may be driven by one of the following reasons :

- The increase in the number of Bridge Applications .Wormhole Launched Ethereum -solana Bridge ,Multichain (AnySwap) Launched Ethereum -Fantom Bridge and Ethereum -moonriver Bridge ,Celer On 2021 Introduced in the cBridge.

- The number of new networks that can be connected to Ethereum has increased .Avalanche、Ronin、Arbitrum One、Optimism and Solana On 2021 Launched in 2013 .

- Decentralized applications launched on chains outside Ethereum (dApp) Increase in the number of projects , And inspired the use of these systems .

Why should users bridge ?

Usually , Users want to connect from one network to another , Because they need :

- Faster and cheaper transactions .

- Use non network native assets .

- Visit a wider range of dApp. Users may want to connect funds from Ethereum to Ronin The Internet , To access information specific to Ronin Applications for , Like their game dApp; Because some dapp Not deployed on Ethereum main network .

- Get extra income from the incentive plan . Many users choose to bridge , Because the target network or projects on the target network may send free tokens to their community members .

2021 What has happened since ?

2021 A lot of things happened in . stay 7 Month to 11 Between months , Many new dapp And new networks are launched . Ethereum's bridging activities peaked during this period . from 2021 From the fourth quarter of , Most bridges become quiet . However ,Polygon PoS This is not the case with bridges —— stay 2021 The number of deposit transactions in the whole year , We see strong and stable bridge flow , From Ethereum to Polygon The Internet , This eventually leads to Polygon PoS stay 2022 Leading cross chain traffic in the first quarter of 2013 .

The following diagram 1 Shows the daily deposit transactions of Ethereum bridge . Our theory is ,2021 year 9 month 11 The recent sharp rise is due to Arbitrum One The launch of .

chart 1 since 2021 Since then , The number of transactions deposited into Ethereum bridge every day .

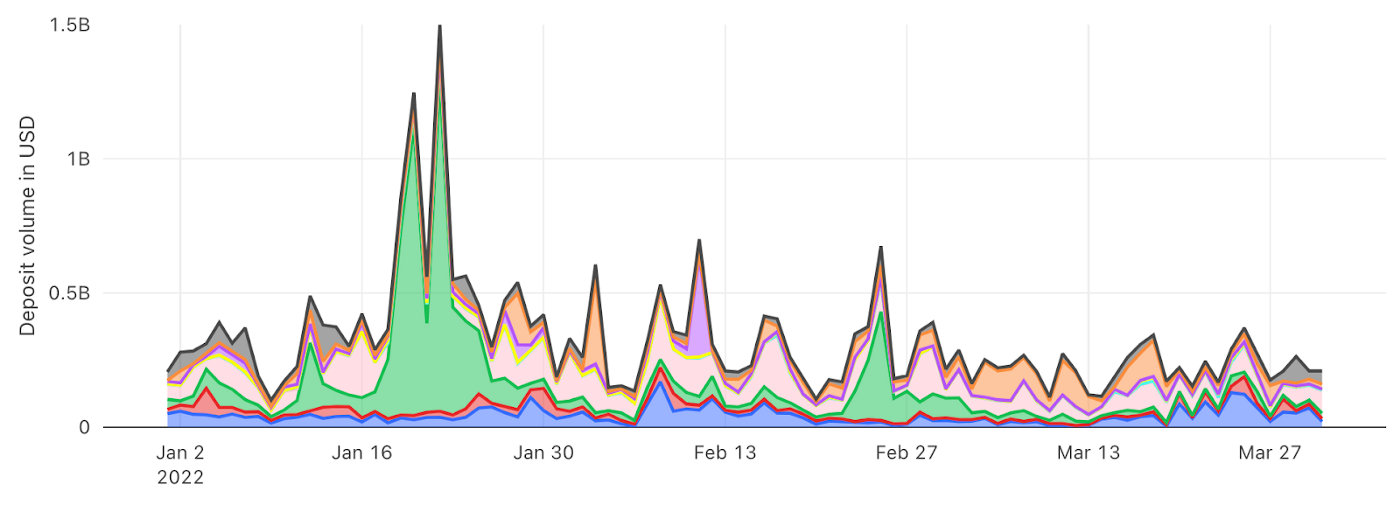

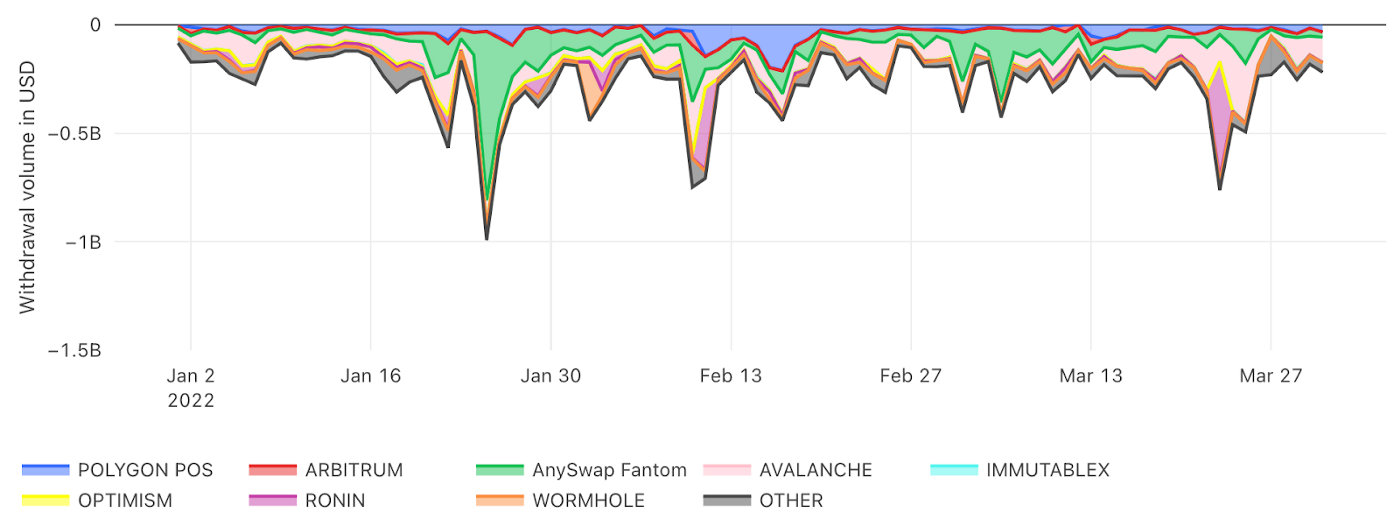

Let's look at the dynamics of deposits and withdrawals in US dollars . The following diagram 2 Shows 2022 Daily deposits and withdrawals in US dollars in the first quarter of 2013 . We think , Some of the sharp rise in trading volume is driven by events ( for example , Start a new project 、 Airdrop 、 Incentive plan 、 Whale activity 、 Bridge loopholes, etc ).

- 2022 Before the total deposits in the first quarter of 2013 3 It is AnySwap Fantom bridge( green , about 84 Billion dollars )、Avalanche bridge( Pink , about 78 Billion dollars ) and Polygon PoS bridge( Blue , about 40 Billion dollars );

- 2022 The top three of the total withdrawals in the first quarter of the year were Avalanche bridge( Pink , about 105 Billion dollars )、AnySwap Fantom bridge( green , about 60 Billion dollars ) and Polygon PoS bridge( Blue , about 38 Billion dollars );

We also observed a very interesting pattern of capital movement , Especially in AnySwap Of Fantom In the bridge , A large amount of money was transferred to Fantom The Internet , Then withdraw the money to Ethereum main network in a short time .

chart 2 2022 Ethereum daily deposits in US dollars in the first quarter of 2013

How safe the bridge is ?

Like most new technologies , There are also some risks to consider . for example , There is such a risk : The user's funds may be stuck in the process of deposit and withdrawal , Or they may become victims of cyber theft . When a user decides to connect to an asset , They should also be aware of the potential risks , So they can make more risk driven decisions .

Theft risk is the most common risk , Can cause the bridge contract to lose part or all of its funds . Here are some problems that can lead to theft :

- Loopholes in smart contracts . Programming or logic errors can have a serious impact on bridge safety , Create opportunities for attackers , Steal locked funds from the bridge contract .

The latest example is 2022 year 2 Of the month Wormhole attack . The attacker found a vulnerability in the smart contract code , Forged... Without the approval of the bridge 120,000 individual Solana ETH, And in 2022 year 2 month 2 Withdrew from Ethereum on the th 80000 individual ETH. Fortunately, ,Jump Trading By way of 120,000 individual ETH Bridge contracts deposited in Ethereum to fill this gap .

chart 3 In dollars Wormhole Daily deposit and withdrawal of the bridge

- Custodian . Now , Most bridge applications rely on external authorities to interact with the bridge and withdraw funds . They are custodians of locked in funds —— They can be trusted parties ( Such as AnySwap Bridge ), It can also be a verifier pool bound by rights and interests ( Such as Polygon PoS Bridge and Ronin Bridge ). In this way, there is a risk that the custodian may compromise or take malicious action .

stay 2022 year 3 month 23 Japan ,Ronin The attacker destroyed Sky Mavis All four validation nodes running .Sky Mavis It was developed Axie Infinity game 、Ronin Network and Ronin bridge The company . Plus a fifth verifier ( from Axie Dao function ), The attacker controls most of the verifiers (9 Among the verifiers 5 individual ).

And then , The attacker without any verification , From Ethereum Ronin On the bridge 173600 ETH and 2550 Thousands of dollars in USDC.

chart 4 Ronin Bridge daily deposit and withdrawal in US dollars

- Malicious third 1 Layer miner / Verifier . If exceeded 50% Of the 1 The computing power or pledge of the layer is controlled by malicious miners or verifiers , They can attack the bridge on the chain , And steal locked funds . for example , After the asset is bridged to another network , They can resume the deposit transaction completed on Ethereum , This allows an attacker to withdraw funds from another network , You don't need to deposit on Ethereum . perhaps , They can prevent the bridge contract from getting updates from another network , This may cause significant losses to the user funds locked on the bridge .

These are unlikely to happen , But it's not impossible . In the worst case , If the asset locked on the utilized bridge has been bridged from another network , And in DeFi Used in applications , This may lead to cascading infection on multiple blockchain networks .

Bridge users should know , The damage caused by theft is usually irreversible .

We are right. 2022 What are you looking forward to in ?

in consideration of 2021 The explosive growth of the bridge in , We believe that the popularity of the bridge will continue to rise , In particular, we expect to see developments in the following areas :

- Bridge demand . With the launch of more networks and bridges this year , We see more users want to build bridges between networks ;

- CEX. To 2022 year , More centralized exchanges will allow alt-Layer 1 and Layer 2 Direct deposit and withdrawal .

- The safety of the bridge . As more and more users are willing to bridge , More encrypted assets will be locked in bridge contracts —— Created a honeypot effect , Will increasingly attract hackers .

- Risk awareness . at present , Many transitional decisions are cost driven . We believe that people have different risk preferences . However , There is a big difference between choosing a bridge's risk weight and choosing a cheap bridge just because of its low cost .

With more information and discussion about bridge safety , Will more risk driven decisions be made when choosing bridges in the future , It will be interesting .

Source:https://medium.com/the-coinbase-blog/what-are-bridges-bridge-basics-facts-and-stats-8dd9449066a0

About

ChinaDeFi - ChinaDeFi.com It's a research driven DeFi Innovation organizations , We are also a blockchain development team . From all over the world every day 500 Close to a good source of information 900 In the content , Looking for deeper thinking 、 Sort out more systematic content , Provide decision-making assistant materials to the Chinese market at the fastest speed .

Layer 2 friends sharing same hobby - Welcome to Layer 2 Interested blockchain technology enthusiasts 、 Study and analyze people and Gavin( WeChat : chinadefi) contact , Discuss together Layer 2 Landing opportunities . Please pay attention to our official account of WeChat “ Decentralized financial community ”.

版权声明

本文为[chinadefi]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204230426454590.html

边栏推荐

- [AI vision · quick review of NLP natural language processing papers today, issue 31] Fri, 15 APR 2022

- 【BIM入门实战】Revit建筑墙体:构造、包络、叠层图文详解

- 【BIM+GIS】ArcGIS Pro2.8如何打开Revit模型,BIM和GIS融合?

- matlab读取多张fig图然后合并为一张图(子图的形式)

- [mapping program design] coordinate inverse artifact v1 0 (with C / C / VB source program)

- TreeSet after class exercises

- 2019 is coming to an end, the longest day.

- The whole process of connecting the newly created unbutu system virtual machine with xshell and xftp

- MYSQL去重方法汇总

- 2020 is coming to an end, special and unforgettable.

猜你喜欢

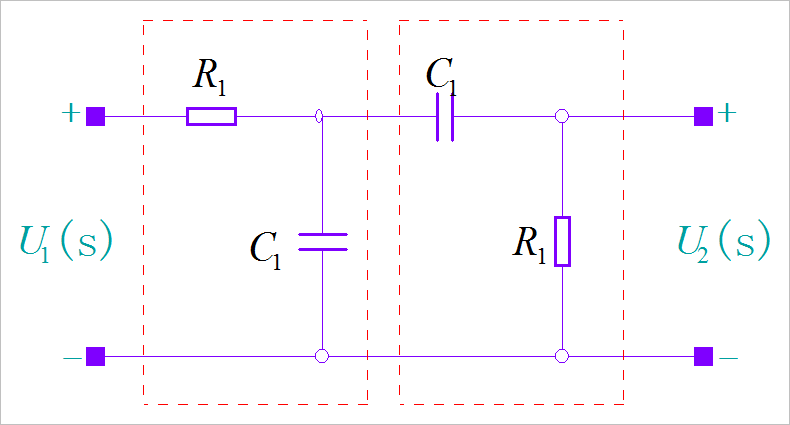

RC低通滤波器的逆系统

Fusobacterium -- symbiotic bacteria, opportunistic bacteria, oncobacterium

![[mapping program design] coordinate inverse artifact v1 0 (with C / C / VB source program)](/img/12/de3b2c6ea98be57a8abe2790debfb5.png)

[mapping program design] coordinate inverse artifact v1 0 (with C / C / VB source program)

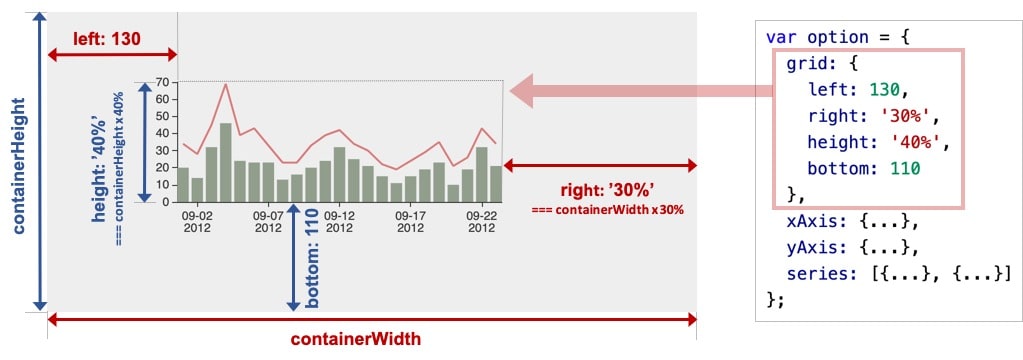

【Echart】echart 入門

Shopping mall for transportation tools based on PHP

优麒麟 22.04 LTS 版本正式发布 | UKUI 3.1开启全新体验

Express middleware ② (classification of Middleware)

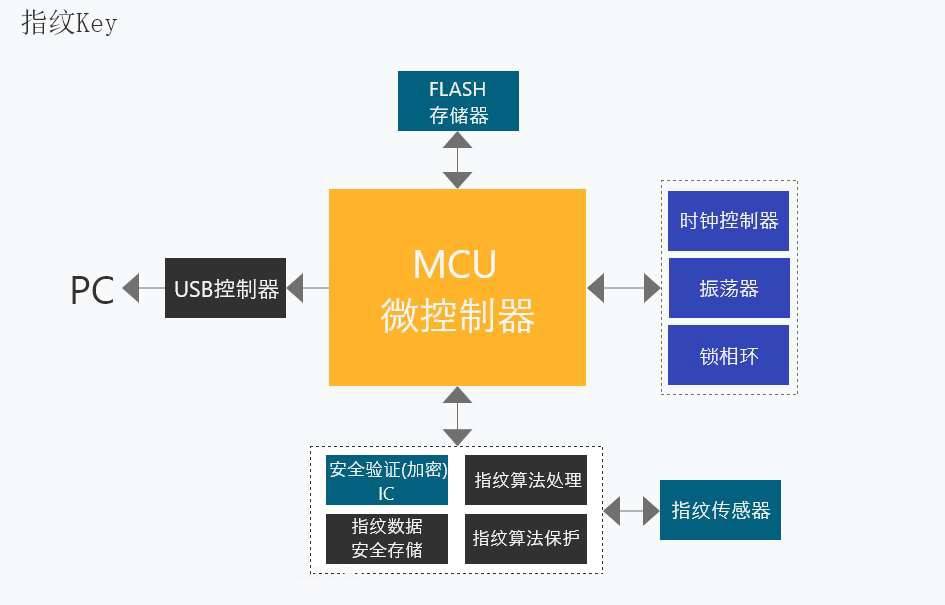

指纹Key全国产化电子元件推荐方案

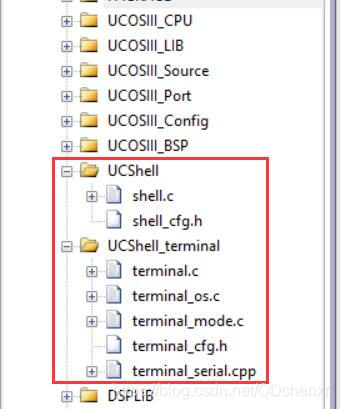

STM32 upper μ C / shell transplantation and Application

補:注解(Annotation)

随机推荐

C语言: 指针的进阶

用D435i录制自己的数据集运行ORBslam2并构建稠密点云

shell wc (统计字符数量)的基本使用

Use recyclerview to realize left-right side-by-side classification selection

Shopping mall for transportation tools based on PHP

中国移动日赚2.85亿很高?其实是5G难带来更多利润,那么钱去哪里了?

thymeleaf th:value 为null时报错问题

Express中间件②(中间件的分类)

[AI vision · quick review of NLP natural language processing papers today, issue 31] Fri, 15 APR 2022

1个需求的一生,团队协作在云效钉钉小程序上可以这么玩

[BIM introduction practice] wall hierarchy and FAQ in Revit

重剑无锋,大巧不工

A new method for evaluating the quality of metagenome assembly - magista

针对NFT的网络钓鱼

Opencv -- yoact case segmentation model reasoning

【时序】基于 TCN 的用于序列建模的通用卷积和循环网络的经验评估

Xiaomi, which has set the highest sales record of domestic mobile phones in overseas markets, paid renewed attention to the domestic market

TreeSet课后练习

记录一下盲注脚本

[Li Hongyi 2022 machine learning spring] hw6_ Gan (don't understand...)