当前位置:网站首页>Wave field Dao new species end up, how does usdd break the situation and stabilize the currency market?

Wave field Dao new species end up, how does usdd break the situation and stabilize the currency market?

2022-04-23 20:10:00 【Digital intelligence node DXN】

For most encryption users , I don't know when , We have completely TRC-20 USDT As a habit . As one of the most important tracks in the field of cryptocurrency , Stable currency has become the first way for many people to officially enter the encryption market “ token ”. And in the whole stable currency market , Based on the wave field TRC-20 Issued USDT It has occupied an absolute dominant position . In the last month Tether In the official data ,TRC-20 USDT The circulation has completely exceeded that of Ethereum version USDT, Become the first in the total circulation USDT edition . Wave field TRON Constructed by USDT、USDC、USDJ、TUSD Composed of four stable currency business patterns , Covering the top two stable currencies in the industry 、 Decentralized stable currency and compliant dollar stable currency .

With the changes of external environment and market demand , The stability currency itself is undergoing new changes , The industry hopes to develop a new kind of currency on the basis of mortgage stable currency , Not relying on central institutions , Decentralized stable currency solution free from external regulatory factors . Benefit from in TRC-20 USDT Successful experience in ,2022 year 4 month 21 Japan , Wave field TRON Sunyuchen, the founder, said in an open letter that , Wave field DAO A decentralized algorithm with high price stability and wide application scenarios will be designed ——USDD, Designed for subsequent cryptocurrency applications 、 A decentralized economy provides a truly usable medium of value .

With USDD The significance of the birth of the first algorithm stable currency lies in , Although the market has adapted to the media role of centralized stable currency , however From the perspective of blockchain and decentralization process , There are still some risks in this medium , The vulnerability of centralized stable currency in the face of extreme environment and emergencies is still debatable , As long as the issuing right of stable currency is still in the hands of centralized institutions , As long as the centralized organization still has the authority to freeze and confiscate at will , As long as the run risk remains , Then the vision of individual sovereignty and inviolability of private assets originally envisaged by blockchain and decentralization spirit is a piece of empty talk . Just as sun Yuchen mentioned in his open letter , The wave field needs to continue to complete self iteration and self revolution , Eliminate the last threshold of the financial world with the mathematics and algorithms believed in by blockchain , Avoid the infringement of users' individual sovereignty by huge profits and central power .

01

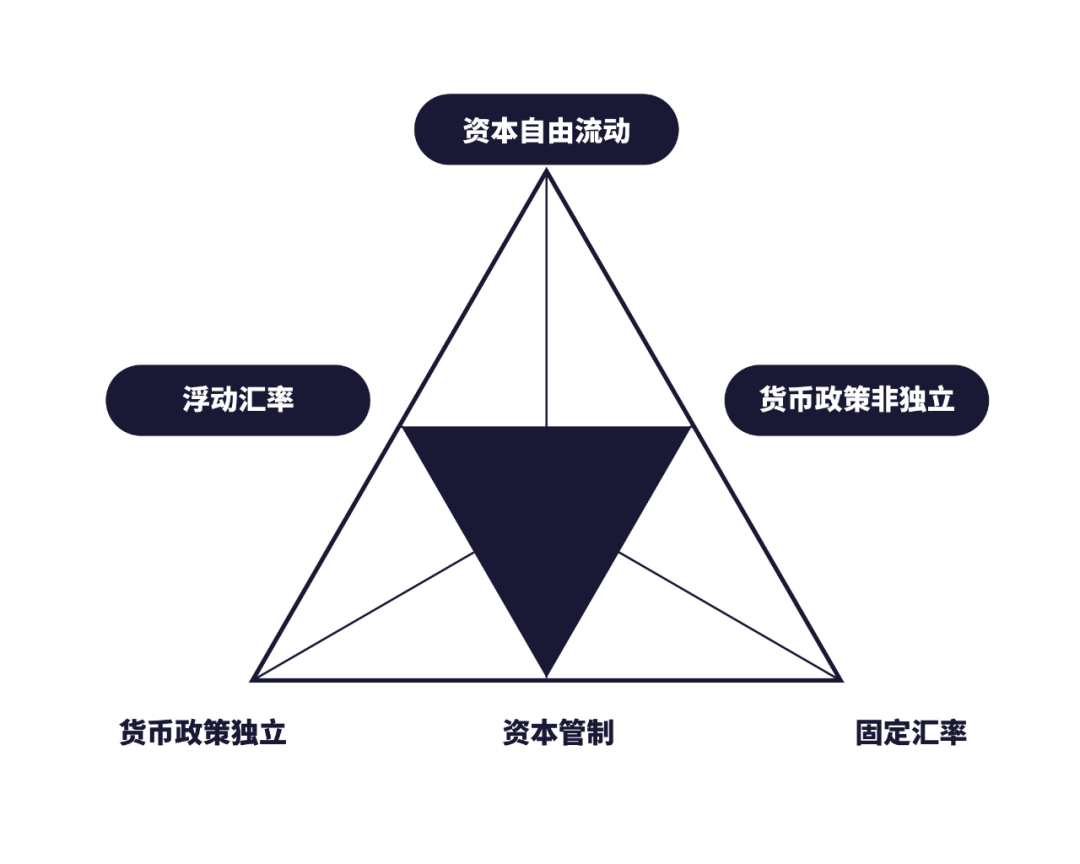

Currency stability triangle based on algorithm

Stable currency is a kind of digital currency with relatively stable market price , That is, the legal tender in the digital money market . The birth background comes from the huge volatility in the digital money market , A more stable digital currency is needed to provide liquidity and benchmark other funds . At the same time, it serves as a bridge between blockchain market and traditional market assets .

Stable currency not only serves as the connection between currencies in the digital money market , At the same time, it also keeps the capital from flowing out when the market fluctuates , In order to maintain the basic capital activity of the digital money market in the cold winter , The stable currency acts as legal tender in the market , But mortgage-backed stable currency is not suitable for long-term operation in a decentralized market .

Mortgage means that all the funds in the market are gathered in the issuing institutions similar to the central bank , The degree of supervision and transparency of assets in institutions determines how much trust the market has in the central bank issuing money , When the central authority loses trust, it represents the bankruptcy of a bank with any insurance measures , The resulting run risk is enough to completely destroy the market in the short term .

Algorithmic stable currency is the most imaginative legal currency processing scheme in the decentralized market , The biggest difference from the traditional stable currency is the definition of the algorithm in the stable currency , Whether to stabilize the price relative to the price figures such as US dollar through some arbitrage model or scarcity algorithm ( Number mapping ) Instead of anchoring the price through mortgage .

therefore , The way the algorithm stabilizes the currency is more in line with the decentralized concept of the blockchain world , It not only gets rid of the trust risk of central institutions , At the same time, the most evil coinage was handed over to each token user , Without the risk of centralized abuse , It not only improves the liquidity of tokens , A relatively stable currency stability triangle is also achieved by using the algorithm .

02

The exploration of decentralization in current algorithm stability currency

The blockchain world always pursues decentralization , Whether it's decentralized finance that once exploded (DeFi), Or now LUNA The unsecured algorithm with fire stabilizes the currency , In the financial market, the biggest profit and market prospect is the centralized banking organization , Seigniorage can be brought along with seigniorage , Generally speaking, it means getting the right to print money .

Whether it's pushing the algorithmic stability coin in front of everyone LUNA Still chasing the main chains of algorithmic stable currency , Are playing such a enclosure game . Without bringing the payment system to traditional consumer or financial markets , The biggest opponent of algorithmic stable currency is still mortgage stable currency (USDT/USDC).

Algorithmic stability is usually achieved in three ways , Through scarcity ( Inflation and deflation )、 Arbitrage design ( Two way arbitrage mechanism )、 Multi currency model ( Wave transfer ). The specific logic is as follows :

Scarcity : The scarcity design is similar to the macro-control of money by traditional banking institutions , That is to adjust the relationship between supply and demand through monetary easing policy and monetary tightening policy , In the algorithmic stable currency market, the way of repurchase destruction is usually used to replace the monetary tightening policy , Monetary easing is simpler , Equivalent to printing money and throwing it into the market , Of course, there is still a need to implement and disclose the algorithm in a fixed way .

Arbitrage design : Arbitrage design is the simplest and most practical short-term stability scheme among many ways , Assume a stable price as 1 Under the circumstances , When the price is greater than 1 The token can be sold for a premium profit , And when the price is less than 1 Under the circumstances , You can buy the token and exchange it through the exchange scheme designed by the arbitrage model 1 Token of value .

Multi currency model : By soft anchoring other digital currencies to transfer the volatility generated by stable currencies , For designing an algorithmic stable currency system with endorsement of other digital currencies , Stabilizing the currency through the transfer algorithm requires a stable control mode , The cost that should have been incurred under the algorithm stability currency , For example, a stable currency requires deflation , The cost of deflation is borne by other tokens , This way can make the algorithm more stable , But at the same time, it also makes it difficult for the market value of the algorithm stable token to exceed the market value of its soft anchor token .

03

Compared with the traditional stable currency

USDD How to solve the core contradiction of stable currency from the root

The biggest problem of mortgage-backed stable currency in the current market is to mortgage the capital liquidity in the digital money market , Obtain price stability through mortgage , This stability also leads to the loss of more capital liquidity in the digital money market , When the market enters a downturn, it will not only be of no benefit to the market , In extreme market conditions, it will also lead to capital stampede and accelerate the decline of the value of digital assets .

about Algorithm stability , Can handle the price volatility and the authenticity of the price obtained by the Oracle , It is the foundation of whether algorithmic stable currency can maintain stability in extreme market , Sufficient liquidity volume + Interest binding in Ecology , In order to deal with the banking risks brought by being a central bank in the digital money market .

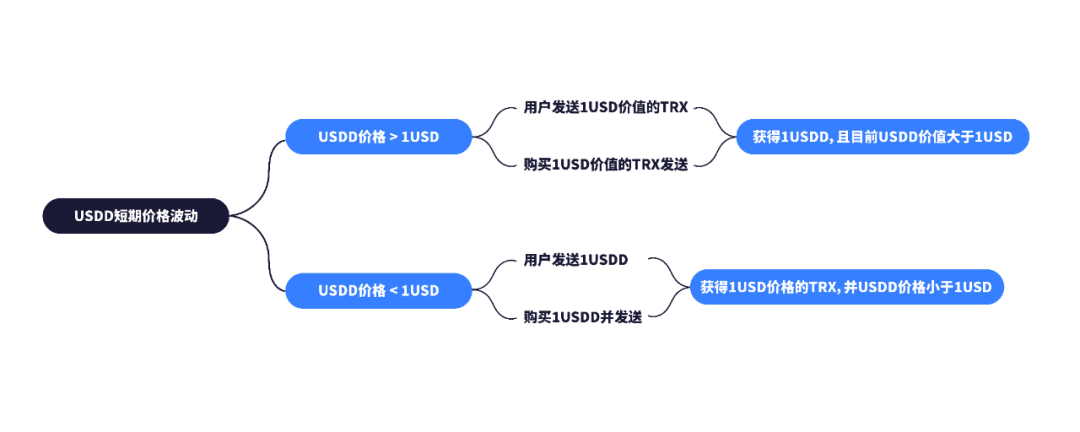

USDD As a wave field DAO The upcoming decentralized stabilization coin , Long term price stability through long-term supply and demand management , The short-term fluctuation solution adopts a more general price fluctuation arbitrage method , In order to achieve short-term price stability by users and arbitragers .

USDD The protocol runs on TRON On the Internet , But the secondary market USDD Price for TRON It belongs to exogenous data , So we still need the oracle to feed the price , To get real price data .

USDD Three types of problem solutions are needed as a whole , That is, how to ensure that the feed price of the Oracle is true data 、 How to manage scarcity to ensure price stability and deal with deflation costs 、 How to design short-term price arbitrage model to reduce short-term price volatility .

① USDD The Oracle service is provided by TRON Provided by network super representative , Every time N Each block counts one vote , The network super representative needs to vote in each voting stage , The voting content is... In the market USD The current real price , The Oracle will take the weighted median of the voting prices of each super representative as the real price .

USDD The agreement will be based on the price obtained in the weighting of the voting results , Calculate a reward deviation value , Super delegates whose voting results are within the deviation will be rewarded , To encourage super delegates to vote at real prices . Limit voters to vested interests in the ecology , Reducing the probability of voters making profits through false prices may , And punish the super representatives whose voting price is outside the deviation range .

② USDD The long-term supply and demand management mode of adopts multi currency soft connection TRX To manage scarcity , stay USDD Agreement ,TRON The super representative of absorbed USDD The volatility of , In the short term , If USDD When the price is below the target ,TRON Super representatives destroy USDD To cast TRX, prompt USDD Go back to the target price .

The cost of monetary contraction in traditional financial markets is borne by the central bank , The cost of currency contraction is usually borne by various financial instruments , That is, the central bank is absorbing the volatility generated by the market currency .USDD Then the responsibility of the central bank is transferred to the super representative in the ecology , In the short term, make super representative by casting TRX Diluted , In the medium and long term, we have achieved USDD Reward compensation in the agreement exchange market .

③ USDD The protocol runs in TRON On the Internet , Short term fluctuations are still caused by TRX Absorption ,TRX yes TRON The network's native cryptocurrency , meanwhile TRX It's also a defense against USDD The most direct defense against price fluctuations , USDD Agreement to use TRX by USDD The resulting short-term fluctuations carry out double token linked arbitrage .

Through various algorithms , The unstable ecological token replaces the stable currency to fluctuate , So that the stable currency can obtain relative stability . And the simple algorithm is easier to pass the test of various extreme market situations in the market , After all, the simpler the structure, the easier it is to operate stably .

04

USDD Behind it is the huge setting of a decentralized central bank

Let's look back at the popular algorithm stabilization currency in the market LUNA, Its ultimate goal is to build a shadow bank based on the real world .LUNA One of our ecology is called CHAI Mobile payment products , This product can be bought, sold or consumed in the real world through CHAI Pay in Terra Stable currency complete .

comparison LUNA My shadow banking dream , Sun Yuchen stated in his open letter USDD The bigger vision behind it , That is to establish a decentralized central bank that really belongs to the blockchain industry , To maintain the stability of the encryption market in the conflict between centralization and decentralization in the future . So in the wave field DAO Decide to release USDD At the same time , Wave field joint reserve (TRON DAO Reserve) Also established simultaneously .

It also became USDD A natural advantage of , Wave field has the most powerful transfer system and experience in the blockchain market , Transfer money in blockchain 1.0 Time USDT adopt Omni Chain transfer , The transfer of the whole stable currency takes a long time ,30 Minutes or more , The cost is very high , It often costs a hundred dollars to complete the transfer , The capacity of the whole blockchain and the number of transactions in a single day are compressed in daily 20 Ten thousand brush .

In the wave field USDT Mainly blockchain transfer 2.0 Time ,USDT Cross era migration to wave field blockchain , It has an independent decentralized liquidation layer , The transfer time is determined by 30 Minutes are compressed to less than one second , Fees are paid by 100 The dollar is compressed to the level of cents , Close to zero , The capacity of the whole blockchain jumped to... In a single day 1000 Ten thousand daily , The total amount of clearing in a single day exceeded 100 Billion dollars .

Sun Yuchen will be in USDD Push the transfer currency into the stable blockchain 3.0 Era ,USDD Will continue USDT stay 2.0 The high speed of the times , Low fee , High scale model standards , However, the stable currency itself no longer relies on centralized institutions for redemption management and reserve , And completely decentralized in the chain , With the standard currency on the chain TRX Conduct decentralized anchor hook issuance .

05

USDD The source of fire for future outbreaks : The absolute advantage of consensus and liquidity

Traditional linked currency stabilizes its own value by anchoring traditional legal currency assets , Algorithmic stable currency needs to use its own algorithm to maintain the unity with the value of the anchored assets , The mortgage stabilization currency transfers all the liquidity generated by itself to the traditional financial market , The algorithm stabilizes the currency and saves the liquidity in the digital money market , This way is more beneficial to the long-term development of the market .

The algorithmic stability currency that preserves high liquidity also faces the risk of death spiral , When the market goes to extremes , The algorithm stabilizes the price of the linked tokens and both drop , Arbitragers and users will face the risk of rapid depreciation of their assets , Rapid depreciation represents the market DeFi And other products that increase leverage face liquidation risk , If the price touches the clearing line of some users , Without enough consensus and liquidity dragging the bottom , The short-term decline of prices will change from arbitrage space to death spiral, resulting in a downward spiral of prices .

For upcoming USDD May face the same problem , but USDD Your confidence also lies in , In terms of consensus, the wave field DAO It is currently the largest decentralized organization in the world , At present, the number of users in the whole wave field network exceeds 8700 ten thousand , The number of transfers exceeds 30 100 million times , The liquidation amount exceeds 4 Trillions of dollars , These wave field ecological users and ecological advocates , Compared with other algorithms, the birth of stable currency , take USDD Be linked to TRX bring USDD We have all the resources and consensus of the wave field before we start .

In terms of liquidity, at the beginning of its establishment, the wave field joint reserve will preserve the funds raised by the sponsors of the hosting blockchain industry 100 $billion of highly liquid assets as early reserves , And will continue to absorb more liquid assets as financial reserves .

The blockchain market has gone through the barbaric growth era of separatism , The process of savage growth is full of decentralized freedom and irresponsibility , When the market enters the extreme market, this unique market will not have core institutions to protect the market like the traditional financial market , But to fully protect their own interests , Make the fragile market more vulnerable in special times , Whether it's 312 still 512 Stampede caused by extreme market , In the cold winter of the market, all blockchain practitioners have no choice , All prove that this market needs liquidity regulation similar to the core of the central bank .

The core of blockchain market is decentralization , But it does not mean that the existence of core institutions cannot be accepted , Algorithmic stable currency is the core product that is most likely to compete in the current market in a style similar to that of the Federal Reserve ,DAO It's a good way , The core does not mean that there can only be one , The algorithm of multi-core decentralized governance, the central bank may bring higher security and capital efficiency to the market , Blockchain is also a market full of attempts step by step , Gradually develop into a stable market with great potential .

END

版权声明

本文为[Digital intelligence node DXN]所创,转载请带上原文链接,感谢

https://yzsam.com/2022/04/202204232008599560.html

边栏推荐

- Mysql database - single table query (III)

- 渤海期货这家公司怎么样。期货开户办理安全?

- uIP1.0 主动发送的问题理解

- R语言使用timeROC包计算存在竞争风险情况下的生存资料多时间AUC值、使用cox模型、并添加协变量、R语言使用timeROC包的plotAUCcurve函数可视化多时间生存资料的AUC曲线

- R语言ggplot2可视化分面图(facet_wrap)、使用lineheight参数自定义设置分面图标签栏(灰色标签栏)的高度

- [text classification cases] (4) RNN and LSTM film evaluation Tendency Classification, with tensorflow complete code attached

- Shanda Wangan shooting range experimental platform project - personal record (V)

- ESP8266-入门第一篇

- Openharmony open source developer growth plan, looking for new open source forces that change the world!

- LPC1768 关于延时Delay时间与不同等级的优化对比

猜你喜欢

Openharmony open source developer growth plan, looking for new open source forces that change the world!

山东大学软件学院项目实训-创新实训-网络安全靶场实验平台(八)

Shanda Wangan shooting range experimental platform project - personal record (IV)

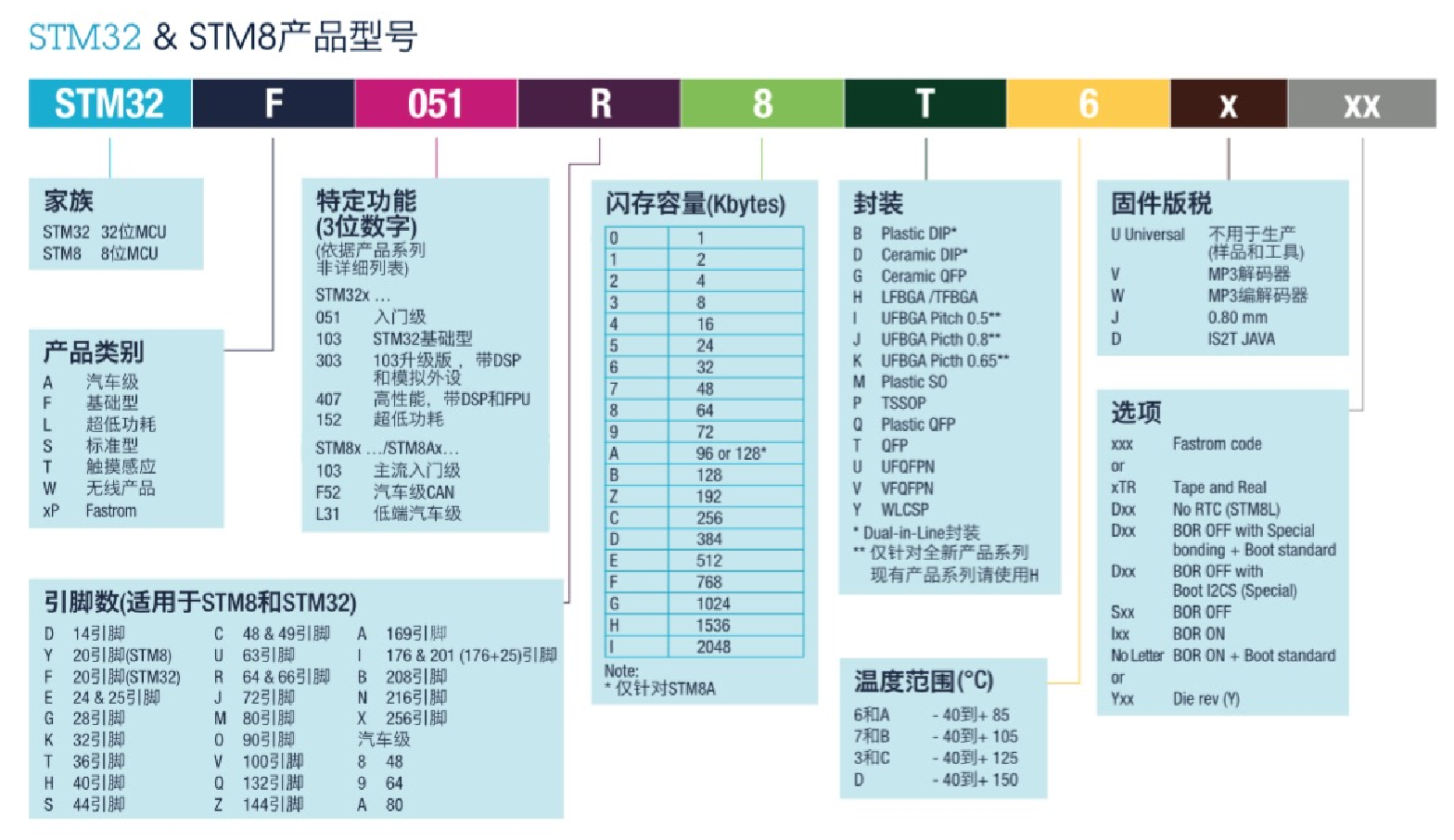

STM32基础知识

How to create bep-20 pass on BNB chain

Comment créer un pass BEP - 20 sur la chaîne BNB

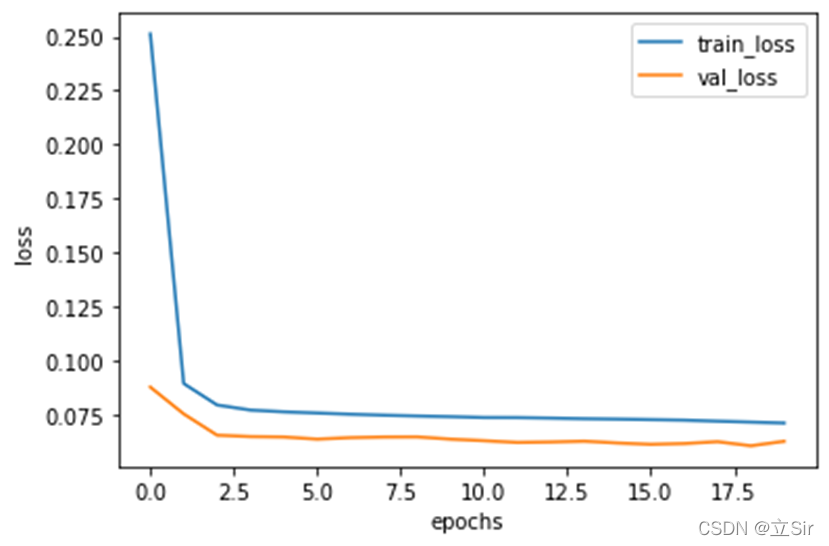

【数值预测案例】(3) LSTM 时间序列电量预测,附Tensorflow完整代码

![[text classification cases] (4) RNN and LSTM film evaluation Tendency Classification, with tensorflow complete code attached](/img/19/27631caff199fbf13f802decbd6ead.gif)

[text classification cases] (4) RNN and LSTM film evaluation Tendency Classification, with tensorflow complete code attached

@Mapperscan and @ mapper

山东大学软件学院项目实训-创新实训-网络安全靶场实验平台(六)

随机推荐

R language ggplot2 visualization: ggplot2 visualizes the scatter diagram and uses geom_ mark_ The ellipse function adds ellipses around data points of data clusters or data groups for annotation

Kubernetes getting started to proficient - install openelb on kubernetes

Introduction to electron Tutorial 4 - switching application topics

渤海期货这家公司怎么样。期货开户办理安全?

Redis cache penetration, cache breakdown, cache avalanche

Shanda Wangan shooting range experimental platform project - personal record (V)

MySQL数据库 - 单表查询(三)

[report] Microsoft: application of deep learning methods in speech enhancement

R语言使用timeROC包计算存在竞争风险情况下的生存资料多时间AUC值、使用cox模型、并添加协变量、R语言使用timeROC包的plotAUCcurve函数可视化多时间生存资料的AUC曲线

Record: call mapper to report null pointer Foreach > the usage of not removing repetition;

Remote code execution in Win 11 using wpad / PAC and JScript 3

nc基础用法2

LPC1768 关于延时Delay时间与不同等级的优化对比

MySQL数据库 - 数据库和表的基本操作(二)

Electron入门教程3 ——进程通信

Redis installation (centos7 command line installation)

IIS data conversion problem: 16bit to 24bit

[webrtc] add x264 encoder for CEF / Chromium

Mfcc: Mel frequency cepstrum coefficient calculation of perceived frequency and actual frequency conversion

腾讯邱东洋:深度模型推理加速的术与道