当前位置:网站首页>ERP function_ Financial management_ The difference between red and blue words in invoices

ERP function_ Financial management_ The difference between red and blue words in invoices

2022-04-23 21:25:00 【Plant a sweet smell】

ERP function _ Financial management _ Invoice red , The difference between blue words

What is invoice in blue ?

1. Blue ink invoice refers to the normal invoice issued at ordinary times , Due to the large quantity, it is usually referred to as invoice , Only when it is different from red ink invoice, it is called blue ink invoice .

2. Blue ink invoice and red ink invoice are the continuation of the traditional handwritten invoice , In the past, invoices were made on carbon paper , Usually use blue carbon paper , So it's called blue ink invoice ;“ Over the month ” When there is a return after , For the convenience of distinguishing , Just invoice with red carbon paper , Red ink invoice .

What is invoice scarlet letter ?

1. A red ink invoice is a negative invoice , An invoice with a negative amount . It also corresponds to the original blue ink invoice , Negative numbers are written back to sales , Or negative return input transfer out

2. Conditions for issuing red ink invoice :

1、 Receipt of the returned invoice sheet 、 The time of the deduction sheet does not exceed the month when the Seller issues the invoice ;

2、 The seller did not copy tax and did not keep an account ;

3、 The buyer is not certified or the certification result is “ The taxpayer identification number is inconsistent with the certification ”、“ Special invoice code 、 The number does not match the authentication ”.

Related development materials

1、3 Invoice in blue in the month :

borrow : Accounts receivable ( The blue words )

loan : Main business income ( The blue words )

Taxes payable —— VAT payable ( Output tax )( The blue words )

2、4 Issue red ink invoice every month , Then write the correct blue invoice :

borrow : Accounts receivable ( The scarlet letter )

loan : Main business income ( The scarlet letter )

3. Taxes payable —— VAT payable ( Output tax )( The scarlet letter )

borrow : Accounts receivable ( The blue words )

loan : Main business income ( The blue words )

4. Taxes payable —— VAT payable ( Output tax )( The blue words )

Register and record according to the above entries , You can also just press the last correct note .

版权声明

本文为[Plant a sweet smell]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/110/202204200619557257.html

边栏推荐

- Introduce structured concurrency and release swift 5.5!

- [leetcode sword finger offer 10 - II. Frog jumping steps (simple)]

- DW basic course (II)

- Question brushing plan - depth first search (II)

- Leetcode-279-complete square number

- Yolov5 NMS source code understanding

- Minecraft 1.12.2模组开发(四十三) 自定义盾牌(Shield)

- This paper solves the cross domain problem of browser

- Graph traversal - BFS, DFS

- The more you use the computer, the slower it will be? Recovery method of file accidental deletion

猜你喜欢

Another data analysis artifact: Polaris is really powerful

![[leetcode refers to offer 52. The first common node of two linked lists (simple)]](/img/bc/cd9c6ec29ecfef74940200e196aed3.png)

[leetcode refers to offer 52. The first common node of two linked lists (simple)]

![[leetcode sword finger offer 28. Symmetric binary tree (simple)]](/img/bc/1f0c9e70470c7d60f821a4ecc2271f.png)

[leetcode sword finger offer 28. Symmetric binary tree (simple)]

Display, move, rotate

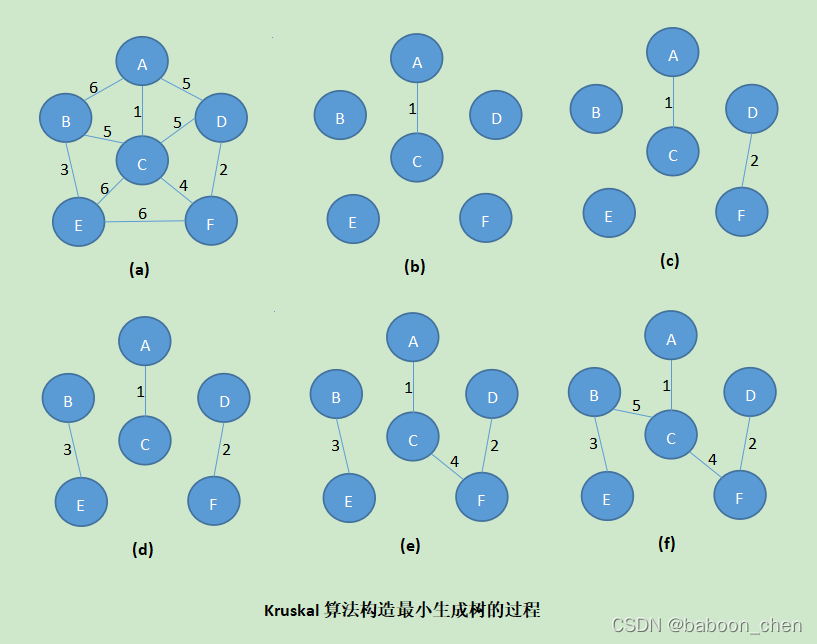

Prim、Kruskal

On the three paradigms of database design

How to make Jenkins job run automatically after startup

flomo软件推荐

Common problems in deploying projects with laravel and composer for PHP

Use 3080ti to run tensorflow GPU = 1 X version of the source code

随机推荐

IIS cannot load * woff,*. woff2,*. Solution of SVG file

Centos7 builds MySQL master-slave replication from scratch (avoid stepping on the pit)

Preliminary analysis of Airbase

Mysql database common sense storage engine

How Axure installs a catalog

FAILURE: Build failed with an exception. * What went wrong: Execution failed for task ‘:app:stripDe

Common problems in deploying projects with laravel and composer for PHP

UKFslam

阿里又一个“逆天”容器框架!这本Kubernetes进阶手册简直太全了

unity 功能扩展

[※ leetcode refers to offer 48. The longest substring without repeated characters (medium)]

Chrome 94 introduces the controversial idle detection API, which apple and Mozilla oppose

How to use the project that created SVN for the first time

Question brushing plan - depth first search (II)

Keras. Layers introduction to various layers

Pytorch selects the first k maximum (minimum) values and their indexes in the data

presto on spark 支持3.1.3记录

Tensorflow1. X and 2 How does x read those parameters saved in CKPT

Deep understanding of modern mobile GPU (continuously updating)

What about laptop Caton? Teach you to reinstall the system with one click to "revive" the computer