当前位置:网站首页>Chapter VII asset impairment

Chapter VII asset impairment

2022-04-23 07:57:00 【Willie Y】

Chapter vii. Asset impairment

One 、 Overview of asset impairment

1、 Scope of impairment of assets

(1)、 The first 8 Number 《 Asset impairment 》 The guidelines apply to : Non current assets

Include : Long term equity investment 、 Investment real estate ( Cost model )、 Fixed assets 、 Intangible assets 、 goodwill 、 Productive biological assets 、 Prove the rights and interests of oil and gas mining areas and well related facilities

2、 Signs and tests of asset impairment

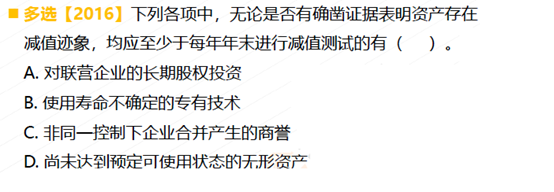

| Asset class |

Impairment test |

| General assets |

There are signs of impairment --> Impairment test only at the end of the period |

notes : None of the above is amortized , No physical form , High risk , |

Whether or not there are signs of impairment --> Impairment test at least at the end of each year |

Impairment test : Book value VS Recoverable amount

Book value > Recoverable amount : Impairment occurred

Book value < Recoverable amount : No impairment occurred

answer :BCD.

Two 、 Measurement of recoverable amount of assets

1、 The basic method of estimating the recoverable amount of assets

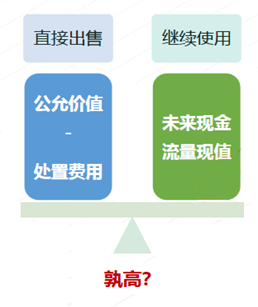

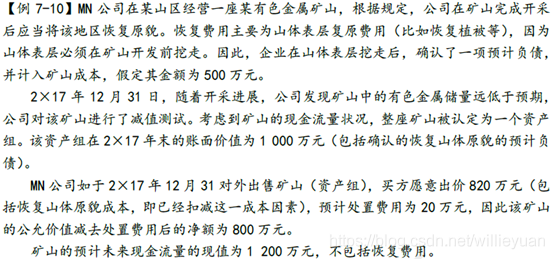

Recoverable amount :Max( fair value – Disposal expenses VS Of future cash flows Present value )

(1)、 The net amount of fair value minus disposal expenses and the present value of estimated future cash flow , As long as one item exceeds Book value , It indicates that the asset is not impaired , There is no need to estimate another amount .

(2)、 There is no conclusive evidence or reason to show that , The present value of the estimated future cash flow of the asset is significantly greater than the net amount of its fair value minus disposal expenses ; The net amount of the fair value of the asset minus the disposal expenses can be regarded as the net amount of the asset Recoverable amount .

(3)、 The net amount of the fair value of the asset minus the disposal expenses if It is impossible to estimate reliably , The recoverable amount shall be the present value of the expected future cash flow of the asset .

2、 Estimated net amount of fair value less disposal expenses

(1)、 fair value : Selling price , The price at which an asset can be sold or a liability can be transferred

Determine in the following order :

- Sales agreement price in fair trade ( The contract price )

- There is no sales agreement, there is an active market ( The market price )

- No agreement, no active market : It is estimated that ( Recent transaction prices of similar assets in the same industry )

(2)、 Disposal expenses : Incremental costs that can be directly attributed to asset disposal , Excluding financial expenses 、 Income tax expense .

3、 Present value estimation of estimated future cash flow

1、 Factors affecting the present value of estimated future cash flow :

a. The expected future cash flow of the asset

b. Service life of assets

c. Discount rate

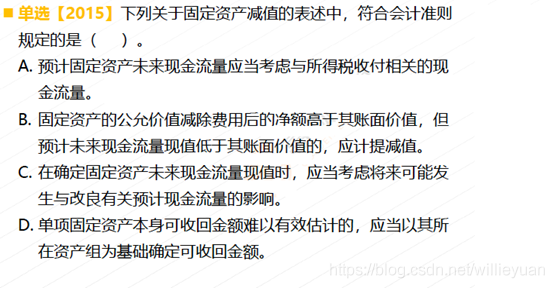

2、 Estimation of future cash flow of assets : To assets Based on the current situation ( affirmatory , Regardless of possible and uncertain )

The following situations are not considered :

- What may happen in the future 、 Restructuring matters for which no commitment has been made .( Determining the of reorganization will consider )

- Estimated future cash flow related to asset improvement .( The future cash flow recognized after improvement will take into account )

- Cash flows from financing activities and income tax payments .

3、 The method of estimating the future cash flow of assets

a. Traditional law ( Single )

b. Expected cash flow method ( Weighted average )

Expected cash flow method : For example, the estimated cash flow at the end of the year 50 Ten thousand probability 70%,30 Ten thousand probability 30%. Then the future cash flow is 50×70% + 30×30% =44 ten thousand .

4、 The estimated discount rate

a. Pre tax interest rate that reflects the current time value of money and the specific risks of assets

b. Market interest rate is preferred , Interest rate substitution comes second

c. The estimation of discount rate is consistent with the estimation basis of future cash flow of assets . For example, risk 、 Inflation .

5、 Foreign currency Prediction of future cash flow and its present value : Discount first , Post conversion ( exchange rate )

Discount first , Post conversion : It ensures that the exchange rate is the current real exchange rate , Instead of forward estimated exchange rates .

answer :D

answer :C

answer :ABCD

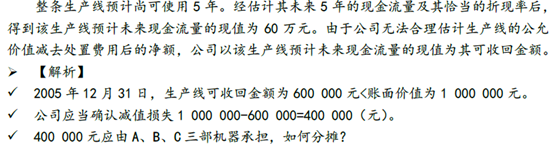

3、 ... and 、 Recognition and measurement of asset impairment loss

1、 Confirmation principle

Recoverable amount < Book value , Impairment occurred , Provision for impairment , Impairment amount ( What happened ) Is the difference between the two .

(1)、 After the asset impairment loss is recognized , Depreciation and amortization expenses of impaired assets shall be adjusted accordingly in future periods .

(2)、 Once an asset is impaired , In the future Do not turn back ( Non current assets , The unit price is high , Prevent operating profit )

2、 Account setting and accounting treatment

borrow : assets impairment loss

loan :XX Provision for impairment

( Affect profits : A decrease in profits , Decrease in assets )

attach :

stock : cost VS Net realizable value , balance ( Inventory falling price reserves )

Asset impairment : Book value VS Recoverable amount , What happened (XX Provision for impairment )

Four 、 Recognition and impairment treatment of asset group

1、 Identification of asset group

(1)、 Generation of asset groups : When the recoverable amount of an asset cannot be estimated individually

(2)、 Identification of asset group :

a. Be able to create Independent Cash flow of

b. Minimum Portfolio ( The most cautious when estimating individual assets , Multiple estimates may offset each other between impaired assets and non impaired assets )

2、 Asset group impairment test

(1)、 Impairment test

The book value of the asset group VS Recoverable amount of asset group

Be careful : Determine whether the basis is consistent

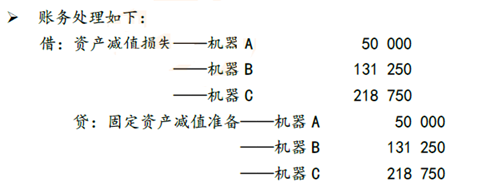

(2)、 Accounting treatment of asset impairment

Offset goodwill first , Deduct other assets in proportion to goodwill . There may also be a need for secondary apportionment .

3、 Impairment test of headquarters assets

(1)、 Headquarters assets

Office buildings of enterprise groups or other business units 、 Electronic data processing equipment 、 R & D center and other assets .

a. features : It is difficult to separate from other assets or asset groups to generate independent cash inflows .

b. It is necessary to conduct impairment test in combination with other asset groups or asset portfolios .

Portfolio : The smallest asset group combination composed of several asset groups , Including asset group or combination of asset groups , And press reasonable The part of headquarters assets allocated by the method .

(2)、 The treatment idea of asset impairment of the headquarters

Apportionable portion a: A reasonable and consistent approach will a Apportion to a1、a2、a3(a=a1+a2+a3), And asset groups respectively A、B、C Package and combine into a new asset portfolio ( Asset group A+a1、 Asset group B+a2、 Asset group C+a3) Conduct impairment test .

Illustrate with examples :

版权声明

本文为[Willie Y]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204230628042332.html

边栏推荐

- Internal network security attack and defense: a practical guide to penetration testing (5): analysis and defense of horizontal movement in the domain

- FUEL: Fast UAV Exploration using Incremental Frontier Structure and Hierarchical Planning

- TimelineWindow

- linux下mysql数据库备份与恢复(全量+增量)

- Export all SVG files in the specified path into pictures in PNG format (thumbnail or original size)

- 从零开始完整学习机器学习和深度学习,包括理论和代码实现,主要用到scikit和MXNet,还有一些实践(kaggle上的)

- Complete color conversion formulas and conversion tables (31 kinds)

- 《内网安全攻防:渗透测试实战指南》读书笔记(七):跨域攻击分析及防御

- 内网渗透系列:内网隧道之dnscat2

- Intranet penetration series: icmpsh of Intranet tunnel

猜你喜欢

Using lambda expression to solve the problem of C file name sorting (whether it is 100 or 11)

Export all SVG files in the specified path into pictures in PNG format (thumbnail or original size)

STO With Billing 跨公司库存转储退货

C problem of marking the position of polygons surrounded by multiple rectangles

How does Apache Hudi accelerate traditional batch mode?

内网渗透系列:内网隧道之icmptunnel(DhavalKapil师傅的)

Use of command line parameter passing library argparse

Houdini>建筑道路可变,学习过程笔记

Internal network security attack and defense: a practical guide to penetration testing (5): analysis and defense of horizontal movement in the domain

内网渗透系列:内网隧道之icmpsh

随机推荐

Protobuf use

RGB color to hex and unit conversion

Série de pénétration Intranet: icmpsh du tunnel Intranet

Personality charm of high paid it workers

C#控制相机,旋转,拖拽观察脚本(类似Scenes观察方式)

保研准备经验贴——18届(2021年)中南计科推免到浙大工院

一些关于网络安全的好教程或笔记的链接,记录一下

What's new in. Net 5 NET 5

Houdini>刚体, 刚体破碎RBD

Teach-Repeat-Replan: A Complete and Robust System for Aggressive Flight in Complex Environments

Search and replacement of C text file (WinForm)

Scrapy modifies the time in the statistics at the end of the crawler as the current system time

从零开始完整学习机器学习和深度学习,包括理论和代码实现,主要用到scikit和MXNet,还有一些实践(kaggle上的)

Robust and Efficient Quadrotor Trajectory Generation for Fast Autonomous Flight

C # control the camera, rotate and drag the observation script (similar to scenes observation mode)

TimelineWindow

Houdini terrain and fluid solution (simulated debris flow)

KCD_EXCEL_OLE_TO_INT_CONVERT报错SY-subrc = 2

About USB flash drive data prompt raw, need to format, data recovery notes

Export all SVG files in the specified path into pictures in PNG format (thumbnail or original size)